UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number: 0-19582

OLD DOMINION FREIGHT LINE, INC.

(Exact name of registrant as specified in its charter)

| VIRGINIA | 56-0751714 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

500 Old Dominion Way

Thomasville, NC 27360

(Address of principal executive offices)

(Zip Code)

(336) 889-5000 (Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock ($0.10 par value) | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one).

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of voting stock held by nonaffiliates of the registrant as of June 30, 2006 was $1,005,873,253, based on the closing sales price as reported on the NASDAQ Global Select Market (formerly known as the NASDAQ National Market).

As of February 26, 2007, the registrant had 37,284,675 outstanding shares of Common Stock ($0.10 par value).

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s Proxy Statement for the 2007 Annual Meeting of Shareholders are incorporated by reference into Part III of this report.

| Part I |

||||

| 1 | ||||

| Item 1 |

1 | |||

| Item 1A |

7 | |||

| Item 1B |

11 | |||

| Item 2 |

11 | |||

| Item 3 |

11 | |||

| Item 4 |

11 | |||

| Part II |

||||

| Item 5 |

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 12 | ||

| Item 6 |

14 | |||

| Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

15 | ||

| Item 7A |

26 | |||

| Item 8 |

27 | |||

| Item 9 |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

44 | ||

| Item 9A |

44 | |||

| Item 9B |

46 | |||

| Part III |

||||

| Item 10 |

46 | |||

| Item 11 |

46 | |||

| Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 46 | ||

| Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

46 | ||

| Item 14 |

46 | |||

| Part IV |

||||

| Item 15 |

47 | |||

| 48 | ||||

Forward-Looking Information

Forward-looking statements in this report, including, without limitation, statements relating to future events or our future financial performance, appear in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report and in other written and oral statements made by or on behalf of us, including, without limitation, statements relating to our goals, strategies, expectations, competitive environment, regulation and availability of resources. Such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties that could cause actual events and results to be materially different from those expressed or implied herein, including, but not limited to, the risk factors detailed in this Annual Report.

Unless the context requires otherwise, references in this report to “Old Dominion”, the “Company”, “we”, “us” and “our” refer to Old Dominion Freight Line, Inc.

General

We are a leading less-than-truckload (“LTL”) multi-regional motor carrier providing one-to-five day service among five regions in the United States and next-day and second-day service within these regions. We operate as one business segment and offer an expanding array of innovative products and services through our four branded product groups, OD-Domestic, OD-Expedited, OD-Global and OD-Technology. At December 31, 2006, we provided full-state coverage to 37 of the 47 states that we served directly within the Southeast, South Central, Northeast, Midwest and West regions of the country. Through marketing and carrier relationships, we also provided service to and from the remaining states as well as international services around the globe. We plan to continue to expand our service center network, as opportunities arise, to achieve our strategic goal of providing full-state coverage throughout the continental United States. These additions should also provide a platform for future growth and ensure that our service center network has sufficient capacity.

We have grown substantially over the last several years through strategic acquisitions and internal growth. Prior to 1995, we provided inter-regional service to major metropolitan areas from, and regional service within, the Southeast region of the United States. Since 1995, we have expanded our infrastructure to provide next-day and second-day service within four additional regions as well as expanded inter-regional service among those regions. From 1995 through December 31, 2006, we increased our number of service centers from 53 to 182 and our states directly served from 21 to 47. We believe that our present infrastructure will enable us to increase freight density, which is to increase the volume of freight moving through our network, and thereby improve our profitability.

We are committed to providing our customers with high quality service. We are continually upgrading our technological capabilities to improve customer service, reduce our transit times and minimize our operating costs. In addition to our core LTL services, we provide other specialized services including premium expedited services, truckload services, truckload brokerage services, logistical solutions, container delivery service to and from ten port facilities and distribution services in which we either consolidate LTL shipments for full truckload transport by a truckload carrier or convert full truckload shipments from a truckload carrier into LTL shipments for our delivery.

We provide consistent customer service from a single organization offering our customers information and pricing from one point of contact. Our multi-regional competitors that offer inter-regional service typically do so through independent companies or with separate points of contact within different operating segments of the

1

company, which can result in inconsistent service and pricing, as well as poor shipment visibility. Our integrated structure allows us to offer our customers consistent and continuous service across all areas of operations and service products.

Old Dominion was founded in 1934 and incorporated in Virginia in 1950. Please refer to the Balance Sheets and Statements of Operations included in Item 8 of this report for information regarding our total assets, revenue from operations and net income.

Our Industry

Trucks provide transportation services to virtually every industry operating in the United States and generally offer higher levels of reliability and faster transit times than other surface transportation options. The trucking industry is comprised principally of two types of motor carriers: truckload and LTL. Truckload carriers generally provide an entire trailer to one customer from origin to destination. LTL carriers pick up multiple shipments from multiple customers on a single truck and then route the goods through service centers where freight may be transferred to other trucks with similar destinations for delivery.

In contrast to truckload carriers, LTL motor carriers require expansive networks of local pickup and delivery service centers, as well as larger breakbulk, or hub, facilities. The significant capital that LTL motor carriers must commit to create and maintain a network of service centers and a fleet of tractors and trailers makes it difficult for new start-up or small operations to effectively compete with established companies. In addition, successful LTL motor carriers generally employ a high level of technology to provide information to customers and to reduce operating costs.

Service Center Operations

At December 31, 2006, we conducted operations through 182 service center locations, of which we own 88 and lease 94. We operate major breakbulk facilities in Atlanta, Georgia; Rialto, California; Indianapolis, Indiana; Greensboro, North Carolina; Harrisburg, Pennsylvania; Memphis and Morristown, Tennessee; and Dallas, Texas, while using some smaller service centers for limited breakbulk activity in order to serve next-day markets. Our service centers are strategically located in five regions of the country to provide the highest quality service and minimize freight rehandling costs.

Each of our service centers is responsible for the pickup and delivery of freight for its service area. Each service center loads outbound freight by destination the day it is picked up. All inbound freight received by the service center in the evening or during the night is scheduled for local delivery the next business day, unless a customer requests a different delivery schedule. Our management reviews the productivity and service performance of each service center on a daily basis to ensure quality service and efficient operations.

While we have established primary responsibility for customer service at the local service center level, our customers may access information and initiate transactions through several different gateways such as our website, electronic data interchange, automated voice response systems, automated fax systems or through our customer service department located at the corporate office. Our systems offer direct access to information such as freight tracking, shipping documents, rate quotes, rate databases and account activity.

Linehaul Transportation

Linehaul dispatchers control the movement of freight among service centers through integrated freight movement systems. We also utilize load-planning software to optimize efficiencies in our linehaul operations. Our senior management continuously monitors freight movements, transit times, load factors and other productivity measurements to ensure that we maintain our highest levels of service and efficiency.

We utilize scheduled routes, and additional linehaul dispatches as necessary, to meet our published service standards. In addition, we lower our cost structure by maintaining flexible work force rules and by primarily

2

using twin 28-foot trailers exclusively in our linehaul operations. The use of twin 28-foot trailers permits us to transport freight directly from its point of origin to destination with minimal unloading and reloading, which also reduces cargo claims expenses. We also utilize long-combination vehicles, such as triple 28-foot trailers and combinations of 48-foot and 28-foot trailers, in states where permitted. Twin trailers and long-combination vehicles permit more freight to be hauled behind a tractor than could be hauled by one larger trailer.

Tractors, Trailers and Maintenance

At December 31, 2006, we operated 4,643 tractors. We generally use new tractors in linehaul operations for approximately three to five years and then transfer those tractors to pickup and delivery operations for the remainder of the assets’ useful lives. In a number of our service centers, tractors perform pickup and delivery functions during the day and linehaul functions at night to maximize tractor utilization.

At December 31, 2006, we operated a fleet of 17,915 trailers. We primarily purchase new trailers for our operations; however, we occasionally purchase pre-owned equipment meeting our specifications from other trucking companies.

We have also acquired tractors and trailers through our acquisition of business assets from other carriers. The purchase of pre-owned equipment can provide an excellent value, but can increase our fleet’s average age. The table below reflects, as of December 31, 2006, the average age of our tractors and trailers:

| Type of equipment (categorized by primary use) |

Number of units |

Average age | ||

| Linehaul tractors |

2,743 | 1.8 | ||

| Pickup and delivery tractors |

1,900 | 6.9 | ||

| Pickup and delivery trucks |

66 | 3.0 | ||

| Linehaul trailers |

13,122 | 7.7 | ||

| Pickup and delivery trailers |

4,793 | 11.2 |

We develop certain specifications for tractors and trailers, the production and purchase of which are negotiated with several manufacturers. These purchases are planned well in advance of anticipated delivery dates in order to accommodate manufacturers’ production schedules. We believe that there is sufficient capacity among suppliers to ensure an uninterrupted supply of equipment to support our operations and planned growth.

The table below sets forth our capital expenditures for tractors and trailers for the years ended December 31, 2006, 2005 and 2004. Our capital expenditures for tractors and trailers in 2006 provided the capacity to support our continued growth and geographic expansion and, to a lesser extent, to replace equipment as part of our normal replacement cycle.

| Year ended December 31, | |||||||||

| (In thousands) |

2006 | 2005 | 2004 | ||||||

| Tractors |

$ | 59,759 | $ | 50,457 | $ | 35,932 | |||

| Trailers |

49,209 | 52,949 | 20,887 | ||||||

| Total |

$ | 108,968 | $ | 103,406 | $ | 56,819 | |||

At December 31, 2006, we had major maintenance operations at our service centers in Los Angeles and Rialto, California; Denver, Colorado; Atlanta, Georgia; Chicago, Illinois; Indianapolis, Indiana; Parsons, Kansas; Jersey City, New Jersey; Greensboro, North Carolina; Columbus, Ohio; Harrisburg, Pennsylvania; Morristown and Memphis, Tennessee; Dallas, Texas; and Salt Lake City, Utah. In addition, nine other service center locations are equipped to perform routine and preventive maintenance and repairs on our equipment.

We have established maintenance policies and procedures. Linehaul tractors are routed to appropriate maintenance facilities at designated mileage or time intervals, depending upon how the equipment was utilized. Pickup and delivery tractors and trailers are scheduled for maintenance every 90 days.

3

Marketing and Customers

At December 31, 2006, we had a sales staff of 428 employees. We compensate our sales force, in part, based upon revenue generated, Company and service center profitability and on-time service performance, which we believe helps to motivate our employees to achieve our service, growth and profitability objectives.

We utilize a computerized freight costing model to determine the price level at which a particular shipment of freight will be profitable. We can modify elements of this freight costing model to simulate the actual conditions under which the freight will be moved. We also compete for business by participating in bid solicitations. Customers generally solicit bids for relatively large numbers of shipments for a period of one to two years, and typically choose to enter into contractual arrangements with a limited number of motor carriers based upon price and service.

Revenue is generated from many customers and locations across the United States and North America. In 2006, our largest customer accounted for approximately 2.9% of revenue and our largest 20, 10 and 5 customers accounted for approximately 22.8%, 15.3% and 9.6% of our revenue, respectively. For each of the previous three years, less than 5% of our revenue was generated from international services. We believe the diversity of our revenue base helps protect our business from adverse developments in a single geographic region and the reduction or loss of business from a single customer.

Competition

The transportation industry is highly competitive on the basis of both price and service. At December 31, 2006, we were the seventh largest LTL carrier in the United States, as measured by revenue. We compete with regional, inter-regional and national LTL carriers and, to a lesser extent, with truckload carriers, small package carriers, airfreight carriers and railroads. Competition is based primarily on personal relationships, price and service. We believe that we are able to compete effectively in our markets by providing high quality and timely service at competitive prices.

We believe our transit times are generally faster than those of our principal national competitors. We believe this performance is due in part to our more efficient service center network, use of team drivers and investment in technology. In addition, we provide greater geographic coverage than most of our regional competitors. We believe our diversified mix and scope of regional and inter-regional services enable us to provide our customers with a single source to meet their LTL shipping needs and provides us with a distinct advantage over our regional, multi-regional and national competition.

We also believe our non-union workforce gives us a significant advantage over our unionized LTL competition. Advantages of our workforce include flexible hours and the ability of our employees to perform multiple tasks, which we believe result in greater productivity, customer service, efficiency and cost savings.

We compete with several larger transportation service providers, each of which may have more equipment, a broader coverage network and a wider range of services than we do. Our larger competitors also have greater financial resources and, in general, the ability to reduce prices to gain business, especially during times of reduced growth rates in the economy. This could potentially limit our ability to maintain or increase prices or maintain significant growth.

Seasonality

Our tonnage levels and revenue mix are subject to seasonal trends common in the motor carrier industry. Financial results in the first quarter are normally lower due to reduced shipments during the winter months. Harsh winter weather can also adversely impact our performance by reducing demand and increasing operating expenses. Freight volumes typically build to a peak in the third quarter and early fourth quarter, which generally result in improved operating margins.

4

Technology

We continually upgrade our technological capabilities, and we provide access to our systems through multiple gateways that offer our customers maximum flexibility and immediate access to information. We also employ freight handling systems and logistics technology to reduce costs and transit times. Our principal technologies include:

| • | www.odfl.com. We continuously update our web site with current information, including service products, coverage maps, financial data, news releases, corporate governance matters, employment opportunities and other information of importance to our customers, investors and employees. Customers may also use our website to, among other things: receive rate estimates; schedule pickups; trace shipments; check transit times; and view or print shipping documents. We make available, free of charge on our web site, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file these reports with, or furnish them to, the Securities and Exchange Commission. |

| • | odfl4me.com. Customers may also manage their shipping needs from their desktops by registering on the secure area of our web site, odfl4me.com, which provides access to: enhanced shipment tracing; customizable reports; document archives; on-line cargo claims processing; interactive bills of lading; and customized rate estimates for customer-specific pricing programs. |

| • | Interactive Voice Response (IVR). Through our IVR telephone system, callers can trace shipments, develop rate estimates and access our fax server to retrieve shipping documents such as delivery receipts and bills of lading. |

| • | Electronic Data Interchange (EDI). For our customers who prefer to exchange information electronically, we provide a number of EDI options with flexible formats and communication alternatives. Our customers can transmit or receive invoices, remittance advices, shipping documents and shipment status information, as well as other customized information. |

| • | Radio Frequency Identification (RFID) System. Our automated arrival/dispatch system monitors equipment location and freight movement throughout our system. Transponders are attached to the equipment in our fleet to enable readers to automatically record arrivals and departures, eliminating the need for manual entry and providing real-time freight tracing capabilities for our customers and our employees. |

| • | Dock Yard Management (DYM) System. The DYM system records the status of shipments moving within our freight handling system through a network of handheld and fixed mounted computers on our freight docks, switching tractors and forklifts. Each barcoded shipment is monitored by these devices, which provides for real-time tracing and freight management. |

| • | Handheld Computer System. Handheld computers provide direct communication to our systems and allow our drivers to capture information during pickups and deliveries, including individual pieces and weights as well as origin and destination shipping points. Timely pickup information allows for better direct loading and efficient scheduling of linehaul operations and enhances real-time information for our customers’ visibility of their supply chain. |

| • | Pickup and Delivery Optimation System. This mapping system is utilized by our service centers to improve the efficiency of pickup and delivery (“P&D”) routes. The optimization of our P&D routes improves the efficiency of our operations, reduces costs and reduces transit times. In addition, this system enhances labor productivity by determining proper staffing and providing the most efficient freight loading patterns at our service centers. |

5

Insurance

We carry significant insurance with third-party insurance carriers and we self-insure a portion of this risk. We are currently self-insured for bodily injury and property damage claims up to $2,750,000 per occurrence. This self-insured retention level was increased from $2,500,000 during the previous plan year ended March 30, 2006. Cargo loss and damage claims are self-insured up to $100,000 per occurrence. We are exposed to workers’ compensation claims up to $1,000,000 per occurrence, through either self-insurance or insurance deductibles, for the states in which we operate. Group health claims are self-insured up to $300,000 per occurrence and long-term disability claims are self-insured to a maximum per individual of $3,000 per month.

We believe that our policy of self-insuring a portion of our risk, together with our safety and loss prevention programs, is an effective means of managing insurance costs. We also believe that our current insurance coverage is adequate to cover our liability risks.

Diesel Fuel Availability and Cost

Our industry depends heavily upon the availability of diesel fuel. From time to time, we may experience shortages at certain locations and have been forced to incur additional expense to ensure adequate supply on a timely basis to prevent a disruption to our service schedules. We have experienced higher diesel fuel costs in recent years and, as a result, implemented a fuel surcharge program in August 1999 that has remained in effect since that time. Our fuel surcharges, which are generally indexed to the U.S. Department of Energy’s published fuel prices, were implemented to offset the additional cost of diesel fuel and are consistent with our competitors’ practices. Our management believes that our operations and financial condition are susceptible to the same diesel fuel price increases or shortages as those of our competitors. Diesel fuel costs, including fuel taxes, totaled 13.2% of revenue in 2006.

Employees

As of December 31, 2006, we employed 10,762 individuals on a full-time basis in the following categories:

| Category |

Number of employees | |

| Drivers |

5,487 | |

| Platform |

1,976 | |

| Fleet technicians |

333 | |

| Sales |

428 | |

| Salaried, clerical and other |

2,538 |

As of December 31, 2006, we employed 2,573 linehaul drivers and 2,914 pickup and delivery drivers. All of our drivers are selected based upon driving records and experience. Drivers are required to pass drug tests and have a current United States Department of Transportation (“DOT”) physical and a valid commercial driver’s license prior to employment. Once employed, drivers are required to obtain and maintain hazardous materials endorsements to their commercial driver’s licenses. Drivers are also required to take drug and alcohol tests periodically, by random selection.

To help fulfill driver needs, we offer qualified employees the opportunity to become drivers through the “Old Dominion Driver Training Program.” Since its inception in 1988, 2,125 individuals have graduated from this program, from which we have experienced an annual turnover rate of approximately 7%. We believe our driver training and qualification programs have been important factors in improving our safety record. Drivers with safe driving records are rewarded with bonuses of up to $1,000 annually. Driver safety bonuses paid during 2006 were $996,000.

Our focus on communication and the continued education, development and motivation of our employees helps to ensure that our relationship with our employees remains excellent. There are no employees represented under a collective bargaining agreement, which we believe is an important factor in our continued success.

6

Governmental Regulation

We are regulated by the Surface Transportation Board, an agency within the DOT, and by various state agencies. These regulatory authorities have broad powers, generally governing matters such as authority to engage in motor carrier operations, hours of service, certain mergers, consolidations and acquisitions, and periodic financial reporting. The trucking industry is subject to regulatory and legislative changes, such as increasingly stringent environmental and occupational safety and health regulations, limits on vehicle weight and size, ergonomics and hours of service. These changes may affect the economics of our industry by requiring changes in operating practices, increasing our cost and influencing the demand for our services.

We believe that the cost of compliance with applicable laws and regulations has not and will not materially affect our results of operations or financial condition.

Environmental Regulation

We are subject to various federal, state and local environmental laws and regulations that focus on the transportation of certain materials, the discharge or retention of storm water and the emission and discharge of hazardous materials into the environment or their presence on or in our properties, vehicles and fuel storage tanks. Under certain environmental laws, we could also be held responsible for any costs relating to contamination at our past or present facilities and at third-party waste disposal sites. We do not believe that the cost of future compliance with environmental laws or regulations will have a material adverse effect on our operations, financial condition, competitive position or capital expenditures for the remainder of fiscal 2007 or fiscal 2008.

In addition to the factors discussed elsewhere in this report, the following are some of the important factors that could cause our actual results to differ materially from those projected in any forward-looking statements:

We operate in a highly competitive industry, and our business will suffer if we are unable to adequately address potential downward pricing pressures and other factors that may adversely affect our operations and profitability.

Numerous competitive factors could impair our ability to maintain our current profitability. These factors include, but are not limited to, the following:

| • | we compete with many other transportation service providers of varying sizes, some of which may have more equipment, a broader coverage network, a wider range of services, greater capital resources or have other competitive advantages; |

| • | some of our competitors periodically reduce their prices to gain business, especially during times of reduced growth rates in the economy, which may limit our ability to maintain or increase prices or maintain significant growth; |

| • | many customers reduce the number of carriers they use by selecting “core carriers” as approved transportation service providers, and in some instances we may not be selected; |

| • | many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress prices or result in the loss of some business to competitors; |

| • | the trend towards consolidation in the ground transportation industry may create other large carriers with greater financial resources and other competitive advantages relating to their size; |

| • | advances in technology require increased investments to remain competitive, and our customers may not be willing to accept higher prices to cover the cost of these investments; and |

| • | competition from non-asset-based logistics and freight brokerage companies may adversely affect our customer relationships and pricing policies. |

7

If our employees were to unionize, our operating costs would increase and our ability to compete would be impaired.

None of our employees are currently represented by a collective bargaining agreement. However, from time to time there have been efforts to organize our employees at various service centers. We can make no assurance that our employees will not unionize in the future, which could in turn have a material adverse effect on our operating results because:

| • | some shippers have indicated that they intend to limit their use of unionized trucking companies because of the threat of strikes and other work stoppages; |

| • | restrictive work rules could hamper our efforts to improve and sustain operating efficiency; |

| • | a strike or work stoppage would hurt our profitability and could damage customer and employee relationships; and |

| • | an election and bargaining process would distract our time and attention from our overall objectives and impose significant expenses. |

These results, and unionization of our workforce generally, could have a material adverse effect on our business, financial condition and results of operations.

If we are unable to successfully execute our growth strategy, our business and future results of operations may suffer.

Our growth strategy includes increasing the volume of freight moving through our existing service center network, selectively expanding our geographic footprint and broadening the scope of our service offerings. In connection with our growth strategy, we have purchased additional equipment, expanded and upgraded service centers, hired additional personnel and increased our sales and marketing efforts, and expect to continue to do so. Our growth strategy exposes us to a number of risks, including the following:

| • | geographic expansion and acquisitions require start-up costs that could expose us to temporary losses; |

| • | growth through acquisition could require us to temporarily match existing freight rates of the acquiree’s markets, which may be lower than the rates that we would typically charge for our services; |

| • | growth and geographic expansion is dependent on the availability of real estate. Shortages of suitable real estate may limit our geographic expansion and might cause congestion in our service center network, which could result in increased operating expenses; |

| • | growth may strain our management, capital resources, information systems and customer service; |

| • | hiring new employees may increase training costs and may result in temporary inefficiencies until the employees become proficient in their jobs; and |

| • | expanding our service offerings may require us to enter into new markets and encounter new competitive challenges. |

We cannot assure that we will overcome the risks associated with our growth. If we fail to overcome those risks, we may not realize additional revenue or profits from our efforts, we may incur additional expenses and therefore our financial position and results of operations could be materially and adversely affected.

Difficulty in attracting drivers could affect our profitability.

Competition for drivers is intense within the trucking industry, and we periodically experience difficulties in attracting and retaining qualified drivers. Our operations may be affected by a shortage of qualified drivers in the future, which could cause us to temporarily under-utilize our fleet, face difficulty in meeting shipper demands

8

and increase our compensation levels for drivers. If we encounter difficulty in attracting or retaining qualified drivers, our ability to service our customers and increase our revenue could be adversely affected.

Insurance and claims expenses could significantly reduce our profitability.

We are exposed to claims related to cargo loss and damage, property damage, personal injury, workers’ compensation, long-term disability and group health. We carry significant insurance with third-party insurance carriers, the cost of which has risen significantly in recent years. To offset, in part, the significant increases we have experienced, we have elected to increase our self-insured retention levels for most of our risk exposures. If the number or severity of claims for which we are self-insured increases, or we are required to accrue or pay additional amounts because the claims prove to be more severe than our original assessment, our operating results would be adversely affected. In addition, insurance companies require us to obtain letters of credit to collateralize our self-insured retention. If these requirements increase, our borrowing capacity could be adversely affected.

Our business is subject to general economic factors that are largely out of our control.

Economic conditions may adversely affect our customers’ business levels, the amount of transportation services they need and their ability to pay for our services. Customers encountering adverse economic conditions represent a greater potential for bad debt losses, which may require us to increase our reserve for bad debt. In addition, because we self-insure a substantial portion of our group health expense, increases in healthcare costs and pharmaceutical expenses can adversely affect our financial results. Our results also may be negatively affected by increases in interest rates, which increase our borrowing costs and can negatively affect the level of economic activity by our customers and thus our freight volumes.

We have significant ongoing cash requirements that could limit our growth and affect our profitability if we are unable to obtain sufficient financing.

Our business is highly capital intensive. Our net capital expenditures, including the acquisition of business assets, in 2006 and 2005 were $212,886,000 and $160,488,000, respectively. We expect our capital expenditures for 2007 to be approximately $245,000,000 to $255,000,000. The increase in our capital expenditures for 2007 is primarily due to planned real estate acquisitions and improvements to increase capacity at our existing service centers, which we believe are necessary in order for us to achieve our growth strategy. We depend on operating leases, lines of credit, senior debt and cash flow from operations to finance our tractors, trailers and service centers. If we are unable in the future to raise sufficient capital or borrow sufficient funds to make these purchases, we will be forced to limit our growth and operate our trucks for longer periods of time, which could have a material adverse effect on our operating results.

In addition, our business has significant operating cash requirements. If our cash requirements are high or our cash flow from operations is low during particular periods, we may need to seek additional financing, which may be costly or difficult to obtain. We entered into a five-year, $225,000,000 senior unsecured revolving credit facility, dated August 10, 2006, with Wachovia Bank, National Association serving as administrative agent for the lenders that we believe provides us with a sufficient source for borrowing as needed.

We may be adversely impacted by fluctuations in the price and availability of diesel fuel.

Diesel fuel is a significant operating expense. We do not hedge against the risk of diesel fuel price increases. Any increase in diesel fuel prices or diesel fuel taxes or any change in federal or state regulations that results in such an increase, to the extent not offset by freight rate increases or fuel surcharges to customers, or any interruption in the supply of diesel fuel, could have a material adverse effect on our operating results. Historically, we have been able to offset significant increases in diesel fuel prices through fuel surcharges to our customers, but we cannot be certain that we will be able to do so in the future. From time to time, we may experience shortages in the availability of diesel fuel at certain locations and may be forced to incur additional expense to ensure adequate supply on a timely basis to prevent a disruption to our service schedules.

9

Limited supply and increased prices for new equipment may adversely affect our earnings and cash flow.

Investment in new equipment is a significant part of our annual capital expenditures. We may face difficulty in purchasing new equipment due to decreased supply. The price of our equipment may also be adversely affected in the future by regulations on newly manufactured tractors and diesel engines. See the risk factor below entitled: “We are subject to various environmental laws and regulations, and costs of compliance with, liabilities under, or violations of, existing or future environmental laws or regulations could adversely affect our business.”

We operate in a highly regulated industry, and increased costs of compliance with, or liability for violation of, existing or future regulations could have a material adverse effect on our business.

We are regulated by the DOT and by various state agencies. These regulatory authorities have broad powers, generally governing matters such as authority to engage in motor carrier operations, safety and fitness of transportation equipment and drivers, driver hours of service and periodic financial reporting. In addition, the trucking industry is subject to regulatory and legislative changes from a variety of other governmental authorities, which address matters such as increasingly stringent environmental, occupational safety and health regulations or limits on vehicle weight and size and ergonomics. Regulatory requirements, and changes in regulatory requirements, may affect our business or the economics of the industry by requiring changes in operating practices or by influencing the demand for and the costs of providing transportation services.

We are subject to various environmental laws and regulations, and costs of compliance with, liabilities under, or violations of, existing or future environmental laws or regulations could adversely affect our business.

We are subject to various federal, state and local environmental laws and regulations regulating, among other things, the emission and discharge of hazardous materials into the environment or presence on or in our properties and vehicles, fuel storage tanks, our transportation of certain materials and the discharge or retention of storm water. Under certain environmental laws, we could also be held responsible for any costs relating to contamination at our past or present facilities and at third-party waste disposal sites. Environmental laws have become and are expected to continue to be increasingly more stringent over time, and there can be no assurance that our costs of complying with current or future environmental laws or liabilities arising under such laws will not have a material adverse effect on our business, operations or financial condition.

The Environmental Protection Agency has issued regulations that require progressive reductions in exhaust emissions from diesel engines through 2007. Beginning in October 2002, new diesel engines were required to meet these new emission limits. Some of the regulations required reductions in the sulfur content of diesel fuel beginning in June 2006 and the introduction of emissions after-treatment devices on newly-manufactured engines and vehicles beginning with model year 2007. The majority of our new tractor purchases in 2007 are expected to have engines manufactured prior to 2007 without these devices, which is permitted under the new regulations. These regulations have resulted in higher prices for tractors and diesel engines and increased fuel and maintenance costs. These adverse effects, combined with the uncertainty as to the reliability of the vehicles equipped with the newly designed diesel engines and the residual values that will be realized from the disposition of these vehicles, could increase our costs or otherwise adversely affect our business and operations.

Our results of operations may be affected by seasonal factors and harsh weather conditions.

Our operations are subject to seasonal trends common in the trucking industry. Our operating results in the first quarter are normally lower due to reduced demand during the winter months. Harsh weather can also adversely affect our performance by reducing demand and reducing our ability to transport freight, which could result in increased operating expenses.

If we are unable to retain our key employees, our financial condition, results of operations and cash flows could be harmed.

Our success will continue to depend upon the experience and leadership of our key employees and executive officers. In that regard, the loss of the services of any of our key personnel could have a material adverse effect on our financial condition, results of operation and cash flows.

10

Our principal shareholders control a large portion of our outstanding common stock.

As of February 26, 2007, Earl E. Congdon and John R. Congdon and members of their families and their affiliates beneficially owned 32.2% of the outstanding shares of our common stock. As long as the Congdon family controls a large portion of our voting stock, they will be able to significantly influence the election of the entire Board of Directors and the outcome of all matters involving a shareholder vote. The Congdon family’s interests may differ from other shareholders.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

We own our general office located in Thomasville, North Carolina, consisting of a two-story office building of approximately 160,000 square feet on 23.6 acres of land. At December 31, 2006, we operated 182 service centers, of which 88 were owned and 94 were leased. We own all of our major breakbulk facilities, which are listed below with the number of doors as of December 31, 2006.

| Service Center |

Doors | |

| Atlanta, Georgia |

227 | |

| Rialto, California |

152 | |

| Indianapolis, Indiana |

223 | |

| Greensboro, North Carolina |

219 | |

| Harrisburg, Pennsylvania |

305 | |

| Memphis, Tennessee |

77 | |

| Morristown, Tennessee |

247 | |

| Dallas, Texas |

146 |

These facilities are strategically dispersed over the states in which we operate. At December 31, 2006, the length of our 94 leased properties ranges from month-to-month to a lease that expires in 2018. We believe that as current leases expire, we will be able to renew them or find comparable facilities without incurring any material negative impact on service to our customers or our operating results.

We also own twelve non-operating properties, all of which are held for lease. Four of these properties are currently leased with month-to-month lease terms.

We believe that all of our properties are in good repair and are capable of providing the level of service required by current business levels and customer demands.

We are involved in various legal proceedings and claims that have arisen in the ordinary course of our business that have not been fully adjudicated. Many of these are covered in whole or in part by insurance. Our management does not believe that these actions, when finally concluded and determined, will have a material adverse effect upon our financial position or results of operations.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

11

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock and Dividend Information

Our common stock is traded on the NASDAQ Global Select Market under the symbol ODFL. At February 26, 2007, there were approximately 11,300 holders of our common stock, including 244 shareholders of record. We did not pay any dividends on our common stock during fiscal year 2006 or 2005, and we have no current plans to declare or pay any dividends on our common stock during fiscal year 2007. For information concerning restrictions on our ability to make dividend payments, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources” included in Item 7 of this report and Note 3 of the Notes to the Financial Statements included in Item 8 of this report.

On October 31, 2005, the Board of Directors approved a three-for-two common stock split for shareholders of record as of the close of business on November 16, 2005. On November 30, 2005, those shareholders received one additional share of common stock for every two shares owned.

The following table sets forth the high and low sales price of our common stock for the periods indicated, adjusted where appropriate for the common stock split on November 30, 2005, as reported by the NASDAQ Global Select Market:

| 2006 | ||||||||||||

| First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter | |||||||||

| High |

$ | 29.040 | $ | 38.590 | $ | 39.500 | $ | 34.030 | ||||

| Low |

$ | 24.620 | $ | 25.540 | $ | 29.200 | $ | 24.040 | ||||

| 2005 | ||||||||||||

| First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter | |||||||||

| High |

$ | 25.673 | $ | 22.767 | $ | 22.773 | $ | 28.210 | ||||

| Low |

$ | 19.380 | $ | 17.633 | $ | 17.920 | $ | 20.600 | ||||

12

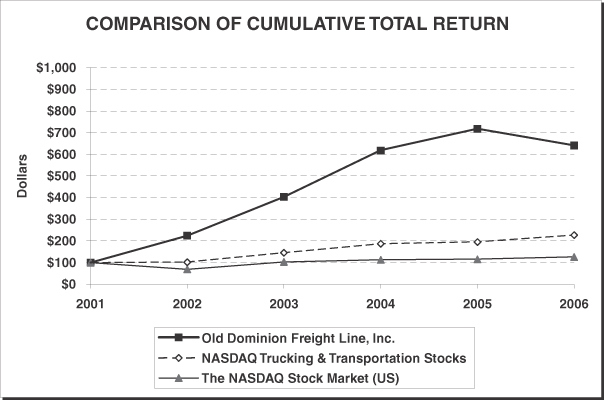

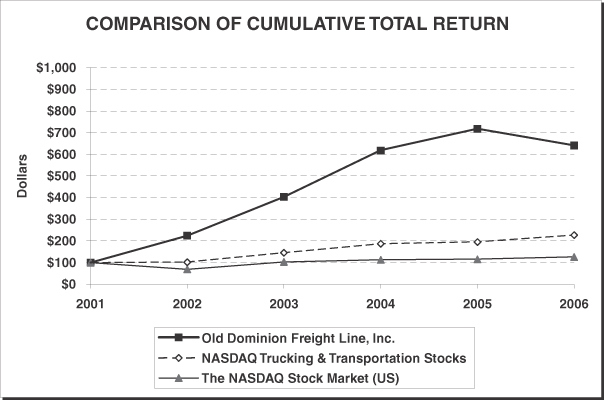

Performance Graph

The following graph compares the total shareholder cumulative returns, assuming the reinvestment of all dividends, of $100 invested on December 31, 2001, in (i) our Common Stock, (ii) the NASDAQ Trucking & Transportation Stocks and (iii) The NASDAQ Stock Market (US) for the five-year period ended December 31, 2006:

Cumulative Total Return

| 12/31/01 | 12/31/02 | 12/31/03 | 12/31/04 | 12/31/05 | 12/31/06 | |||||||||||||

| Old Dominion Freight Line, Inc. |

$ | 100 | $ | 224 | $ | 403 | $ | 618 | $ | 718 | $ | 641 | ||||||

| NASDAQ Trucking and Transportation Stocks |

$ | 100 | $ | 102 | $ | 146 | $ | 187 | $ | 195 | $ | 227 | ||||||

| The NASDAQ Stock Market (US) |

$ | 100 | $ | 69 | $ | 103 | $ | 112 | $ | 115 | $ | 126 | ||||||

13

ITEM 6. SELECTED FINANCIAL DATA

SELECTED FINANCIAL DATA

| For the Year Ended December 31, | ||||||||||||||||||||

| (In thousands, except per share amounts |

2006 | 2005 | 2004 | 2003 | 2002 | |||||||||||||||

| Operating Data: |

||||||||||||||||||||

| Revenue from operations |

$ | 1,279,431 | $ | 1,061,403 | $ | 824,051 | $ | 667,531 | $ | 566,459 | ||||||||||

| Operating expenses: |

||||||||||||||||||||

| Salaries, wages and benefits |

682,886 | 585,879 | 468,775 | 396,521 | 340,820 | |||||||||||||||

| Operating supplies and expenses |

204,386 | 158,029 | 100,660 | 72,084 | 56,309 | |||||||||||||||

| General supplies and expenses |

37,507 | 31,940 | 27,630 | 23,222 | 21,038 | |||||||||||||||

| Operating taxes and licenses |

46,693 | 38,961 | 31,286 | 26,627 | 22,681 | |||||||||||||||

| Insurance and claims |

33,080 | 28,143 | 26,095 | 17,583 | 16,313 | |||||||||||||||

| Communications and utilities |

14,278 | 12,573 | 11,361 | 10,280 | 9,999 | |||||||||||||||

| Depreciation and amortization |

67,634 | 55,897 | 44,823 | 38,210 | 31,081 | |||||||||||||||

| Purchased transportation |

43,933 | 35,005 | 29,443 | 21,389 | 18,873 | |||||||||||||||

| Building and office equipment rents |

11,143 | 9,490 | 7,531 | 7,403 | 7,435 | |||||||||||||||

| Miscellaneous expenses, net |

7,406 | 7,901 | 5,839 | 2,996 | 5,624 | |||||||||||||||

| Total operating expenses |

1,148,946 | 963,818 | 753,443 | 616,315 | 530,173 | |||||||||||||||

| Operating income |

130,485 | 97,585 | 70,608 | 51,216 | 36,286 | |||||||||||||||

| Interest expense, net * |

10,206 | 6,527 | 5,273 | 6,111 | 5,736 | |||||||||||||||

| Other expense (income), net |

936 | 787 | 748 | (192 | ) | 285 | ||||||||||||||

| Income before income taxes and cumulative effect of accounting change |

119,343 | 90,271 | 64,587 | 45,297 | 30,265 | |||||||||||||||

| Provision for income taxes |

46,774 | 36,388 | 25,595 | 17,697 | 11,803 | |||||||||||||||

| Income before cumulative effect of accounting change |

72,569 | 53,883 | 38,992 | 27,600 | 18,462 | |||||||||||||||

| Cumulative effect of accounting change, net |

— | 408 | — | — | — | |||||||||||||||

| Net income |

$ | 72,569 | $ | 53,475 | $ | 38,992 | $ | 27,600 | $ | 18,462 | ||||||||||

| Per Share Data: |

||||||||||||||||||||

| Diluted earnings per share before cumulative effect of accounting change |

$ | 1.95 | $ | 1.45 | $ | 1.06 | $ | 0.76 | $ | 0.63 | ||||||||||

| Diluted earnings per share |

$ | 1.95 | $ | 1.43 | $ | 1.06 | $ | 0.76 | $ | 0.63 | ||||||||||

| Operating Statistics: |

||||||||||||||||||||

| Operating ratio |

89.8 | % | 90.8 | % | 91.4 | % | 92.3 | % | 93.6 | % | ||||||||||

| Revenue per hundredweight |

$ | 13.16 | $ | 12.63 | $ | 11.61 | $ | 11.00 | $ | 10.35 | ||||||||||

| Revenue per intercity mile |

$ | 4.32 | $ | 4.12 | $ | 3.76 | $ | 3.53 | $ | 3.47 | ||||||||||

| Intercity miles (in thousands) |

296,464 | 257,900 | 219,201 | 189,084 | 163,097 | |||||||||||||||

| Total tons (in thousands) |

4,859 | 4,203 | 3,550 | 3,040 | 2,740 | |||||||||||||||

| Total shipments (in thousands) |

6,428 | 5,751 | 4,918 | 4,366 | 3,870 | |||||||||||||||

| Average length of haul (miles) |

934 | 926 | 937 | 926 | 903 | |||||||||||||||

| As of December 31, | ||||||||||||||||||||

| 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Current assets |

$ | 256,367 | $ | 150,213 | $ | 122,537 | $ | 97,055 | $ | 104,896 | ||||||||||

| Current liabilities |

121,546 | 111,028 | 93,820 | 74,017 | 53,481 | |||||||||||||||

| Total assets |

892,193 | 641,648 | 504,733 | 430,244 | 379,829 | |||||||||||||||

| Long-term debt (including current maturities) |

274,582 | 128,956 | 79,454 | 97,426 | 93,223 | |||||||||||||||

| Shareholders’ equity |

417,620 | 345,051 | 291,528 | 232,541 | 203,563 | |||||||||||||||

| * | For the purpose of this table, interest expense is presented net of interest income. |

14

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

We are a leading non-union less-than-truckload (“LTL”) multi-regional motor carrier providing one-to-five day service among five regions in the United States and next-day and second-day service within these regions. Historically, over 90% of our revenue is derived from transporting LTL shipments for our customers, whose demand for our services is generally tied to the overall health of the U.S. domestic economy.

In analyzing the components of our revenue, we monitor changes and trends in the following key metrics:

| • | Revenue Per Hundredweight – This measurement reflects our pricing policies, which are influenced by competitive market conditions and our growth strategies. Generally, freight is rated by a class system, which is established by the National Motor Freight Traffic Association, Inc. Light, bulky freight typically has a higher class and is priced at higher revenue per hundredweight than dense, heavy freight. Changes in the class, packaging of the freight and length of haul of the shipment can also affect this average. Fuel surcharges, accessorial charges and revenue adjustments, excluding adjustments for undelivered freight, are included in this measurement for all periods presented in this report. Revenue adjustments for undelivered freight are required for financial statement purposes in accordance with the Company’s revenue recognition policy; however, we believe excluding these adjustments from this calculation results in a better indicator of changes in our pricing. |

| • | Weight Per Shipment – Fluctuations in weight per shipment can indicate changes in the class, or mix, of freight we receive from our customers as well as changes in the number of units included in a shipment. Generally, increases in weight per shipment indicate higher demand for our customers’ products and overall increased economic activity. |

| • | Average Length of Haul – We consider lengths of haul less than 500 miles to be regional traffic, lengths of haul between 500 miles and 1,000 miles to be inter-regional traffic, and lengths of haul in excess of 1,000 miles to be national traffic. By segmenting our revenue into lengths of haul, we can determine our market share and the growth potential of our service products in those markets. |

| • | Revenue Per Shipment – This measurement is primarily determined by the three metrics listed above and is used, in conjunction with the number of shipments we receive, to calculate total revenue, excluding adjustments for undelivered freight. |

Our primary revenue focus is to increase shipment and tonnage growth within our existing infrastructure, generally referred to as increasing density, thereby maximizing asset utilization and labor productivity. We measure density over many different functional areas of our operations including revenue per service center, linehaul load factor, P&D stops per hour, P&D shipments per hour and platform pounds handled per hour. We believe continued improvement in density is a key component in our ability to sustain profitable growth.

Our primary cost elements are direct wages and benefits associated with the movement of freight; operating supplies and expenses; and depreciation of our equipment fleet and service center facilities. We gauge our overall success in managing these costs by monitoring our operating ratio, a measure of profitability calculated by dividing total operating expenses by revenue, which also allows industry-wide comparisons with our competition.

We continually upgrade our technological capabilities to improve our customer service and lower our operating costs. This technology provides our customers with visibility of their shipments throughout our systems, while providing key metrics from which we can monitor our processes.

15

Results of Operations

The following table sets forth, for the years indicated, expenses and other items as a percentage of revenue from operations:

| 2006 | 2005 | 2004 | |||||||

| Revenue from operations |

100.0 | % | 100.0 | % | 100.0 | % | |||

| Salaries, wages and benefits |

53.4 | 55.2 | 56.9 | ||||||

| Operating supplies and expenses |

16.0 | 14.9 | 12.2 | ||||||

| General supplies and expenses |

2.9 | 3.0 | 3.3 | ||||||

| Operating taxes and licenses |

3.6 | 3.7 | 3.8 | ||||||

| Insurance and claims |

2.6 | 2.6 | 3.2 | ||||||

| Communication and utilities |

1.1 | 1.2 | 1.4 | ||||||

| Depreciation and amortization |

5.3 | 5.3 | 5.4 | ||||||

| Purchased transportation |

3.4 | 3.3 | 3.6 | ||||||

| Building and office equipment rents |

0.9 | 0.9 | 0.9 | ||||||

| Miscellaneous expenses, net |

0.6 | 0.7 | 0.7 | ||||||

| Total operating expenses |

89.8 | 90.8 | 91.4 | ||||||

| Operating income |

10.2 | 9.2 | 8.6 | ||||||

| Interest expense, net * |

0.8 | 0.6 | 0.7 | ||||||

| Other expense, net |

0.1 | 0.1 | 0.1 | ||||||

| Income before income taxes and cumulative effect of accounting change |

9.3 | 8.5 | 7.8 | ||||||

| Provision for income taxes |

3.6 | 3.4 | 3.1 | ||||||

| Income before cumulative effect of accounting change |

5.7 | % | 5.1 | % | 4.7 | % | |||

| * | For the purpose of this table, interest expense is presented net of interest income. |

2006 Compared to 2005

Key financial and operating metrics for 2006 and 2005 are presented below:

| 2006 | 2005 | Change | % Change | ||||||||||||

| Revenue (in thousands) |

$ | 1,279,431 | $ | 1,061,403 | $ | 218,028 | 20.5 | % | |||||||

| Operating ratio |

89.8 | % | 90.8 | % | (1.0 | %) | (1.1 | %) | |||||||

| Net income (in thousands) |

$ | 72,569 | $ | 53,475 | $ | 19,094 | 35.7 | % | |||||||

| Diluted earnings per share |

$ | 1.95 | $ | 1.43 | $ | 0.52 | 36.4 | % | |||||||

| Tonnage (in thousands) |

4,859 | 4,203 | 656 | 15.6 | % | ||||||||||

| Shipments (in thousands) |

6,428 | 5,751 | 677 | 11.8 | % | ||||||||||

| Revenue per hundredweight |

$ | 13.16 | $ | 12.63 | $ | 0.53 | 4.2 | % | |||||||

| Weight per shipment (lbs.) |

1,512 | 1,462 | 50 | 3.4 | % | ||||||||||

| Average length of haul (miles) |

934 | 926 | 8 | 0.9 | % | ||||||||||

| Revenue per shipment |

$ | 199.03 | $ | 184.61 | $ | 14.42 | 7.8 | % | |||||||

In 2006 and for the third consecutive year, we produced revenue growth in excess of 20% and growth in diluted earnings per share in excess of 30%. We maintained our revenue focus on increasing density, which resulted in producing over 90% of our revenue from service centers open for more than one year and a 3.7% increase in average revenue per service center. The operating leverage we generated resulted in continued improvement in our operating ratio to 89.8%, which is the first time we have operated below 90.0% in our fifteen years as a public company and is our fifth consecutive year of improvement.

16

Our revenue growth in 2006 was the result of an 11.8% growth in shipments and a 7.8% increase in revenue per shipment. The increase in revenue per shipment consists of increases in both revenue per hundredweight and weight per shipment of 4.2% and 3.4%, respectively, from 2005. The combination of increases in shipments and weight per shipment produced 15.6% tonnage growth over 2005. We believe our growth, particularly in existing markets, is attributable to our ability to offer a one-source solution for shippers’ regional and inter-regional needs by providing these services through one company, in contrast to many of our principal competitors. Additionally, the expansion of our geographic footprint, as well as increased full-state coverage, has positioned us to be attractive to more and more shippers.

While most of our revenue growth is derived from service centers open for more than one year, the expansion of our service center network and improvement in our service capabilities should provide a platform for future growth. We increased the total number of service centers in our network to 182 at December 31, 2006 from 154 at December 31, 2005. Revenue growth from geographic expansion typically results in additional freight moving through our existing service center network, which helps to offset higher operating margins that typically accompany new service center openings. Seven of the service centers opened in 2006 were spin-offs of existing service centers to improve service and create additional capacity for growth. Due to the established customer base and operating presence in those markets, we were able to operate those spin-offs profitably within a shorter period of time than traditional openings in new geographic territories.

Revenue per hundredweight increased 4.2% to $13.16 from $12.63 in 2005. This pricing improvement reflects the general rate increase on our base rates and minimum charges for certain tariffs, effective April 17, 2006, and occurred despite the increase in weight per shipment, which generally has the effect of reducing revenue per hundredweight. This pricing improvement demonstrates a stable economy and pricing environment throughout most of 2006 and our ability to maintain pricing discipline while increasing the volume of freight moving through our service center network. We experienced a decline in the fourth quarter of 2006 in weight per shipment and a slowdown in our tonnage growth, which are consistent with market indicators of a slowing economy and the reported results of others in our industry. If these trends continue, pricing pressures could become more prevalent in the marketplace and our growth in revenue and net income could slow in comparison to the historical annual growth rates. However, we believe that we can maintain operational efficiencies to continue our trend of comparable quarter improvement in our operating ratio even in a period of slower growth.

Our tariffs and contracts generally provide for a fuel surcharge as diesel fuel prices increase above stated levels that are generally indexed to the U.S. Department of Energy’s published fuel prices, which is consistent with industry practice. This surcharge is recorded as additional revenue and was implemented to offset significant fluctuations in the price of diesel fuel, which is one of the larger components of our operating supplies and expenses. Because of the sustained increase in diesel fuel costs and other petroleum-based products, our freight pricing strategy, as well as that in the LTL industry, has evolved and the fuel surcharge is one of many components in the overall price for our transportation services. As a result, the fuel surcharge often represents more than just the pass through of increased diesel fuel cost. Because of average higher diesel fuel prices in 2006 and the evolution of our freight pricing strategy, the fuel surcharge increased to 11.9% of revenue from 10.3% in 2005. A rapid and significant decrease in diesel fuel prices would likely reduce our revenue and operating income until we revised our pricing strategy to reflect these changes.

Much of the overall improvement in our operating ratio was achieved by the improvement in salaries, wages and benefits as a percent of revenue, which decreased to 53.4% of revenue in 2006 from 55.2% of revenue in 2005. This improvement primarily resulted from a decrease in benefit costs to 11.5% of revenue from 12.4% in 2005. Workers compensation expenses decreased 1.2%, as a percent of revenue, from 2005, as a result of favorable claims experience and a favorable adjustment to our reserve for unpaid claims following an independent actuarial review conducted in the fourth quarter of 2006. These improvements were somewhat offset by a 0.3% increase, as a percent of revenue, in benefit costs resulting from enhancements to our vacation policy and additional costs to provide group health benefits to our employees.

17

In addition to the improvement in benefit costs, our salary and clerical wages decreased by 0.4% of revenue from 2005 as we leveraged our revenue growth over this segment of our workforce. P&D driver wages decreased by 0.2% of revenue from 2005, which can be attributed to a 2.9% improvement in our P&D stops per hour. We benefited from the additional density caused by growth in tonnage, the efficiencies in our route planning through the use of our P&D route optimization software and the use of our driver handheld computers. Platform wages also decreased by 0.2% of revenue from 2005, primarily due to a 6.3% increase in platform pounds handled per hour.

Operating supplies and expenses increased to 16.0% of revenue in 2006 from 14.9% in 2005. This increase was primarily due to a 35.2% increase in diesel fuel costs, excluding fuel taxes, resulting from increased diesel fuel prices and a 16.5% increase in consumption. The consumption increase resulted in an increase in our fuel taxes, which primarily accounts for the change in our “operating taxes and licenses”. We currently do not use diesel fuel hedging instruments; therefore, we are subject to market price fluctuations. Our fuel surcharge revenue more than offset our increased cost of diesel fuel in 2006.

We made significant investments in revenue equipment and real estate in 2005 and 2006 to support our growth and to prevent our fleet and service center network from becoming a limiting factor to our growth. As a result, depreciation and amortization remained consistent at 5.3% of revenue in 2006 and 2005. In addition, building and office equipment rents also remained consistent at 0.9% of revenue in 2006 and 2005.

We purchase transportation services from other motor carriers and railroads for linehaul and P&D services. We also contract with lease operators for our container operations and incur short-term rentals for tractors, trailers and other revenue-producing equipment. We primarily utilize these services when there are capacity restraints or imbalances of freight flow within our service center network or when it is economically beneficial. Purchased transportation increased slightly to 3.4% of revenue in 2006 from 3.3% in 2005. The increase is primarily due to the increased use of purchased linehaul services beginning in the second quarter of 2006, which became necessary in certain lanes because of our significant growth. We were able to add a sufficient number of drivers in the third quarter of 2006, which allowed us to utilize our own equipment and decrease the use of purchased linehaul services. As a result, purchased linehaul services have returned to historical levels and represent an opportunity for additional operating leverage that may be obtained with the continued expansion of our network.

Interest expense, net of interest income, increased to $10,206,000 for 2006 from $6,527,000 for 2005. This increase is primarily due to an increased average balance outstanding on our long-term debt resulting from the two separate issuances of privately-placed senior notes under the Note Purchase Agreement entered into on April 25, 2006, offset by the $2,237,000 of interest income earned on cash equivalents and short-term investments. The effective average tax-equivalent yield, excluding the state-tax benefit, on our short-term investments was 5.68% for 2006.

Our effective tax rate for 2006 was 39.2% compared to 40.3% in 2005. The decrease in our effective tax rate is due primarily to the tax-exempt interest income earned on our cash equivalents and short-term investments in 2006. Due to our cash needs in 2007 to fund capital expenditures, we expect our annual effective tax rate to be 39.8% in 2007. Our effective tax rate exceeds the federal statutory rate of 35% primarily due to the impact of state taxes and, to a lesser extent, certain non-deductible items.

18

2005 Compared to 2004

Key financial and operating metrics for 2005 and 2004 are presented below:

| 2005 | 2004 | Change | % Change |

||||||||||||

| Revenue (in thousands) |

$ | 1,061,403 | $ | 824,051 | $ | 237,352 | 28.8 | % | |||||||

| Operating ratio |

90.8 | % | 91.4 | % | (0.6 | %) | (0.7 | %) | |||||||

| Net income (in thousands) |

$ | 53,475 | $ | 38,992 | $ | 14,483 | 37.1 | % | |||||||

| Diluted earnings per share |

$ | 1.43 | $ | 1.06 | $ | 0.37 | 34.9 | % | |||||||

| Tonnage (in thousands) |

4,203 | 3,550 | 653 | 18.4 | % | ||||||||||

| Shipments (in thousands) |

5,751 | 4,918 | 833 | 16.9 | % | ||||||||||

| Revenue per hundredweight |

$ | 12.63 | $ | 11.61 | $ | 1.02 | 8.8 | % | |||||||

| Weight per shipment (lbs.) |

1,462 | 1,444 | 18 | 1.2 | % | ||||||||||

| Average length of haul (miles) |

926 | 937 | (11 | ) | (1.2 | %) | |||||||||

| Revenue per shipment |

$ | 184.61 | $ | 167.55 | $ | 17.06 | 10.2 | % | |||||||

The 28.8% growth in revenue we produced in 2005 was a primary driver of our financial performance for that year. For the first time in our history, we achieved revenue over $1 billion while extending a four-year trend of producing double-digit growth in revenue, net income and diluted earnings per share. Our profitability was due primarily to our focus on growth in existing markets, thereby leveraging our existing infrastructure and capacity. As a result, we lowered our operating ratio to 90.8%, increased net income by 37.1% and increased diluted earnings per share by 34.9%.

Our revenue growth in 2005 was generated through an 18.4% growth in tonnage and an 8.8% increase in revenue per hundredweight. The tonnage growth consists of increases in both shipments and weight per shipment of 16.9% and 1.2%, respectively, from 2004. We have achieved this growth primarily through expanding our business with existing customers and adding new customers in existing areas, as well as launching new services and improving the quality of our service. We believe that our continued geographic expansion, as well as increased full-state coverage, has positioned us to be attractive to more and more shippers. Additionally, we are able to offer a one-source solution to customers’ regional and inter-regional shipping needs by providing these services through one company, in contrast to many of our principal competitors. For these reasons, combined with a stable economy and industry consolidation during 2005, we continued to gain market share and increase our revenues.

Our average length of haul decreased from 937 in 2004 to 926 miles in 2005, reflecting higher growth in our shorter-haul regional lanes. The growth in these shorter-haul lanes can be attributed to our evolving customer base, our growing number of states with full-state coverage and our focus on building our presence in regional markets. We believe that our competitiveness in the next-day and two-day lanes presents us with further growth opportunities, as these are the fastest growing markets in the industry due to the changing demands of shippers.

Revenue per hundredweight increased to $12.63 from $11.61 in 2004. Our tariffs and contracts generally provide for a fuel surcharge as diesel fuel prices increase above stated levels, which is consistent with industry practice. This surcharge is recorded as additional revenue and was implemented to offset significant fluctuations in the price of diesel fuel, which is one of the larger components of our operating supplies and expenses. Because of the sustained increase in diesel fuel costs, our freight pricing strategy, as well as that in the industry, has evolved and the fuel surcharge is one of many components in the overall price customers are willing to pay for transportation services. As a result, the fuel surcharge often represents more than just the pass through of increased diesel fuel cost. Because of average higher diesel fuel prices in 2005 and the evolution of our freight pricing strategy, the fuel surcharge increased to 10.3% of revenue from 6.3% in 2004. Our fuel surcharge revenue more than offset our increased cost of diesel fuel in 2005. A rapid and significant decrease in diesel fuel prices would likely reduce our revenue and operating income until we revised our pricing strategy to reflect these changes.

19

Our pricing has remained relatively stable despite the increased weight per shipment and decreased length of haul, which generally have the effect of reducing revenue per hundredweight. The overall stability in our pricing demonstrates our ability to maintain our pricing discipline while increasing the volume of freight moving through our service center network.

We increased the total number of service centers in our network to 154 at December 31, 2005 from 138 at December 31, 2004. The expansion of our service center network and improvement in our service capabilities should provide a platform for future growth. However, the majority of our revenue growth for the years compared was generated from our existing service center network, which contributed to a 13.6% increase in revenue per service center in 2005 and the continued improvement in our operating ratio. The revenue growth from geographic expansion typically results in additional freight moving through our existing service center network, which helps to offset higher operating margins that typically accompany new service center openings.

Much of the overall improvement in our operating ratio was achieved by the improvement in salaries, wages and benefits as a percent of revenue, which decreased to 55.2% of revenue in 2005 from 56.9% of revenue in 2004. Driver wages decreased to 21.8% of revenue from 22.9% of revenue in 2004. We saw continued improvement in our linehaul load averages and P&D productivity in 2005, as reflected by our 9.6% improvement in revenue per linehaul mile and our 3.0% improvement in P&D shipments handled per hour from 2004. We also experienced a similar improvement in platform labor, which decreased to 7.5% of revenue in 2005 from 7.7% in 2004. This improvement primarily resulted from a 3.3% increase in platform pounds handled per hour. Fringe benefit costs increased to 29.0% of payroll from 27.3% in 2004, primarily due to increases in workers’ compensation expense recorded in the fourth quarter of 2005. We engaged an independent actuary to review our workers’ compensation and group health self-insurance accruals in 2005, which resulted in $6.8 million of additional expense in our fringe benefit costs.

Operating supplies and expenses increased to 14.9% of revenue in 2005 from 12.2% in 2004. This increase was primarily due to a 78.3% increase in diesel fuel costs, excluding fuel taxes, resulting from increased diesel fuel prices and a 22.4% increase in consumption. We currently do not use diesel fuel hedging instruments; therefore, we are subject to market price fluctuations. Our fuel surcharges, which are generally indexed to the U.S. Department of Energy’s published fuel prices, more than offset the increases in diesel fuel prices during 2005.

Insurance and claims expense, primarily consisting of premiums and self-insured costs for auto liability and cargo claims, decreased to 2.6% of revenue in 2005 compared to 3.2% in 2004. We choose to self-insure a portion of our auto and cargo claims liabilities and obtain excess insurance coverage for claims above our retention levels. The improvement in 2005 is primarily a result of a reduction in our auto liability expense in the fourth quarter of 2005 as a result of an independent actuarial review of our self-insured reserve for unpaid claims. Cargo claims expense also decreased slightly in 2005, which we attribute to the increased utilization of adjustable rack systems and reusable inflatable air bags in our trailer fleet, which protect freight from damage caused by load shifting. New trailer purchases are equipped with these adjustable rack systems and we have retrofitted a portion of our existing trailer fleet.