| By Order of the Board of Directors |

|

|

| Joel B. McCarty, Jr. |

| Secretary |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

OLD DOMINION FREIGHT LINE, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount previously paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

OLD DOMINION FREIGHT LINE, INC.

500 Old Dominion Way

Thomasville, North Carolina 27360

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of Shareholders of Old Dominion Freight Line, Inc. (the “Company”) will be held Monday, May 22, 2006, at 10:00 a.m. local time, in the Company’s executive offices, 500 Old Dominion Way, Thomasville, North Carolina 27360, for the following purposes:

| 1. | To elect a board of nine directors of the Company. |

| 2. | To transact such other business as may be brought before the meeting. |

Shareholders of record at the close of business on March 27, 2006, are entitled to notice of and to vote at the meeting.

| By Order of the Board of Directors |

|

|

| Joel B. McCarty, Jr. |

| Secretary |

Thomasville, North Carolina

April 18, 2006

If you do not intend to be present at the meeting, please sign, date and return the accompanying proxy promptly so that your shares of Common Stock may be represented and voted at the Annual Meeting. A return envelope is enclosed for your convenience.

OLD DOMINION FREIGHT LINE, INC.

Executive Offices: 500 Old Dominion Way

Thomasville, North Carolina 27360

PROXY STATEMENT

This Proxy Statement is being sent to shareholders on or about April 18, 2006, in connection with the solicitation of proxies by the Board of Directors of Old Dominion Freight Line, Inc. (the “Company”, “we”, “us” or “our”) for use at the Annual Meeting of Shareholders to be held at the Company’s executive offices on Monday, May 22, 2006, at 10:00 a.m. local time, and at any adjournment thereof (the “Annual Meeting”).

GENERAL

The accompanying proxy is solicited by and on behalf of our Board of Directors, and the entire cost of such solicitation will be borne by us. In addition to solicitation by mail, arrangements will be made with brokerage houses and other custodians, nominees and fiduciaries to send proxy material to their principals, and we will reimburse them for their reasonable expenses in so doing.

The Board of Directors has fixed March 27, 2006, as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. On March 27, 2006, there were 37,284,675 outstanding shares of common stock (the “Common Stock”) of the Company, each entitled to one vote.

The presence in person or by proxy of a majority of the shares of Common Stock outstanding on the record date constitutes a quorum for purposes of conducting business at the meeting. Shareholders do not have cumulative voting rights in the election of directors. Directors are elected by a plurality of the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present. With regard to the election of directors, votes may be cast in favor or withheld. Votes that are withheld will be excluded entirely from the vote and will have no effect, although they will be counted for purposes of establishing the presence of a quorum. Brokers who are members of the New York Stock Exchange, Inc. and who hold shares in street name for customers have authority to vote on certain items when they have not received instructions from beneficial owners. Brokers that do not receive instructions are entitled to vote on the election of directors.

Where a choice is specified on any proxy as to the vote on any matter to come before the meeting, the proxy will be voted in accordance with such specification. If no specification is made but the proxy is properly signed, the shares represented thereby will be voted in favor of each proposal. Such proxies, whether submitted by shareholders of record or by brokers holding shares in street name for their customers (“broker non-votes”), will be voted in favor of nominees for directors. Broker non-votes will not be counted either way in voting on other matters (where direction of beneficial owners is required) and, therefore, will have the effect of negative votes.

Any shareholder submitting the accompanying proxy has the right to revoke it by notifying the Secretary of the Company in writing at any time prior to the voting of the proxy. A proxy is suspended if the person giving the proxy attends the meeting and elects to vote in person.

Management is not aware of any matters, other than those specified above, that will be presented for action at the meeting, but, if any other matters do properly come before the meeting, the persons named as agents in the proxy will vote upon such matters in accordance with their best judgment.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth information with respect to the beneficial ownership of our Common Stock, $0.10 par value, the only class of voting security, as of March 27, 2006, or such other date as indicated in the footnotes to the table, for (i) each person known by us to own beneficially more than five percent of our Common Stock; (ii) each director; (iii) each director nominee; (iv) each executive officer; and (v) all current directors and executive officers as a group. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”). Unless otherwise indicated, the address of all listed shareholders is c/o Old Dominion Freight Line, Inc., 500 Old Dominion Way, Thomasville, NC 27360. Except as indicated in the footnotes to this table and under applicable community property laws, each shareholder named in the table has sole voting and dispositive power with respect to the shares set forth opposite the shareholder’s name.

- 2 -

| Name of Beneficial Owner |

Shares Beneficially Owned (1) |

Percent | ||||

| Munder Capital Management 480 Pierce Street Birmingham, MI 48009 |

2,999,485 | (2) | 8.0 | % | ||

| David S. Congdon |

2,418,359 | (3) | 6.5 | % | ||

| Earl E. Congdon |

2,258,634 | (4) | 6.1 | % | ||

| John R. Congdon 7511 Whitepine Road Richmond, VA 23237 |

2,126,947 | (5) | 5.7 | % | ||

| Jeffrey W. Congdon 7511 Whitepine Road Richmond, VA 23237 |

2,058,298 | (6) | 5.5 | % | ||

| John R. Congdon, Jr. 7511 Whitepine Road Richmond, VA 23237 |

1,863,225 | (7) | 4.9 | % | ||

| John B. Yowell |

1,600,183 | (8) | 4.3 | % | ||

| John A. Ebeling |

16,875 | * | ||||

| J. Wes Frye |

9,645 | (9) | * | |||

| J. Paul Breitbach |

7,875 | * | ||||

| Joel B. McCarty, Jr. |

7,562 | (10) | * | |||

| Harold G. Hoak |

3,375 | * | ||||

| Franz F. Holscher |

3,375 | * | ||||

| Robert G. Culp, III |

675 | (11) | * | |||

| W. Chester Evans, III |

— | — | ||||

| All Directors and Executive Officers as a Group (12 persons) |

9,150,205 | (12) | 24.5 | % | ||

| * | Less than 1%. |

| (1) | Except as described below, each person or group identified possesses sole voting and investment power with respect to the shares shown opposite the name of such person or group. |

- 3 -

| (2) | Based on information obtained from a Schedule 13G dated March 30, 2006 and filed with the SEC by Munder Capital Management (“Munder”), an investment adviser formed under the general partnership laws of the state of Delaware. Munder is the beneficial owner of 2,999,485 shares of the Company’s common stock on behalf of its numerous clients who have the right to receive and the power to direct the receipt of dividends from, or the proceeds of the sale of, such common stock. No such client has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, more than 5% of the common stock. Munder has the sole power to vote or direct the vote of 2,803,681 shares. |

| (3) | Includes (i) 29,578 shares owned of record by the named shareholder; (ii) 515,154 shares held as trustee of the David S. Congdon Revocable Trust; (iii) 60,148 shares held as trustee of the David S. Congdon Grantor Retained Annuity Trust, dated May 27, 2004; (iv) 58,577 shares held as trustee of the David S. Congdon Grantor Retained Annuity Trust 2005; (v) 309,204 shares held as custodian for minor children of the shareholder; (vi) 35,161 shares held as trustee of an Irrevocable Trust, dated December 18, 1998, f/b/o Marilyn Congdon; (vii) 35,161 shares held as trustee of an Irrevocable Trust, dated December 18, 1998, f/b/o Kathryn Congdon; (viii) 35,161 shares held as trustee of an Irrevocable Trust, dated December 18, 1998, f/b/o Ashlyn Congdon; (ix) 678,275 shares held through shared voting and investment rights as trustee under the Earl E. Congdon Intangibles Trust, dated July 23, 2003; (x) 347,625 shares held through shared voting and investment rights as trustee under the Kathryn W. Congdon Intangibles Trust, dated May 23, 2001; (xi) 275,815 shares held through shared voting and investment rights with the shareholder’s spouse as trustee under the David S. Congdon Irrevocable Trust #1, dated December 1, 1992; and (xii) 38,500 shares owned by the shareholder’s spouse. |

| (4) | Includes (i) 678,275 shares held through shared voting and investment rights as grantor of the Earl E. Congdon Intangibles Trust, dated July 23, 2003; (ii) 342,396 shares owned through the Earl E. Congdon Grantor Retained Annuity Trust - 2004; (iii) 591,000 shares owned through the Earl E. Congdon Granter Retained Annuity Trust 2005; (iv) 158,713 shares held by the shareholder’s spouse as trustee of The Earl E. Congdon GRAT Remainder Trust; (v) 140,625 shares held through shared voting and investment rights as grantor of the 1998 Earl E. Congdon Family Trust; and (vi) 347,625 shares owned beneficially by the shareholder’s spouse through shared voting and investment rights under the Kathryn W. Congdon Intangibles Trust, with respect to which Earl E. Congdon disclaims beneficial ownership. |

| (5) | Includes (i) 1,980,477 shares held as trustee of the John R. Congdon Revocable Trust; (ii) 140,625 shares held through shared voting and investment rights as trustee of the 1998 Earl E. Congdon Family Trust; and (iii) 5,845 shares owned by the shareholder’s spouse as trustee of the Natalie Congdon Revocable Trust, with respect to which John R. Congdon disclaims beneficial ownership. |

| (6) | Includes (i) 719,502 shares held as trustee of the Jeffrey W. Congdon Revocable Trust; (ii) 219,618 shares held as trustee of the John R. Congdon Trust for Michael Davis Congdon; (iii) 219,618 shares held as trustee of the John R. Congdon Trust for Peter Whitefield Congdon; (iv) 219,617 shares held as trustee of the John R. Congdon Trust for Mary Evelyn Congdon; (v) 226,648 shares held as co-trustee of the John R. Congdon Trust for Hunter Andrew Terry; (vi) 226,647 shares held as co-trustee of the John R. Congdon Trust for Nathaniel Everett Terry; and (vii) 226,648 shares held as co-trustee of the John R. Congdon Trust for Kathryn Lawson Terry. |

- 4 -

| (7) | Includes (i) 714,394 shares held as trustee of the John R. Congdon, Jr. Revocable Trust; (ii) 234,360 shares held as trustee of the John R. Congdon Trust for Jeffrey Whitefield Congdon, Jr.; (iii) 234,528 shares held as trustee of the John R. Congdon Trust for Mark Ross Congdon; (iv) 226,648 shares held as co-trustee of the John R. Congdon Trust for Hunter Andrew Terry; (v) 226,647 shares held as co-trustee of the John R. Congdon Trust for Nathaniel Everett Terry; and (vi) 226,648 shares held as co-trustee of the John R. Congdon Trust for Kathryn Lawson Terry. |

| (8) | Includes (i) 62,266 shares owned of record by the named shareholder; (ii) 168,327 shares held as trustee of the Audrey L. Congdon Irrevocable Trust #1, dated December 1, 1992; (iii) 5,953 shares owned of record by the shareholder’s spouse; (iv) 538,001 shares held by the shareholder’s spouse as trustee of the Audrey L. Congdon Revocable Trust, dated March 27, 1992; (v) 62,085 shares held by the shareholder’s spouse as trustee of the Audrey L. Congdon Grantor Retained Annuity Trust, dated May 28, 2004; (vi) 120,000 shares held by the shareholder’s spouse as trustee of the Audrey L. Congdon Grantor Retained Annuity Trust 2005; (vii) 206,136 shares held by the shareholder’s spouse as custodian for minor children; (viii) 35,161 shares held by the shareholder’s spouse as trustee of an Irrevocable Trust, dated December 18, 1998, f/b/o Megan Yowell; (ix) 35,161 shares held by the shareholder’s spouse as trustee of an Irrevocable Trust, dated December 18, 1998, f/b/o Seth Yowell; (x) 247,093 shares held by the shareholder’s spouse through shared voting rights as trustee of the Karen C. Vanstory Irrevocable Trust #1, dated December 1, 1992; and (xi) 120,000 shares held by the shareholder’s spouse as trustee of the Karen C. Pigman Grantor Retained Annuity Trust. |

| (9) | Includes (i) 8,349 shares owned of record by the named shareholder; (ii) 958 shares owned in the named shareholder’s 401(k) retirement plan; and (iii) 338 shares owned jointly by the named shareholder and his spouse. |

| (10) | Includes (i) 6,962 shares owned of record by the named shareholder; (ii) 500 shares owned by the named shareholder’s daughter; and (iii) 100 shares by the named shareholder’s daughter as custodian for minor children. |

| (11) | Consists of 675 shares owned jointly by the named shareholder and his spouse. |

| (12) | The group total for all Directors and Executive Officers includes 1,166,525 shares that have shared voting power between individuals within the group. These shares are counted only once in the total for the group. |

- 5 -

ELECTION OF DIRECTORS

Our bylaws provide that the number of directors shall be not less than five nor more than nine. The Governance and Nomination Committee of our Board of Directors has determined that the number of directors should remain at nine in 2006. Unless authority is withheld, it is intended that proxies received in response to this solicitation will be voted in favor of the nominees. In accordance with its charter and our Corporate Governance Guidelines, the Governance and Nomination Committee has recommended, and the entire Board of Directors has approved, the nine individuals named below to serve as directors until the next Annual Meeting and until their successors shall have been elected and shall qualify. The age and a brief biographical description of each director nominee are set forth below. This information and certain information regarding beneficial ownership of securities by such nominees contained in this proxy statement has been furnished to us by the nominees or obtained from filings with the SEC. All of the nominees have consented to serve as directors if elected.

Harold G. Hoak, who currently serves as a director and member of the Audit Committee, is not standing for re-election to the Board of Directors in 2006. Mr. Hoak, a retired Regional Vice President of Wachovia Bank of North Carolina, N.A., has served as a director since 1991. The Company and its Board would like to thank Mr. Hoak for his 15 years of service to the Company and are grateful for his wisdom and guidance during his tenure on the Board.

Nominees for election as directors are:

Earl E. Congdon (75) joined our company in 1949 and has served as Chairman of the Board of Directors and Chief Executive Officer since 1985 and as a director since 1952. He is a son of E. E. Congdon, one of our founders, the brother of John R. Congdon, the father of David S. Congdon and the father-in-law of John B. Yowell.

John R. Congdon (73) joined us in 1951 and is currently a Senior Vice President. He has served as Vice Chairman of the Board of Directors since 1985 and as a director since 1955. He is also the Chairman of the Board of Directors of Old Dominion Truck Leasing, Inc., a North Carolina corporation that is engaged in the full-service leasing of tractors, trailers and other equipment, to which he devotes more than half of his time. He is a son of E. E. Congdon, one of our founders, the brother of Earl E. Congdon and the father of John R. Congdon, Jr.

David S. Congdon (49) joined our Company in 1978 and, since May 1997, has served as our President and Chief Operating Officer. He has held various positions with us including Vice President – Quality and Field Services, Vice President – Quality, Vice President – Transportation and other positions in operations and engineering. Mr. Congdon became a director in May 1998. He is the son of Earl E. Congdon.

J. Paul Breitbach (68) was elected a director in 2003. Since May 2002, he has served as a director of The Shepherd Street Funds, Inc., a registered investment company. From November 1992 to his retirement in January 2002, Mr. Breitbach was employed by Krispy Kreme Doughnuts, Inc. where he held Executive Vice President positions in Finance and Administration as well as Support Operations. Mr. Breitbach is a Certified Public Accountant.

John R. Congdon, Jr. (49) was elected a director in 1998. He currently serves as the Vice Chairman of the Board of Directors of Old Dominion Truck Leasing, Inc., where he has been employed since May 1979. He is the son of John R. Congdon.

- 6 -

Robert G. Culp, III (59) is the Chairman of the Board of Directors of Culp, Inc., a High Point, North Carolina-based producer of upholstery and mattress fabrics, which he co-founded in 1972. Mr. Culp was elected a director in 2003 and also serves on the Board of Directors of Stanley Furniture Company, Inc.

John A. Ebeling (68) has been a director since August 1985. He formerly served as Vice Chairman from May 1997 to May 1999 and as President and Chief Operating Officer from August 1985 to May 1997. Mr. Ebeling was previously employed by ANR Freight Systems from 1978 to 1985, holding the positions of Chairman and Chief Executive Officer.

W. Chester Evans, III (56) is a retired Partner with KPMG LLP where he served in various audit and management capacities from 1971 to 2006. Mr. Evans is a Certified Public Accountant.

Franz F. Holscher (84) was elected a director in August 1991. He served in a number of executive positions from 1970 to 1987 with Thurston Motor Lines, Inc. and was its Chairman of the Board of Directors from July 1984 through December 1987, when he retired.

The Board of Directors recommends a vote “FOR” the election of each of the nominees identified above.

EXECUTIVE OFFICERS

The following provides certain information concerning the executive officers of the Company who are not directors:

John B. Yowell (54) joined us in February 1983 and has served as Executive Vice President since May 1997. He has also served the Company as a Vice President in many functional areas including Corporate Services, Operations and Information Systems. He is a son-in-law of Earl E. Congdon.

J. Wes Frye (58) has served as Senior Vice President – Finance since May 1997. He has also served as Chief Financial Officer and Treasurer since joining us in February 1985 and has held the position of Assistant Secretary since December 1987. Mr. Frye is a Certified Public Accountant.

Joel B. McCarty, Jr. (68) was appointed Senior Vice President in May 1997 and has served as General Counsel and Secretary since joining us in June 1987. He was formerly the Assistant General Counsel of McLean Trucking Company and was in private law practice prior to 1985.

CORPORATE GOVERNANCE

Independent Directors

In accordance with the listing standards of The Nasdaq Stock Market, Inc. (“Nasdaq”), the Company’s Board of Directors must consist of a majority of independent directors, as determined in accordance with NASD Rule 4200(a)(15). The Board has determined that Messrs. Breitbach, Culp, Ebeling, Hoak and Holscher (collectively, the “independent directors”) and new director nominee W. Chester Evans, III, are independent. The Company’s Corporate Governance Guidelines provide that the independent directors of the Board will meet in executive session at least twice each year. Shareholders may communicate with the independent directors by following the procedures set forth in “Shareholder Communications with the Board”, below.

- 7 -

Attendance and Committees of the Board

Pursuant to the Company’s Corporate Governance Guidelines, directors are expected to attend the Annual Meeting and all meetings of the Board, including all meetings of Board committees of which they are members. All directors were present at the previous Annual Meeting that was held on May 16, 2005. Our Board of Directors held four quarterly meetings and three special telephonic meetings during 2005, at which all members were present, except that John R. Congdon, Jr., John A. Ebeling and Harold G. Hoak each were not present at one of the telephonic Board meetings at which all other members were present. The Board of Directors has five standing committees: the Executive Committee, the Audit Committee, the Compensation Committee, the Governance and Nomination Committee and the Stock Option Plan Committee. Each member of the Audit Committee, the Compensation Committee and the Governance and Nomination Committee is independent as defined under current Nasdaq listing standards. All directors attended more than 75% of the Board meetings and assigned committee meetings held in 2005.

Executive Committee

The Executive Committee consists of Earl E. Congdon (Chairman), John R. Congdon and David S. Congdon. The Executive Committee is empowered to act between meetings of the Board of Directors with powers of the full Board, to the extent permitted by our bylaws and applicable law. This committee did not meet in 2005.

Audit Committee

The Audit Committee currently consists of J. Paul Breitbach (Chairman), John A. Ebeling and Harold G. Hoak, each of whom the Board of Directors has determined is independent pursuant to applicable SEC rules and regulations and Nasdaq listing standards. The Board of Directors has determined that all Audit Committee members are financially literate and that J. Paul Breitbach qualifies as an “audit committee financial expert” as defined by the SEC rules adopted pursuant to the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). If he is elected to serve as a director at the Annual Meeting, the Board intends to appoint Mr. Evans, who also qualifies as an “audit committee financial expert”, to serve as a member of the Audit Committee. The Audit Committee is governed by a written charter approved by the Board of Directors, which is available on our website at http://www.odfl.com/company/corpGovernance.shtml. Information regarding the functions performed by this committee is set forth in the “Report of Audit Committee”, which is included in this proxy statement. The Audit Committee met five times in 2005 and, in addition, held six telephonic meetings, at which all members were present, except that Harold G. Hoak participated by telephone at two of the five meetings and John A. Ebeling was not present at one telephonic meeting. The six telephonic meetings of the Audit Committee included a telephonic meeting after each quarterly period to discuss with both management and the independent auditor, Ernst & Young LLP, the quarterly financial results to be included in the Company’s earnings release and in its financial statements filed with the SEC on either Form 10-Q or Form 10-K.

- 8 -

Compensation Committee

The Compensation Committee consists of Franz F. Holscher (Chairman), Robert G. Culp, III and John A. Ebeling, each of whom the Board of Directors has determined is independent pursuant to Nasdaq listing standards. The Compensation Committee meets periodically to review and approve the salaries and classifications of our executive officers and other significant employees, review and approve our personnel policies and to evaluate and make recommendations regarding the corporate officers’ compensation and benefit plans. The charter for this committee is available on our website at http://www.odfl.com/company/corpGovernance.shtml. The Compensation Committee met two times and held two telephonic meetings in 2005, at which all members were present.

Governance and Nomination Committee

The Governance and Nomination Committee consists of John A. Ebeling (Chairman), J. Paul Breitbach and Robert G. Culp, III, each of whom the Board of Directors has determined is independent pursuant to Nasdaq listing standards. This committee makes recommendations concerning the size and composition of the Board of Directors, evaluates and recommends candidates for election as directors (including nominees recommended by shareholders), coordinates the orientation and educational requirements of new and existing directors, develops and implements the Company’s corporate governance policies and assesses the effectiveness of the Board of Directors and its committees. The charter for this committee is available on our website at http://www.odfl.com/Company/corpGovernance.shtml. The Governance and Nomination Committee met five times in 2005, and all members were present at each meeting.

Stock Option Plan Committee

The Stock Option Plan Committee consists of Earl E. Congdon (Chairman), John R. Congdon and Franz F. Holscher. The Committee has authority to administer our 1991 Employee Stock Option Plan, for which there were no options eligible for grant nor any unexercised options outstanding at year-end 2005. The Stock Option Plan Committee did not meet in 2005.

Corporate Governance Guidelines

The Board has adopted written Corporate Governance Guidelines, which provide the framework for fulfillment of the Board’s duties and responsibilities in light of the best practices in corporate governance and applicable laws and regulations. The Corporate Governance Guidelines address a number of matters applicable to directors, including director qualification standards, meeting requirements and responsibilities of the Board and its committees. The Corporate Governance Guidelines are available on our website at http://www.odfl.com/company/corpGovernance.shtml.

Code of Business Conduct

We have adopted a Code of Business Conduct that applies to all of our directors, officers (including our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer and any person performing similar functions) and employees. Our Code of Business Conduct is available on our website at http://www.odfl.com/company/corpGovernance.shtml. Any waivers or substantive amendments to our Code of Business Conduct applicable to the Company’s directors or executive officers will be disclosed and filed with the SEC on a Form 8-K. Any waiver or substantive amendment of the Code of Business Conduct for directors or executive officers may be made only by the Board or a Board committee.

- 9 -

Shareholder Communications with the Board

Any shareholder desiring to contact the Board or any individual director serving on the Board may do so by written communication mailed to: Board of Directors (Attention: (name of director(s), as applicable)), care of the Corporate Secretary, Old Dominion Freight Line, Inc., 500 Old Dominion Way, Thomasville, North Carolina 27360. Any communication so received will be processed by the Corporate Secretary and be promptly delivered to each member of the Board, or, as appropriate, to the member(s) of the Board named in the communication.

Director Nominations

In evaluating prospective nominees, the Governance and Nomination Committee considers the criteria outlined in our Corporate Governance Guidelines, which include but are not limited to high personal and professional ethics and values; relevant educational and business experience; willingness to devote the time required to evaluate the effectiveness of management; and a commitment to represent the best interests of the Company and its shareholders. After this evaluation process is concluded, the Governance and Nomination Committee selects and submits nominees to the Board of Directors for further consideration and approval.

The Governance and Nomination Committee will consider qualified director nominees recommended by shareholders when such recommendations are submitted in accordance with our bylaws and policies regarding director nominations. Shareholders may submit in writing the names and qualifications of potential director nominees to the Secretary of the Company (500 Old Dominion Way, Thomasville, North Carolina 27360) for delivery to the Chairman of the Governance and Nomination Committee for consideration. When submitting a nomination to the Company for consideration, a shareholder must provide the following minimum information for each director nominee: full name, address, age, principal occupation during the past five years, current directorships on publicly held companies and investment companies, number of Company shares owned, if any, and a signed statement by the nominee consenting to serve as a director if elected. Shareholder nominations for director must also be made in a timely manner and otherwise in accordance with the Company’s bylaws (please refer to Article 3, Section 6 of the Company’s bylaws to determine the precise requirements for any shareholder nomination.) If the Governance and Nomination Committee receives a director nomination from a shareholder or group of shareholders who (individually or in the aggregate) have beneficially owned greater than 5% of the Company’s outstanding stock for at least one year as of the date of such recommendation, the Company, to the extent required by applicable securities law, will identify the candidate and shareholder or group of shareholders recommending the candidate and will disclose in its proxy statement whether the Governance and Nomination Committee chose to nominate the candidate, as well as certain other information required by SEC rules and regulations.

In addition to potential director nominees submitted by shareholders, the Governance and Nomination Committee considers candidates submitted by directors, as well as self-nominations by directors, and, from time to time, it may consider candidates submitted by a third-party search firm hired for the purpose of identifying director candidates. The Governance and Nomination Committee investigates potential director candidates and their individual qualifications, and all such candidates, including those submitted by shareholders, are similarly evaluated by the Governance and Nomination Committee using the board membership criteria described above.

- 10 -

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee has adopted a written policy that requires advance approval of all audit services, audit-related services, tax services and other services performed by the independent auditors. The policy provides for pre-approval by the Audit Committee of specifically defined audit and permissible non-audit services. Unless the specific service has been pre-approved with respect to that year, the Audit Committee must approve the permitted service before the independent auditors are engaged to perform it. The Audit Committee has delegated to the Chairman of the Audit Committee authority to pre-approve permitted services under $20,000 provided that the Chairman reports any decisions to all members of the Committee at the earliest convenience. In the event the Chairman is unavailable, the remaining members must unanimously approve the request for permitted services, not to exceed $20,000, and notify the Chairman at the earliest convenience.

Policy for Accounting Complaints

The Audit Committee of the Board of Directors has established procedures for (i) the receipt, retention and treatment of complaints related to accounting, internal accounting controls and auditing matters and (ii) the confidential, anonymous submission by Company employees of concerns regarding questionable accounting or auditing matters, in compliance with section 301 of the Sarbanes-Oxley Act and related SEC rules and regulations. The Audit Committee has contracted with a third party to provide a toll-free telephone service that is staffed 24 hours a day, seven days a week. This service documents the complaint, assigns a reference number to the complaint for tracking purposes and forwards that information, through email, to the Audit Committee Chairman and the Director of Internal Audit. In the event the complaint concerns an internal audit matter, only the Audit Committee Chairman is notified. The Audit Committee Chairman, using whatever resources are required, investigates the complaint and initiates corrective action when appropriate. The identity of the caller and the details of the complaint remain anonymous throughout this process. The Company periodically tests this process to ensure that complaints are handled in accordance with these procedures.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires certain of our officers, directors and persons who own more than 10% of a registered class of our equity securities to file reports of ownership and changes in ownership with the SEC. Such officers, directors and shareholders are required by the SEC regulations to furnish us with copies of all such reports that they file. Based solely on a review of copies of the reports filed with the SEC since January 1, 2005 and on representations by certain officers and directors, all persons subject to the reporting requirements of Section 16(a) filed the reports required to be filed in 2005 on a timely basis.

REPORT OF AUDIT COMMITTEE

The Audit Committee oversees our financial reporting, internal controls and audit functions on behalf of the Board of Directors and operates under a written charter adopted on April 24, 2000, which is reviewed on an annual basis and most recently revised on March 24, 2004. The charter is available on the Company’s website at http://www.odfl.com/company/corpGovernance.shtml. The Audit Committee is comprised solely of independent directors as defined by Nasdaq listing standards and

- 11 -

SEC rules and its Chairman is designated as an “audit committee financial expert” as defined by SEC rules. The Chairman of the Audit Committee reports its actions and deliberations to the Board at quarterly scheduled Board meetings.

During the fiscal year ended December 31, 2005, the Audit Committee fulfilled its duties and responsibilities as outlined in the charter. Among its actions, the Audit Committee:

| • | Reviewed and discussed the Company’s quarterly earnings press releases and the quarterly financial statements filed on Forms 10-Q with the SEC, with management and the Company’s independent auditor, Ernst & Young LLP; |

| • | Reviewed with management, the internal auditor and Ernst & Young LLP the audit scope and plan for the audit of the fiscal year ended December 31, 2005; and |

| • | Met with each of the internal auditor and Ernst & Young LLP, out of management’s presence, to discuss, among other things, the Company’s financial disclosures, accounting policies and principles and internal controls. |

In fulfilling its oversight responsibilities, the Audit Committee also reviewed the audited financial statements in the Annual Report on Form 10-K with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. Management is responsible for the preparation, presentation and integrity of the Company’s financial statements; accounting and financial reporting principles; establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)); establishing and maintaining internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f)); evaluating the effectiveness of disclosure controls and procedures; evaluating the effectiveness of internal control over financial reporting; and evaluating any change in internal control over financial reporting. Ernst & Young LLP is responsible for performing an independent audit of those financial statements and expressing an opinion as to their conformity with U.S. generally accepted accounting principles, as well as expressing an opinion on (i) management’s assessment of the effectiveness of the Company’s internal control over financial reporting and (ii) the effectiveness of the Company’s internal control over financial reporting.

During the course of 2005, management completed the documentation, testing and evaluation of the Company’s system of internal control over financial reporting in response to the requirements set forth in Section 404 of the Sarbanes-Oxley Act and related regulations. The Audit Committee was kept apprised of the progress of the documentation, testing and evaluation and provided oversight and advice to management during the process. The Audit Committee reviewed the report of management contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005, filed with the SEC, as well as Ernst & Young LLP’s Report of Independent Registered Public Accounting Firm included in the Company’s Annual Report on Form 10-K relating to its audit of (i) the financial statements and financial statement schedule; (ii) management’s assessment of the effectiveness of the Company’s internal control over financial reporting; and (iii) the effectiveness of the Company’s internal control over financial reporting. The Audit Committee continues to oversee the Company’s efforts related to its internal control over financial reporting and management’s preparations for the evaluation and assessment in 2006.

- 12 -

The Audit Committee reviewed with the independent auditors their judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed with the Audit Committee under Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees” and PCAOB Auditing Standard No. 2, “An Audit of Internal Control Over Financial Reporting Performed in Conjunction with an Audit of Financial Statements”. In addition, the Audit Committee has discussed with Ernst & Young LLP their independence from management and the Company and has received the written disclosures and the letter from Ernst & Young LLP required by the Independence Standards Board Standard No. 1, as amended, “Independence Discussions with Audit Committees”. The Audit Committee has also considered the compatibility of the provision of non-audit services with the auditors’ independence.

The Audit Committee has reviewed transactions disclosed in this proxy statement between the Company and entities in which the Company’s officers or directors or their affiliates have material interests and has determined that such existing transactions are fair to the Company. Any new transactions with officers, directors or their affiliates, and any extensions, modifications or renewals of existing transactions with such persons must be approved in advance by the Audit Committee as being on terms no less favorable to the Company than the terms that could be obtained in a similar transaction with an unaffiliated party.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in Old Dominion Freight Line, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2005, for filing with the SEC.

| The Audit Committee, |

| J. Paul Breitbach, Chairman |

| John A. Ebeling |

| Harold G. Hoak |

- 13 -

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table provides a three-year overview of the compensation paid to our five most highly compensated executive officers (the “Named Executive Officers”):

| Annual Compensation |

||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (i) | |||||||||||

| Name and Principal Position |

Year | Salary ($) |

Bonus ($)(1) |

Other Annual ($)(2) |

All Other ($)(4) |

|||||||||||

| Earl E. Congdon |

2005 | $ | 435,500 | $ | 1,741,594 | $ | 110,892 | (3) | $ | 15,454 | (5) | |||||

| 2004 | $ | 435,405 | $ | 1,309,828 | $ | 107,796 | $ | 10,024 | ||||||||

| 2003 | $ | 420,900 | $ | 768,284 | $ | 77,650 | $ | 16,931 | ||||||||

| David S. Congdon |

2005 | $ | 240,460 | $ | 1,054,123 | $ | 69,356 | (3) | $ | 6,486 | (5) | |||||

| 2004 | $ | 234,365 | $ | 792,791 | $ | 39,302 | $ | 4,702 | ||||||||

| 2003 | $ | 220,560 | $ | 465,014 | $ | 37,039 | $ | 2,896 | ||||||||

| John B. Yowell |

2005 | $ | 197,810 | $ | 458,314 | $ | 57,632 | (3) | $ | 7,190 | (5) | |||||

| 2004 | $ | 188,215 | $ | 344,692 | $ | 10,415 | $ | 4,979 | ||||||||

| 2003 | $ | 174,420 | $ | 202,180 | $ | 16,596 | $ | 3,462 | ||||||||

| John R. Congdon |

2005 | $ | 303,500 | $ | 362,999 | $ | — | (3) | $ | 28,353 | (5) | |||||

| 2004 | $ | 302,905 | $ | 185,049 | $ | — | $ | 21,681 | ||||||||

| 2003 | $ | 290,900 | $ | — | $ | — | $ | 25,244 | ||||||||

| J. Wes Frye |

2005 | $ | 178,590 | $ | 320,820 | $ | — | (3) | $ | 7,429 | (5) | |||||

| 2004 | $ | 173,985 | $ | 241,284 | $ | — | $ | 5,111 | ||||||||

| 2003 | $ | 164,600 | $ | 141,526 | $ | — | $ | 3,617 | ||||||||

| (1) | Pursuant to an Executive Profit Sharing Bonus Program, we pay monthly incentive cash bonuses to the Named Executive Officers based upon our pre-tax income during the fiscal year. Profit-sharing bonuses earned in December may be paid in December based upon an estimate of pre-tax income or they may be paid in the following January based upon actual results. Accordingly, there were 12, 13 and 11 months of bonuses paid in 2005, 2004 and 2003, respectively, as reflected in the amounts as shown. However, the 2004 bonus reflected in the “Summary Compensation Table” for John R. Congdon, to which he was entitled pursuant to his employment agreement, was paid in 2005. See “Report of Compensation Committee” below. |

| (2) | Includes the personal use of Company automobiles and aircraft, including amounts reimbursed for payment of taxes on that personal use, pursuant to employment agreements with Earl E. Congdon, David S. Congdon and John B. Yowell. For the purpose of this table, compensation for the personal use of corporate aircraft is calculated using only the direct incremental variable cost for each flight involving personal use. The employment agreements with David S. Congdon |

- 14 -

| and John B. Yowell entitle each executive to an additional $10,000,000 in life insurance benefits, the premiums for which are reimbursed to the employee upon request. The amounts included in this table are actual reimbursements for those premiums in 2005. These amounts do not include premium payments made by David S. Congdon in 2005 for which he is entitled to, but has not requested reimbursement for, totaling $29,142. Also includes the cost of club membership dues for Earl E. Congdon, David S. Congdon and John B. Yowell. See “Employment Agreements” below. |

| (3) | The allocation of 2005 “Other Annual Compensation” is presented below: |

| Name |

Corporate Aircraft |

Corporate Automobile |

Club Memberships |

Life Insurance | ||||||||

| Earl E. Congdon |

$ | 106,282 | $ | 3,246 | $ | 1,364 | $ | — | ||||

| David S. Congdon |

20,784 | 7,720 | 4,930 | 35,922 | ||||||||

| John B. Yowell |

8,658 | 4,556 | 4,125 | 40,293 | ||||||||

| John R. Congdon |

— | — | — | — | ||||||||

| J. Wes Frye |

— | — | — | — | ||||||||

| (4) | Includes pre-tax contributions made to the Old Dominion 401(k) retirement plan, excess premiums paid on group life insurance and the compensation element of premiums paid on split-dollar life insurance policies. |

| (5) | The allocation of 2005 “All Other Compensation” is presented below: |

| Name |

Company Contribution to 401(k) Plan |

Excess Life Insurance Premiums |

Split-Dollar Life Insurance | ||||||

| Earl E. Congdon |

$ | 4,174 | $ | 11,280 | $ | — | |||

| David S. Congdon |

5,616 | 870 | — | ||||||

| John B. Yowell |

5,750 | 1,440 | — | ||||||

| John R. Congdon |

4,153 | 11,280 | 12,920 | ||||||

| J. Wes Frye |

5,179 | 2,250 | — | ||||||

Stock Options

Our Board of Directors and shareholders approved and adopted the 1991 Employee Stock Option Plan of Old Dominion Freight Line, Inc. (the “Option Plan”) under which 843,750 shares of our common stock, as adjusted for the three-for-two stock splits that occurred on June 16, 2003, May 20, 2004 and November 30, 2005, were reserved for the benefit of key employees. The Stock Option Plan Committee of the Board of Directors was formed to administer the Option Plan. Earl E. Congdon and John R. Congdon were not eligible to participate in the Option Plan.

The Option Plan did not allow any options to be granted after August 31, 2001 and limited the period during which the options could be exercised to ten years from the date of grant. At year-end 2005, there were no outstanding unexcercised options.

The Option Plan provided for the granting of stock options that qualify as incentive stock options pursuant to Section 422 of the Internal Revenue Code as well as nonqualified options. After giving effect to the stock splits, options to purchase 756,000 shares were granted, all of which were granted as incentive options.

- 15 -

The following table reflects cumulative information for the last fiscal year regarding exercises under the Option Plan:

| Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values | |||||||||

| (a) | (b) | (c) | (d) | (e) | |||||

| Name |

Shares Acquired on Exercise (#) |

Value Realized ($) (1) |

Number of Securities Underlying Exercisable/Unexercisable (#) |

Value of Unexercised In-The- Money Options at FY-End Exercisable/Unexercisable ($) | |||||

| Earl E. Congdon (2) |

— | — | — | — | |||||

| David S. Congdon |

3,375 | $ | 56,531 | — | — | ||||

| John B. Yowell |

3,375 | $ | 56,531 | — | — | ||||

| John R. Congdon (2) |

— | — | — | — | |||||

| J. Wes Frye |

5,063 | $ | 84,805 | — | — | ||||

| (1) | Value realized is calculated by subtracting the exercise price from the closing price of our stock on the exercise date. |

| (2) | Not eligible to participate in the Option Plan. |

Employment Agreements

On May 17, 2004, we entered into employment agreements with Earl E. Congdon, Chief Executive Officer and Chairman of the Board of Directors; John R. Congdon, Senior Vice President and Vice Chairman of the Board of Directors; David S. Congdon, President and Chief Operating Officer; and John B. Yowell, Executive Vice President. Each of these agreements was reviewed and approved by the Compensation Committee. Each separate agreement requires the executive to perform duties customarily performed by persons holding their respective positions and to perform other services and duties reasonably assigned from time to time by the Company or the Board of Directors with respect to the agreements with Earl E. Congdon and John R. Congdon.

Earl E. Congdon and John R. Congdon

The employment agreements with Earl E. Congdon and John R. Congdon provide for each executive to receive a base salary to be reviewed annually in accordance with standard payroll practices and procedures applicable to the Company’s executive officers, and both executives are entitled to participate in the Company’s Executive Profit Sharing Bonus Program. The Board may also award a discretionary bonus to be paid to each executive in the manner specified by the Board at the time any such bonus is approved. Earl E. Congdon is also entitled to: (i) a special annual bonus equal to the amount necessary to pay all taxes applicable to income derived from the personal use of corporate aircraft (as well as any taxes on the special annual bonus itself); (ii) membership dues and initiation fees for membership in private clubs; and (iii) an automobile for personal and business use.

Each of the employment agreements provide for a term commencing June 1, 2004, and continuing until the earliest of: (i) the death of the executive; (ii) upon written notice by either of the executives or the Company a desire to terminate, subject to a 365-day notice requirement (the “365-

- 16 -

Day Notice Exception”); (iii) termination for “cause” (as defined in the employment agreements); and (iv) termination resulting from total disability. The executive may terminate his employment and forego the 365-day notice requirement if the notice of termination is within 12 months of a change in control. Principally, a change in control is defined in the agreement to be either: (a) the date any person or group of persons, excluding employee benefit plans, directly or indirectly becomes the beneficial owner of 20% or more of the combined voting power of the then outstanding shares of Common Stock; (b) the date when individuals who at the beginning of any two-year period constitute the Board, plus new directors whose nomination or election was approved by two-thirds of the directors still in office at the beginning of the two-year period, cease for any reason during the two-year period to constitute at least two-thirds of the members of the Board; (c) the date shareholders approve an equity transaction that would result in the voting securities of the Company immediately prior to the transaction to represent less than 60% of the combined voting power of the Company or surviving entity immediately after the transaction; (d) the date shareholders approve a plan of complete liquidation; (e) the date shareholders approve an agreement to dispose of substantially all of the Company’s assets; (f) the date of a bankruptcy filing; or (g) the date of any event that the Board determines to constitute a substantial threat to corporate policy or effectiveness.

If either executive’s employment is terminated by the Company or the executive through exercise of the 365-Day Notice Exception, and such exercise occurs within 12 months of a change in control, the executive is entitled to receive a lump sum payment equal to three times the average annual compensation for the prior five taxable years before the change in control, less one dollar. If employment is terminated by the 365-Day Notice Exception and does not occur within 12 months of a change in control, the executive is due only the compensation not paid through the termination date.

Each executive is also subject to a non-competition and non-solicitation clause, which covers the term of the executive’s employment plus the twenty-four month period following such executive’s termination of employment.

David S. Congdon and John B. Yowell

The employment agreements with David S. Congdon and John B. Yowell provide for each executive to receive a base salary, participation in the Executive Profit Sharing Bonus Program, discretionary bonuses as determined by the Board, $10,000,000 in life insurance benefits, a special annual bonus equal to the amount necessary to pay all taxes applicable to income derived from Company paid life insurance benefits and the personal use of corporate aircraft (as well as any taxes on the special annual bonus itself), membership dues and initiation fees for membership in private clubs, and an automobile for personal and business use.

Each of the agreements provide for a term commencing on June 1, 2004 and continuing until the earliest of: (i) May 31, 2007; (ii) the date of death of the executive; (iii) upon written notice by either the executive or the Company to terminate, subject to a 90-day notice requirement (the “90-Day Notice Exception”); (iv) the date of termination due to cause (as defined in the agreements); (v) the date the executive terminates his employment for good reason, which includes a breach of the employment contract, resignation due to a change in control (as defined in the above description of the Earl E. Congdon and John R. Congdon employment agreements), any reduction in the executive’s base salary, the dissolution or liquidation of a significant portion of Company assets, the assignment of duties inconsistent with the executive’s position, exclusion from employee benefit plans, transfer of primary work location or substantially greater travel requirements; or (vi) the date

- 17 -

of total disability. Unless written notification is provided by either of the executives or the Company, the term is automatically extended on the first day of each month for one additional calendar month beginning July 1, 2004, unless either of the executives or the Company desires to fix the term for a definite three-year period.

Upon termination due to the Company’s exercise of the 90-Day Notice Exception by the Company, disability, good reason, the executive’s exercise of the 90-Day Notice Exception after attaining the age of 65 or the expiration of a three-year term after being fixed by the Company, the executive is entitled to receive: (i) the base salary through the last day of the month of termination; (ii) three years of annual compensation continuance, to be paid weekly, calculated by averaging the three years in the five-year period preceding termination that produces the highest average annual compensation; and (iii) a lump sum special termination bonus equal to the amount of the highest annual bonus earned by the executive during any one of the three calendar years preceding termination. During the compensation continuance period, the Company will pay the entire cost for the executives and their families to participate in the Company welfare benefit programs, which include health, dental, vision and life insurance programs, and the executives will continue to participate in the Company’s non-qualified deferred compensation plan.

Each executive is also subject to a non-competition and non-solicitation clause, which covers the term of the executive’s employment plus the twenty-four month period following such executive’s termination of employment.

Old Dominion Freight Line, Inc. Change of Control Severance Plan for Key Executives

On May 16, 2005, the Board approved and the Company immediately adopted the Old Dominion Freight Line, Inc. Change of Control Severance Plan for Key Executives (the “Severance Plan”) for eligible key executives as determined by the Committee (generally, a senior vice president or vice president). Under the Severance Plan, termination of a participant’s employment by the Company for any reason other than for cause, death or total disability, or by the participant for good reason occurring within 36 months following a change in control, entitles the participant to receive the following benefits: receipt of base salary through the last day of the month in which the termination date occurs; a monthly benefit equal to the participant’s monthly termination compensation, as defined in the Severance Plan, during the compensation continuance period; and continued participation in the Company welfare benefit plans until the earlier of the participant’s death or the last day of the calendar month in which the participant receives his final payment of termination compensation. The compensation continuance period is equal to 12 calendar months plus three additional calendar months for each year of service completed by the participant as of the termination date in excess of 10 years, not to exceed 36 calendar months.

Old Dominion Freight Line, Inc. Phantom Stock Plan

On May 16, 2005, the Board of Directors approved and the Company adopted the Old Dominion Freight Line, Inc. Phantom Stock Plan (the “Phantom Stock Plan”), which provides a long-term retirement incentive for the Company’s key executives. The maximum number of shares of phantom stock available for awards under the Phantom Stock Plan is 375,000, after adjusting for the three-for-two stock split on November 30, 2005. Each share of phantom stock represents a contractual right to receive an amount in cash equal to the fair market value of a share of the Company’s Common Stock on the settlement date, to be paid out of the general funds of the Company. Generally, each award vests on the earlier to occur of the following: a change of control of the Company; the fifth anniversary of

- 18 -

the grant date of the award, provided the participant is employed on such date; the date of the participant’s death while employed by the Company; the date of the participant’s total disability; or the date the participant attains the age of 65 while employed by the Company. No shares of common stock will be issued pursuant to the Phantom Stock Plan. There were no awards of phantom stock in 2005.

2006 Nonqualified Deferred Compensation Plan of Old Dominion Freight Line, Inc.

On October 31, 2005, the Board of Directors approved the 2006 Nonqualified Deferred Compensation Plan of Old Dominion Freight Line, Inc. (the “Deferred Compensation Plan”) that became effective on January 1, 2006. The Plan was established to permit certain management employees of the Company, as determined by the Deferred Compensation Plan’s Administrative Committee to be highly compensated or a management employee who is in a position materially to affect the profits of the Company, to defer receipt of current compensation from the Company in order to provide retirement benefits on behalf of such employees. The Deferred Compensation Plan is intended to be an unfunded plan maintained primarily for the purpose of providing deferred compensation benefits for eligible employees. Participating employees may elect to reduce their (i) regular salary from the Company by a whole number percentage from three to fifty percent and/or (ii) bonus by a whole number percentage from five to seventy-five percent. The deferred amount will be credited to the deferred compensation account maintained by the Company for each participant. As of each March 31, June 30, September 30 and December 31, the deferred compensation account of each participant is adjusted to reflect gains and losses from the investments in which the amount in the account is deemed invested. Distributions are generally made in the event of retirement, disability, death or other termination of service. Distributions also may be made upon the occurrence of certain other events, such as an unforeseeable emergency, or delayed under certain circumstances, such as when a distribution might violate the terms of a loan agreement to which the Company is a party. Payments are made from the Deferred Compensation Plan in a lump sum or in annual installments over a term certain, as elected by the participant.

Old Dominion 401(k) Retirement Plan

All employees meeting certain service requirements are eligible to participate in the Company’s 401(k) employee retirement plan. Employee contributions are limited to a percentage of their compensation, as defined in the plan. Company contributions are based upon the greater of a percentage of employee contributions or ten percent of net income.

REPORT OF COMPENSATION COMMITTEE

The Compensation Committee (the “Committee”) is responsible for conducting an annual review of the Company’s compensation plans and policies for its executive officers, including an evaluation of the components of compensation, the standards of performance measurement and the relationship between performance and compensation. Our charter reflects these responsibilities and we periodically review and consider appropriate changes to the charter. The Committee consists entirely of independent directors chosen by the Board and meets at scheduled intervals during the year or as required to fulfill its responsibilities. The Committee has the authority to utilize internal resources, as well as engage outside advisors and counsel. The Chairman of the Committee reports its actions and deliberations to the Board at quarterly scheduled Board meetings.

- 19 -

General Compensation Philosophy

The Committee believes that weight on pay-for-performance incentives produces results that are more aligned with overall corporate objectives and shareholder interests. The Committee recognizes that this philosophy can produce higher-than-market compensation in periods of high financial achievement and conversely, lower-than-market compensation during depressed phases of the economic cycle. As a result, the Committee believes long-term incentives are necessary to retain and motivate key executives. We have historically relied on three primary components to compensate the Company’s executive officers: base salary, executive profit sharing and incentive stock options.

In addition to these components, the Committee concluded that the stability and retention of our key executive management team is critical to the success of the Company and, accordingly, the Company entered into four separate employment agreements in 2004 with the following employees: Earl E. Congdon, Chief Executive Officer and Chairman of the Board of Directors; John R. Congdon, Senior Vice President and Vice Chairman of the Board of Directors; David S. Congdon, President and Chief Operating Officer; and John B. Yowell, Executive Vice President. A summary of these agreements is provided in this proxy statement under the heading “Employment Agreements”.

Base Salary – The Committee sets base salary to approximate competitive market levels, which have been determined from contacts with other carriers in the LTL industry, compensation consultants and other public information, such as filings with the SEC. Annual increases to base salaries for executive officers are generally limited to cost of living adjustments; however, the Committee periodically reviews these base salaries for competitiveness and makes adjustments as it deems appropriate.

Executive Profit Sharing Bonus Program – The Company’s Executive Profit Sharing Bonus Program rewards key officers and other management personnel. Participants in the program are eligible to receive a percentage, determined by the Committee, of pre-tax income. Periodically, the Compensation Committee reviews the balance between executive profit sharing bonuses and base salary for each executive to ensure that each executive’s overall compensation is appropriate. Pre-tax income increased 39.8% in 2005 and 42.6% in 2004, resulting in similar increases in the amount of executive profit sharing bonuses paid to participating executives.

Stock Options – In 1991, our Board of Directors and shareholders adopted the 1991 Employee Stock Option Plan under which 843,750 shares of our Common Stock, after adjusting for the three-for-two stock splits occurring on June 16, 2003, May 20, 2004 and November 30, 2005, were reserved for grant to benefit key employees. While the Option Plan was administered by the Stock Option Plan Committee, the compensation to executives resulting from the grant of stock options is considered by the Committee in our overall evaluation of executive compensation. Under the Option Plan, no options could be granted after August 31, 2001, and the exercise period for all shares granted prior to that date expired in October 2005. As a result, the granting and exercise of incentive stock options will no longer be a component of executive compensation.

- 20 -

In 2005, the Board of Directors took specific action on certain findings of a third-party compensation consultant engaged in 2004 to review the Company’s compensation plans for its key executives. The findings of the compensation consultant, which were corroborated by the Committee, included the following observations concerning compensation risks to our key executives inherent in our executive compensation programs:

| • | The compensation in place for the Company’s key executives did not offer any protection against a change in control or ownership of the Company, which, if such an event were to occur, could have an adverse effect on the overall compensation and retention of those employees; and |

| • | The Company’s executive compensation programs did not provide any long-term retirement incentives to retain key executives, which are typical for executives with similar responsibilities at comparable companies. |

On May 16, 2005 and in response to these findings, the Board of Directors approved and the Company immediately adopted the Old Dominion Freight Line, Inc. Change of Control Severance Plan for Key Executives (the “Severance Plan”) and the Old Dominion Freight Line, Inc. Phantom Stock Plan (the “Phantom Stock Plan”). These plans were both adopted to retain the Company’s officers and key employees who are critical in developing and executing the strategic plans that have proven successful as reflected by our recent financial performance. The Severance Plan provides protection to these key employees against a change in control or ownership of the Company. The Phantom Stock Plan provides for a long-term retirement benefit, which is based on the fair market value of the Company’s Common Stock. We believe that a retirement benefit based on the fair market value of the Company’s stock ensures that the interest of management are aligned with those of the Company’s shareholders.

On October 31, 2005, the Board of Directors approved the 2006 Nonqualified Deferred Compensation Plan of Old Dominion Freight Line, Inc. (the “Deferred Compensation Plan”) that became effective on January 1, 2006. The Deferred Compensation Plan allows participating key employees to defer current compensation, generally, to their retirement date.

We believe the adoption of the Severance Plan, the Phantom Stock Plan and the Deferred Compensation Plan will provide both the security and long-term incentives that are necessary to attract and retain the quality of leadership that is needed to sustain our financial success. Each of these plans was considered in evaluating compensation in 2005 and in our planning for the appropriate compensation instruments that will be used in future periods.

Compensation for the Chief Executive Officer

In evaluating Earl E. Congdon’s base salary, the Committee considered Mr. Congdon’s tenure with the Company, his leadership and experience in the industry and comparisons with other chief executive officers with similar responsibilities at other similarly-sized public companies, which were obtained from public sources. Based upon this review, the Committee determined that Mr. Congdon’s base salary was competitive and approved an increase to the base salary of 1.5%, effective May 20, 2005, which approximated an adjustment for inflation. In addition, the Committee did not change Mr. Congdon’s level of participation in the Company’s Executive Profit Sharing Bonus Program because we believe that the profit sharing bonus provided by the plan in 2005 is appropriate for the 39.8% increase in pre-tax income achieved.

- 21 -

As a result of the findings of the compensation consultant in 2004 and other deliberations, the Company and Mr. Congdon executed an employment agreement on May 17, 2004, which established a 365-day notice of termination by either party, unless the termination was due to death, disability, cause or within 12 months of a change in control (as defined in the agreement). If termination by notice, initiated by either party, occurs within 12 months of a change in control, Mr. Congdon is entitled to a lump sum payment of three times his average annual salary for the preceding five-year taxable period less one dollar. Otherwise, Mr. Congdon is entitled only to a lump sum payment equal to the compensation earned but not paid through the termination date. The contract allows Mr. Congdon to continue to participate in the Executive Profit Sharing Bonus Program and other employee benefit plans common to all Company employees during his employment. The contract also provides for a special annual bonus equal to the amount necessary to pay income taxes applicable to income derived from the personal use of corporate aircraft, as well as any income taxes resulting from the special annual bonus itself. In addition, Mr. Congdon is entitled to membership dues and initiation fees for membership in private clubs, and the personal and business use of a Company automobile. The Board may also award Mr. Congdon a discretionary bonus from time to time, based upon factors it considers appropriate at the time of its deliberations.

Compensation for Other Officers

John R. Congdon received a 2.1% increase in base salary on May 20, 2005, which the Committee approved as an annual inflationary adjustment. Under an employment agreement executed May 17, 2004, Mr. Congdon is also entitled to participate in the Company’s Executive Profit Sharing Bonus Program and may receive discretionary bonuses awarded by the Board, although none were awarded in 2005. The employment agreement also provides Mr. Congdon with the same 365-day notice of termination and change in control provisions that apply to the employment agreement with Earl E. Congdon.

On May 20, 2005, David S. Congdon received a 4.4% increase to his annual base salary, which was consistent with annual base salary increases for other senior officers that are responsible for the overall financial performance of the Company. Also on May 20, 2005, John B. Yowell received a 6.8% increase in his annual base salary which was primarily based upon the overall financial performance of the Company as well as consideration of the relationship of his base salary to job duties in comparison to other officers in the Company. A portion of each individual’s increase in annual base salary was also provided as an inflationary adjustment.

The employment agreements with David S. Congdon and John B. Yowell, also executed on May 17, 2004, provide each executive a rolling three-year employment term, participation in the Executive Profit Sharing Bonus Program, discretionary bonuses as determined by the Board, $10,000,000 of life insurance benefits for each executive, a special annual bonus equal to the amount necessary to pay all taxes applicable to income derived from Company-paid life insurance benefits and the personal use of corporate aircraft (as well as any taxes on the special annual bonus itself), membership dues and initiation fees for membership in private clubs, and an automobile for personal and business use. Both contracts also provide for a three-year compensation continuance in the event of termination due to a 90-day termination notice by the Company, disability, good reason, a 90-day termination notice by the executive after attaining the age of 65 or the expiration of a fixed three-year term that may be fixed by the Company and the executive. The compensation continuance provision entitles each executive to receive three years of annual compensation to be paid through normal cycles, calculated by averaging the three years in the five-year period preceding termination that produces the highest average annual compensation, and a lump sum special termination bonus equal to the highest bonus earned by the

- 22 -

executive during any one of the three calendar years preceding termination. The Company would also pay the entire cost for each executive and their family to participate in the Company’s welfare benefit programs during the three-year compensation continuance period, and each executive would be allowed to continue to participate in the Company’s non-qualified deferred compensation plan.

The base salary for all of our other officers is based upon the experience and qualifications of each officer, with the additional objective of remaining competitive in the industry in recruiting and retaining a well-qualified, effective management team. Each other officer’s level of participation in the Executive Profit Sharing Bonus Program is determined by the Committee based upon the officer’s performance and relative position within the organization.

Section 162(m) of the Internal Revenue Code (the “Code”) generally limits amounts that can be deducted for compensation paid to executives to $1 million, unless certain requirements are met. In 2005, the components of compensation that exceeded this threshold for Earl E. Congdon and David S. Congdon, and are thus deemed nondeductible to the Company under Section 162(m) of the Code, were $1,231,884 and $356,631, respectively. No other executive received compensation in excess of $1 million in 2005. The Compensation Committee will continue to monitor the applicability of this section of the Code to our compensation program each year.

| The Compensation Committee, |

| Franz F. Holscher, Chairman |

| Robert G. Culp, III |

| John A. Ebeling |

Compensation Committee Interlocks and Insider Participation

John A. Ebeling, who serves as a member of our Compensation Committee, formerly served as Vice Chairman of the Company from May 1997 to May 1999 and as President and Chief Operating Officer of the Company from August 1985 to May 1997. As part of its determination that a majority of the members of the Board of Directors are independent in accordance with applicable Nasdaq listing standards, the Board reviewed and considered Mr. Ebeling’s former employment with the Company. The Board has determined that such former employment does not impair or otherwise affect Mr. Ebeling’s status as an independent director.

Compensation of Directors

On January 31, 2005, the Board of Directors approved our current fee structure for outside directors, which became effective on May 16, 2005. Under this fee structure, each outside director receives an annual retainer of $22,500 plus $1,500 for each Board meeting attended. The chairman of the Audit Committee receives an additional annual retainer of $7,500 and each member of that committee receives an additional annual retainer of $5,000. The chairman of the Compensation Committee receives an additional annual retainer of $5,000 and each member of that committee receives an additional annual retainer of $3,000. The chairman of the Governance and Nomination Committee receives an additional annual retainer of $5,000 and each member of that committee receives an additional annual retainer of $3,000. In addition, all members of these committees receive $1,500 for each meeting attended that is not held in conjunction with a meeting of the entire Board of Directors. There is no meeting compensation for telephonic meetings of the Board or Committees of the Board.

- 23 -

All directors receive reimbursement of business expenses incurred as a director. Directors who are also officers of the Company receive no retainers.

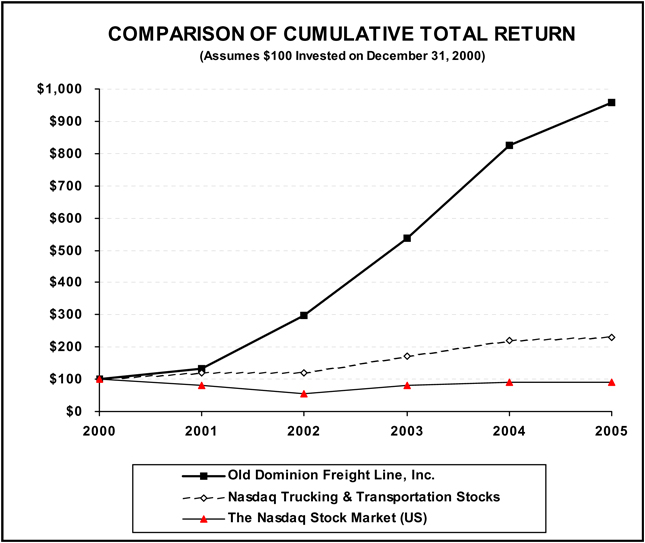

Performance Graph

The following graph compares the total shareholder cumulative returns, assuming the reinvestment of all dividends, of $100 invested on December 31, 2000, in (i) our Common Stock, (ii) the Nasdaq Trucking & Transportation Stocks and (iii) The Nasdaq Stock Market (US) for the five-year period ended December 31, 2005:

- 24 -

| Cumulative Total Return | ||||||||||||||||||

| 12/31/00 | 12/31/01 | 12/31/02 | 12/31/03 | 12/31/04 | 12/31/05 | |||||||||||||

| Old Dominion Freight Line, Inc. |

$ | 100.00 | $ | 133 | $ | 299 | $ | 538 | $ | 824 | $ | 958 | ||||||

| Nasdaq Trucking and Transportation Stocks |

$ | 100.00 | $ | 118 | $ | 120 | $ | 172 | $ | 221 | $ | 231 | ||||||

| The Nasdaq Stock Market |

$ | 100.00 | $ | 79 | $ | 55 | $ | 82 | $ | 89 | $ | 91 | ||||||

RELATED PARTY TRANSACTIONS

Family Relationships

Earl E. Congdon, the Chairman of our Board of Directors and Chief Executive Officer, is the brother of John R. Congdon, the Vice Chairman of our Board of Directors, and is the father of David S. Congdon, our President and Chief Operating Officer. John B. Yowell, the Executive Vice President, is the son-in-law of Earl E. Congdon. John R. Congdon, Jr., a director, is the son of John R. Congdon. Earl E. Congdon, John R. Congdon and David S. Congdon each beneficially own more than 5% of our Common Stock.

Transactions with Old Dominion Truck Leasing, Inc.