| By Order of the Board of Directors |

|

| Joel B. McCarty, Jr. Secretary |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x |

Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ¨ |

Definitive Proxy Statement | |||||

| ¨ |

Definitive Additional Materials | |||||

| ¨ |

Soliciting Material Pursuant to §240.14a-12 |

OLD DOMINION FREIGHT LINE, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount previously paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

OLD DOMINION FREIGHT LINE, INC.

500 Old Dominion Way

Thomasville, North Carolina 27360

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of Shareholders of Old Dominion Freight Line, Inc. (the “Company”) will be held Monday, May 17, 2004, at 10:00 a.m. local time, in the Company’s executive offices, 500 Old Dominion Way, Thomasville, North Carolina 27360, for the following purposes:

| 1. | To elect a board of nine directors of the Company. |

| 2. | To amend the articles of incorporation to eliminate director and officer liability under certain circumstances. |

| 3. | To amend the articles of incorporation to increase the number of authorized shares of common stock. |

| 4. | To transact such other business as may be brought before the meeting. |

Shareholders of record at the close of business on March 29, 2004, are entitled to notice of and to vote at the meeting.

| By Order of the Board of Directors |

|

| Joel B. McCarty, Jr. Secretary |

Thomasville, North Carolina

April , 2004

| If you do not intend to be present at the meeting, please sign, date and return the accompanying proxy promptly so that your shares of Common Stock may be represented and voted at the Annual Meeting. A return envelope is enclosed for your convenience. |

OLD DOMINION FREIGHT LINE, INC.

Executive Offices: 500 Old Dominion Way

Thomasville, North Carolina 27360

PROXY STATEMENT

This Proxy Statement is being sent to shareholders on or about April , 2004, in connection with the solicitation of proxies by the Board of Directors of Old Dominion Freight Line, Inc. (the “Company”) for use at the Annual Meeting of Shareholders to be held at the Company’s executive offices on Monday, May 17, 2004, at 10:00 a.m. local time, and at any adjournment thereof (the “Annual Meeting”).

GENERAL

The accompanying Proxy is solicited by and on behalf of our Board of Directors, and the entire cost of such solicitation will be borne by us. In addition to solicitation by mail, arrangements will be made with brokerage houses and other custodians, nominees and fiduciaries to send proxy material to their principals, and we will reimburse them for their reasonable expenses in so doing.

The Board of Directors has fixed March 29, 2004, as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. On March 29, 2004, there were 16,059,352 outstanding shares of Common Stock of the Company, each entitled to one vote.

The presence in person or by proxy of a majority of the shares of Common Stock outstanding on the record date constitutes a quorum for purposes of conducting business at the meeting. Shareholders do not have cumulative voting rights in the election of directors. Directors are elected by a plurality of the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present. With regard to the election of directors, votes may be cast in favor or withheld. Votes that are withheld will be excluded entirely from the vote and will have no effect, although they will be counted for purposes of establishing the presence of a quorum. Under the rules of the New York Stock Exchange, Inc., brokers who hold shares in street name for customers have authority to vote on certain items when they have not received instructions from beneficial owners. Brokers that do not receive instructions are entitled to vote on the election of directors.

Where a choice is specified on any Proxy as to the vote on any matter to come before the meeting, the Proxy will be voted in accordance with such specification. If no specification is made but the Proxy is properly signed, the shares represented thereby will be voted in favor of each proposal. Such Proxies, whether submitted by shareholders of record or by brokers holding shares in street name for their customers (“broker non-votes”), will be voted in favor of nominees for directors. Broker non-votes will not be counted either way in voting on other matters (where direction of beneficial owners is required) and, therefore, will have the effect of negative votes.

Any shareholder submitting the accompanying Proxy has the right to revoke it by notifying the Secretary of the Company in writing at any time prior to the voting of the Proxy. A Proxy is suspended if the person giving the Proxy attends the meeting and elects to vote in person.

Management is not aware of any matters, other than those specified above, that will be presented for action at the meeting, but, if any other matters do properly come before the meeting, the persons named as agents in the Proxy will vote upon such matters in accordance with their best judgment.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth information with respect to the beneficial ownership of our common stock (“Common Stock”), $.10 par value, the only class of voting security, as of March 29, 2004, or such other date as indicated in the footnotes to the table, for (i) each person known by us to own beneficially more than five percent of our Common Stock; (ii) each director; (iii) each executive officer; and (iv) all current directors and executive officers as a group. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”). In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares subject to options or warrants held by that person that are currently exercisable or that are or may become exercisable within 60 days of March 29, 2004 are deemed to be outstanding. These shares, however, are not deemed to be outstanding for purposes of computing the percentage ownership of any other person. Except as indicated in the footnotes to this table and under applicable community property laws, each shareholder named in the table has sole voting and dispositive power with respect to the shares set forth opposite the shareholder’s name.

| Name of Beneficial Owner |

Shares Beneficially Owned (1) |

Percent |

||||

| David S. Congdon |

1,934,774 | (2) | 12.0 | % | ||

| Earl E. Congdon |

1,360,469 | (3) | 8.5 | % | ||

| John R. Congdon |

1,289,516 | (4) | 8.0 | % | ||

| Fidelity Management & Research Company |

1,097,315 | (5) | 6.8 | % | ||

| Jeffrey W. Congdon |

1,032,726 | (6) | 6.4 | % | ||

| John R. Congdon, Jr. |

945,997 | (7) | 5.9 | % | ||

-2-

| Name of Beneficial Owner |

Shares Beneficially Owned (1) |

Percent |

||||

| John B. Yowell |

780,098 | (8) | 4.9 | % | ||

| J. Wes Frye |

8,036 | (9) | * | |||

| John A. Ebeling |

7,500 | * | ||||

| Joel B. McCarty, Jr. |

7,200 | (10) | * | |||

| J. Paul Breitbach |

2,500 | * | ||||

| Harold G. Hoak |

1,500 | * | ||||

| Franz F. Holscher |

1,500 | * | ||||

| Robert G. Culp, III |

300 | (11) | * | |||

| All Directors and Executive Officers |

5,081,230 | (12) | 31.6 | % | ||

| * | Less than 1%. |

| (1) | Except as described below, each person or group identified possesses sole voting and investment power with respect to the shares shown opposite the name of such person or group. |

| (2) | Includes (i) 8,646 shares owned of record by the named shareholder; (ii) 4,500 shares obtainable upon exercise of stock options exercisable within 60 days; (iii) 405,397 shares held as trustee by the David S. Congdon Revocable Trust; (iv) 137,424 shares held as custodian for minor children of the shareholder; (v) 14,854 shares held as trustee by an Irrevocable Trust, dated December 18, 1998, f/b/o Marilyn Congdon; (vi) 14,854 shares held as trustee by an Irrevocable Trust, dated December 18, 1998, f/b/o Kathryn Congdon; (vii) 14,854 shares held as trustee by an Irrevocable Trust, dated December 18, 1998, f/b/o Ashlyn Congdon; (viii) 1,041,160 shares held through shared voting and investment rights as trustee under the Earl E. Congdon Intangibles Trust; (ix) 154,500 shares held through shared voting and investment rights as trustee under the Kathryn W. Congdon Intangibles Trust; (x) 122,585 shares held through shared voting and investment rights with the shareholder’s spouse as trustee under the David S. Congdon Irrevocable Trust #1; and (xi) 16,000 shares owned by the shareholder’s spouse. |

| (3) | Includes (i) 1,041,160 shares held through shared voting and investment rights as grantor of the Earl E. Congdon Intangibles Trust; (ii) 102,309 shares owned through the Earl E. Congdon Grantor Retained Annuity Trust 2003; (iii) 62,500 shares held through shared voting and investment rights as grantor of the Earl E. Congdon Family Trust; and (iv) 154,500 shares owned beneficially by the shareholder’s spouse through shared voting and investment rights under the Kathryn W. Congdon Intangibles Trust, with respect to which Earl E. Congdon disclaims beneficial ownership. |

-3-

| (4) | Includes (i) 1,224,418 shares held as trustee by the John R. Congdon Revocable Trust; (ii) 62,500 shares held through shared voting and investment rights as trustee of the Earl E. Congdon Family Trust; and (iii) 2,598 shares owned by the shareholder’s spouse as trustee of the Natalie Congdon Revocable Trust, with respect to which John R. Congdon disclaims beneficial ownership. |

| (5) | Based on information obtained from a Schedule 13G dated February 16, 2004 and filed with the SEC by Fidelity Management & Research Company, a wholly-owned subsidiary of FMR Corp. (“Fidelity”) and an investment adviser registered under Section 203 of the Investment Advisers Act of 1940. Fidelity is the beneficial owner of 1,097,315 shares of the Company’s common stock as a result of acting as investment adviser to various investment companies registered under Section 8 of the Investment Company Act of 1940. The ownership of one investment company, Fidelity Low Priced Stock Fund, amounted to 1,097,215 shares, or 6.8%, of the Company’s outstanding Common Stock. |

| (6) | Includes (i) 445,920 shares held as trustee by the Jeffrey W. Congdon Revocable Trust; (ii) 96,100 shares held as trustee of the John R. Congdon Trust for Michael Davis Congdon; (iii) 96,100 shares held as trustee of the John R. Congdon Trust for Peter Whitefield Congdon; (iv) 96,100 shares held as trustee of the John R. Congdon Trust for Mary Evelyn Congdon; (v) 99,502 shares held as co-trustee of the John R. Congdon Trust for Hunter Andrew Terry; (vi) 99,502 shares held as co-trustee of the John R. Congdon Trust for Nathaniel Everett Terry; and (vii) 99,502 shares held as co-trustee of the John R. Congdon Trust for Kathryn Lawson Terry. |

| (7) | Includes (i) 3,375 shares owned of record by the named shareholder; (ii) 439,537 shares held as trustee by the John R. Congdon, Jr. Revocable Trust; (iii) 102,252 shares held as trustee of the John R. Congdon Trust for Jeffrey Whitefield Congdon; (iv) 102,327 shares held as trustee of the John R. Congdon Trust for Mark Ross Congdon; (v) 99,502 shares held as co-trustee of the John R. Congdon Trust for Hunter Andrew Terry; (vi) 99,502 shares held as co-trustee of the John R. Congdon Trust for Nathaniel Everett Terry; and (vii) 99,502 shares held as co-trustee of the John R. Congdon Trust for Kathryn Lawson Terry. |

| (8) | Includes (i) 21,754 shares owned of record by the named shareholder; (ii) 74,813 shares held as trustee of the Audrey L. Congdon Irrevocable Trust #1; (iii) 4,500 shares obtainable upon exercise of stock options exercisable within 60 days; (iv) 2,646 shares owned of record by the shareholder’s spouse; (v) 445,241 shares held by the shareholder’s spouse as trustee of the Audrey L. Congdon Revocable Trust; (vi) 91,616 shares held by the shareholder’s spouse as custodian for minor children; (vii) 14,854 shares held by the shareholder’s spouse as trustee of an Irrevocable Trust, dated December 18, 1998, f/b/o Megan Yowell; (viii) 14,854 shares held by the shareholder’s spouse as trustee of an Irrevocable Trust, dated December 18, 1998, f/b/o Seth Congdon; and (ix) 109,820 shares held by the shareholder’s spouse through shared voting rights as trustee of the Karen C. Pigman Irrevocable Trust. |

| (9) | Includes (i) 1,461 shares owned of record by the named shareholder; (ii) 425 shares owned in the named shareholder’s 401(k) retirement plan; (iii) 6,000 shares obtainable upon exercise of stock options exercisable within 60 days; and (iv) 150 shares owned jointly by the named shareholder and his spouse. |

| (10) | Includes (i) 1,200 shares owned of record by the named shareholder and (ii) 6,000 shares obtainable upon exercise of stock options exercisable within 60 days. |

-4-

| (11) | Consists of 300 shares owned jointly by the named shareholder and his spouse. |

| (12) | Includes 1,210,469 shares for which certain directors and executive officers share voting power with other directors and executive officers; however, these shares are counted only once in the total for the group. Also includes 21,000 shares issuable upon exercise of stock options within 60 days by certain executive officers and directors. |

PROPOSAL 1 – ELECTION OF DIRECTORS

Our bylaws provide that the number of directors shall be not less than five nor more than nine. The Board of Directors has determined that the number of directors should remain at nine in 2004. Unless authority is withheld, it is intended that Proxies received in response to this solicitation will be voted in favor of the nominees. A majority of the independent directors has recommended, and the entire Board of Directors has approved, the nine individuals named below to serve as directors until the next Annual Meeting and until their successors shall have been elected and shall qualify. The age and a brief biographical description of each director nominee are set forth below. This information and certain information regarding beneficial ownership of securities by such nominees contained in this proxy statement has been furnished to us by the nominees or obtained from filings with the SEC. All of the nominees have consented to serve as directors if elected. Nominees for election as directors are:

Earl E. Congdon (73) joined our company in 1950 and has served as Chairman of the Board of Directors and Chief Executive Officer since 1985 and as a director since 1952. He is a son of E. E. Congdon, one of our founders, the brother of John R. Congdon, the father of David S. Congdon and the father-in-law of John B. Yowell.

John R. Congdon (71) joined us in 1953 and has served as Vice Chairman of the Board of Directors since 1985 and as a director since 1955. He is also the Chairman of the Board of Directors of Old Dominion Truck Leasing, Inc., a North Carolina corporation that is engaged in the full-service leasing of tractors, trailers and other equipment, to which he devotes more than half of his time. He is a son of E. E. Congdon, one of our founders, the brother of Earl E. Congdon and the father of John R. Congdon, Jr.

John A. Ebeling (66) has been a director since August 1985. He formerly served as Vice Chairman from May 1997 to May 1999 and as President and Chief Operating Officer from August 1985 to May 1997. Mr. Ebeling was previously employed by ANR Freight Systems from 1978 to 1985, holding the positions of Chairman and Chief Executive Officer.

Harold G. Hoak (74) was elected a director in August 1991. Now retired, he serves on the Board of Directors of the Charlotte Merchants Foundation, Inc. He was President and General Manager of the Charlotte Merchants Association, Inc. from 1989 to 1994. Mr. Hoak was formerly employed by Wachovia Bank of North Carolina, N.A. from 1956 to 1989 and served as Regional Vice President for the Southern Region from 1976 to 1989.

Franz F. Holscher (82) was elected a director in August 1991. He served in a number of executive positions from 1970 to 1987 with Thurston Motor Lines, Inc. and was its Chairman of the Board of Directors from July 1984 through December 1987, when he retired.

David S. Congdon (47) has been employed by us since 1978 and, since May 1997, has served as our President and Chief Operating Officer. He has held various positions with us including Vice

-5-

President—Quality and Field Services, Vice President—Quality, Vice President—Transportation and other positions in operations and engineering. Mr. Congdon became a director in May 1998. He is the son of Earl E. Congdon.

John R. Congdon, Jr. (47) was elected a director in 1998. He currently serves as the Vice Chairman of the Board of Directors of Old Dominion Truck Leasing, Inc., where he has been employed since May 1979. He is the son of John R. Congdon.

J. Paul Breitbach (66) was elected a director in 2003 and is the President of Krispy Kreme Foundation, a non-profit organization established by Krispy Kreme Doughnuts, Inc. From November 1992 to January 2002, Mr. Breitbach was employed by Krispy Kreme Doughnuts, Inc. where he held Executive Vice President positions in Finance and Administration as well as Support Operations. Mr. Breitbach is a Certified Public Accountant.

Robert G. Culp, III (57) is the Chairman of the Board of Directors of Culp, Inc., a High Point, North Carolina-based producer of upholstery and mattress fabrics, which he co-founded in 1972. Mr. Culp was elected a director in 2003 and also serves on the Board of Directors of Stanley Furniture Company, Inc.

The Board of Directors recommends a vote “FOR” the election of each of the nominees identified above.

EXECUTIVE OFFICERS

The following provides certain information concerning the executive officers of the Company who are not directors:

John B. Yowell (52) joined us in February 1983 and has served as Executive Vice President since May 1997. He has also served the Company as a Vice President in many functional areas including Corporate Services, Operations and Information Systems. He is a son-in-law of Earl E. Congdon.

J. Wes Frye (56) has served as Senior Vice President – Finance since May 1997. He has also served as Chief Financial Officer and Treasurer since joining us in February 1985 and has held the position of Assistant Secretary since December 1987. Mr. Frye is a Certified Public Accountant.

Joel B. McCarty, Jr. (66) was appointed Senior Vice President in May 1997 and has served as General Counsel and Secretary since joining us in June 1987. He was formerly the Assistant General Counsel of McLean Trucking Company and was in private law practice prior to 1985.

CORPORATE GOVERNANCE

Independent Directors

In accordance with the listing standards of The Nasdaq Stock Market, Inc. (the “Nasdaq”), the Company’s Board of Directors must consist of a majority of independent directors, as determined in accordance with Nasdaq Rule 4200(a)(15). The Board has determined that Messrs. Ebeling, Hoak, Holscher, Breitbach and Culp are independent (collectively, the “independent directors”). Pursuant to the Company’s Corporate Governance Guidelines, the independent directors of the Board will meet in executive session at least twice each year. Shareholders may communicate with the independent

-6-

directors by following the procedures set forth in “Shareholder Communications with the Board,” below.

Attendance and Committees of the Board

Pursuant to the Company’s Corporate Governance Guidelines, directors are expected to attend the annual meeting of shareholders and all meetings of the Board, including all meetings of Board committees of which they are members. All directors were present at the previous annual meeting of shareholders that was held on May 19, 2003. Our Board of Directors held four meetings during 2003, at which all members were present. The Board of Directors has five standing committees: the Executive Committee, the Audit Committee, the Compensation Committee, the Governance and Nomination Committee and the Stock Option Plan Committee. Each member of the Audit Committee, the Compensation Committee and the Governance and Nomination Committee are independent as defined under current Nasdaq listing standards. All directors attended more than 75% of the Board meetings and assigned committee meetings held in 2003.

Executive Committee

The Executive Committee consists of Earl E. Congdon (Chairman), John R. Congdon and David S. Congdon. The Executive Committee is empowered to act between meetings of the Board of Directors with powers of the full Board, to the extent permitted by our bylaws and applicable law. This committee did not meet in 2003.

Audit Committee

The Audit Committee currently consists of J. Paul Breitbach (Chairman), John A. Ebeling and Harold G. Hoak, each of whom the Board of Directors has determined is independent pursuant to applicable SEC rules and regulations and Nasdaq listing standards. The Board of Directors has determined that all Audit Committee members are financially literate and that J. Paul Breitbach qualifies as an “audit committee financial expert” as defined by the SEC rules adopted pursuant to the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). The Audit Committee is governed by a written charter approved by the Board of Directors, which is included in this proxy statement as Appendix A and is available on our website at http://www.odfl.com/Company/corpGovernance.jsp. Information regarding the functions performed by this committee is set forth in the “Report of Audit Committee,” which is included in this proxy statement. The Audit Committee met five times in 2003 and held two telephone conferences, at which all members were present.

Compensation Committee

The Compensation Committee consists of Franz F. Holscher (Chairman), Robert G. Culp, III and John A. Ebeling, each of whom the Board of Directors has determined is independent pursuant to Nasdaq listing standards. The Compensation Committee meets periodically to review and approve the salaries and classifications of our executive officers, other significant employees and its personnel policies. The Compensation Committee met twice in 2003, and all members were present at each meeting. The charter for this committee is available on our website at http://www.odfl.com/Company/corpGovernance.jsp.

-7-

Governance and Nomination Committee

The Governance and Nomination Committee consists of John A. Ebeling (Chairman), J. Paul Breitbach and Robert G. Culp, III, each of whom the Board of Directors has determined is independent pursuant to Nasdaq listing standards. This committee was formed to make recommendations concerning the size and composition of the Board of Directors, evaluate and recommend candidates for election as directors (including nominees recommended by shareholders), coordinate the orientation and educational requirements of new and existing directors, develop and implement the Company’s corporate governance policies and assess the effectiveness of the Board of Directors and its committees. The charter for this committee is available on our website at http://www.odfl.com/Company/corpGovernance.jsp.

The Governance and Nomination Committee was formed in January 2004 and thus did not meet in 2003. The Governance and Nomination Committee will be responsible for evaluating and recommending to the full Board of Directors individuals for election as a director immediately following the 2004 Annual Meeting. Nominees for election to the Board of Directors at the 2004 Annual Meeting of Shareholders were evaluated and recommended by a majority of the independent directors of the Board for approval by the full Board of Directors.

Stock Option Plan Committee

The Stock Option Plan Committee consists of Earl E. Congdon (Chairman), John R. Congdon and Franz F. Holscher. The Committee has authority to administer our 1991 Employee Stock Option Plan. The Stock Option Plan Committee met once in 2003.

Corporate Governance Guidelines

The Board has adopted written Corporate Governance Guidelines, which provide the framework for fulfillment of the Board’s duties and responsibilities in light of the best practices in corporate governance and applicable laws and regulations. The Corporate Governance Guidelines address a number of matters applicable to directors, including director qualification standards, meeting requirements and responsibilities of the Board and its committees. The Corporate Governance Guidelines are available on our website at http://www.odfl.com/Company/corpGovernance.jsp.

Code of Ethics

We have adopted a Code of Business Conduct that applies to all of our directors, officers (including our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer and any person performing similar functions) and employees. Our Code of Business Conduct is available on our website at http://www.odfl.com/Company/corpGovernance.jsp. Any waivers or substantive amendments to our Code of Business Conduct applicable to the Company’s directors or executive officers will be disclosed and filed with the SEC on a Form 8-K. Any waiver or substantive amendment of the Code of Business Conduct for directors or executive officers may be made only by the Board or a Board committee.

Shareholder Communications with the Board

Any shareholder desiring to contact the Board or any individual director serving on the Board may do so by written communication mailed to: Board of Directors (Attention: (name of director(s), as

-8-

applicable), care of the Corporate Secretary, Old Dominion Freight Line, Inc., 500 Old Dominion Way, Thomasville, North Carolina 27360. Any communication so received will be processed by the Corporate Secretary and be promptly delivered to each member of the Board, or, as appropriate, to the member(s) of the Board named in the communication.

Director Nominations

In evaluating prospective nominees, the Board considers the criteria outlined in our Corporate Governance Guidelines, which include but are not limited to high personal and professional ethics and values; relevant educational and business experience; willingness to devote the time required to evaluate the effectiveness of management; and a commitment to represent the best interests of the Company and its shareholders.

Immediately following the 2004 Annual Meeting, any director nominees will be recommended to the Board by the Governance and Nomination Committee. The Governance and Nomination Committee will consider qualified director nominees recommended by shareholders when such recommendations are submitted in accordance with our bylaws and policies regarding director nominations. Shareholders may submit in writing the names and qualifications of potential director nominees to the Secretary of the Company (500 Old Dominion Way, Thomasville, North Carolina 27360) for delivery to the Chairman of the Governance and Nomination Committee for consideration. When submitting a nomination to the Company for consideration, a shareholder must provide the following minimum information for each director nominee: full name and address, age, principal occupation during the past five years, current directorships on publicly held companies and investment companies, number of Company shares owned, if any, and a signed statement by the nominee consenting to serve as a director if elected. Shareholder nominations for director must also be made in a timely manner and otherwise in accordance with the Company’s bylaws (please refer to Article 3, Section 6 of the company’s bylaws to determine the precise requirements for any shareholder nomination.) If the Governance and Nomination Committee receives a director nomination from a shareholder or group of shareholders who (individually or in the aggregate) have beneficially owned greater than 5% of the Company’s outstanding stock for at least one year as of the date of such recommendation, the Company, to the extent required by applicable securities law, will identify the candidate and shareholder or group of shareholders recommending the candidate and will disclose in its proxy statement whether the Governance and Nomination Committee chose to nominate the candidate, as well as certain other information required by SEC rules and regulations.

In addition to potential director nominees submitted by shareholders, the Governance and Nomination Committee will consider candidates submitted by directors, as well as self-nominations by directors, and, from time to time, it may consider candidates submitted by a third-party search firm hired for the purpose of identifying director candidates. The Governance and Nomination Committee will investigate potential director candidates and their individual qualifications, and all such candidates, including those submitted by shareholders, will be similarly evaluated by the Governance and Nomination Committee using the board membership criteria described above.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee has adopted a written policy that requires advance approval of all audit services, audit-related services, tax services and other services performed by the independent auditors. The policy provides for pre-approval by the Audit Committee of specifically defined audit and permissible non-audit services. Unless the specific service has been previously pre-approved with

-9-

respect to that year, the Audit Committee must approve the permitted service before the independent auditors are engaged to perform it. The Audit Committee has delegated to the Chairman of the Audit Committee authority to pre-approve permitted services under $10,000 provided that the Chairman reports any decisions to all members of the Committee at the earliest convenience. In the event the Chairman is unavailable, the remaining members must unanimously approve the request for permitted services, not to exceed $10,000, and notify the Chairman at the earliest convenience.

Policy for Accounting Complaints

The Audit Committee of the Board of Directors has established procedures for (i) the receipt, retention and treatment of complaints related to accounting, internal accounting controls and auditing matters and (ii) the confidential, anonymous submission by Company employees of concerns regarding questionable accounting or auditing matters, in compliance with section 301 of the Sarbanes-Oxley Act and related SEC rules and regulations. The Audit Committee has contracted with a third party to provide a toll-free telephone service that is staffed 24 hours a day, seven days a week. This service documents the complaint, assigns a reference number to the complaint for tracking purposes and forwards that information, through email, to the Audit Committee Chairman and the Director of Internal Audit. In the event the complaint concerns an internal audit matter, only the Audit Committee Chairman is notified. The Audit Committee Chairman, using whatever resources are required, investigates the complaint and initiates corrective action when appropriate. The identity of the caller and the details of the complaint remain anonymous throughout this process. The Company periodically tests this process to ensure that complaints are handled in accordance with these procedures.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires certain of our officers, directors and persons who own more than 10% of a registered class of our equity securities to file reports of ownership and changes in ownership with the SEC. Such officers, directors and shareholders are required by the SEC regulations to furnish us with copies of all such reports that they file. Based solely on a review of copies of the reports filed with the SEC since January 1, 2003 and on representations by certain officers and directors, all persons subject to the reporting requirements of Section 16(a) filed the reports required to be filed in 2003 on a timely basis except for (i) John R. Congdon, Jr., who failed to timely report the disposition of shares held as trustee for three separate trusts on his Form 5 for the fiscal year 2002, (ii) Robert G. Culp, III, who failed to timely file a Form 3 after becoming a director, and (iii) J. Paul Breitbach, who failed to timely file a Form 3 after becoming a director and failed to timely report on Form 4 the aggregate purchase of 1,000 shares of the Company’s common stock on July 30, 2003 and August 4, 2003.

REPORT OF AUDIT COMMITTEE

The Audit Committee oversees our financial reporting process on behalf of the Board of Directors and operates under a written charter adopted on April 24, 2000, and most recently revised on March 24, 2004. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report on Form 10-K with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

-10-

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards and under Statement on Auditing Standards No. 61, Communication with Audit Committees, as currently in effect. In addition, the Audit Committee has discussed with the independent auditors their independence from management and the Company, including the written disclosures and the letter from the independent auditors required by Independence Standards Board No. 1, Independence Discussions with Audit Committees, as currently in effect, and has considered the compatibility of nonaudit services with the auditors’ independence.

The Audit Committee discussed with our internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee meets with the internal and independent auditors to discuss the results of their examinations, their evaluations of our internal controls and the overall quality of our financial reporting.

The Audit Committee has also reviewed transactions between the Company and entities in which our officers or directors or their affiliates have material interests and has determined that such existing transactions are fair to the Company. Any new transactions with officers, directors or their affiliates, and any extensions, modifications or renewals of existing transactions with such persons must be approved in advance by the Audit Committee as being on terms no less favorable to the Company than the terms that could be obtained in a similar transaction with an unaffiliated party.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2003, for filing with the Securities and Exchange Commission.

The Audit Committee,

J. Paul Breitbach, Chairman

John A. Ebeling

Harold G. Hoak

-11-

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table provides a three-year overview of the compensation paid to our five most highly compensated executive officers (the “Named Executive Officers”):

| Annual Compensation |

||||||||||

| (a) Name and Principal Position |

(b) Year |

(c) Salary ($) |

(d) Bonus(1) ($) |

(e) All Other Compensation(2) ($) | ||||||

| Earl E. Congdon |

2003 2002 2001 |

$ $ $ |

420,900 349,210 315,260 |

$ $ $ |

768,284 567,436 367,856 |

$29,040(3) $10,324 $ 9,948 | ||||

| David S. Congdon |

2003 2002 2001 |

$ $ $ |

220,560 212,760 210,585 |

$ $ $ |

465,014 343,448 222,650 |

$17,077(3) $ 6,537 $ 6,092 | ||||

| John B. Yowell |

2003 2002 2001 |

$ $ $ |

174,420 168,180 166,380 |

$ $ $ |

202,180 149,325 96,804 |

$ 8,877(3) $ 6,963 $ 6,351 | ||||

| John R. Congdon |

2003 2002 2001 |

$ $ $ |

290,900 219,210 182,760 |

|

0 0 0 |

$25,244(3) $15,629 $15,346 | ||||

| J. Wes Frye |

2003 2002 2001 |

$ $ $ |

164,600 160,740 160,125 |

$ $ $ |

141,526 104,528 67,763 |

$ 3,617(3) $ 1,962 $ 2,010 | ||||

| (1) | Pursuant to an executive profit-sharing bonus program, we pay incentive cash bonuses to the Named Executive Officers based upon our income before taxes during the fiscal year. |

| (2) | Includes pre-tax contributions made to the Old Dominion 401(k) retirement plan, personal use of Company assets, excess premiums paid on group life insurance and the compensation element of premiums paid on split-dollar life insurance policies. |

-12-

| (3) | Allocation of 2003 All Other Compensation: |

| Name |

Company Contribution To 401k Plan |

Split-Dollar Life Insurance |

Personal Use of Company Assets |

Excess Life Insurance Premiums | ||||||||

| Earl E. Congdon |

$ | 1,517 | $ | 8,646 | $ | 12,109 | $ | 6,768 | ||||

| David S. Congdon |

$ | 2,374 | $ | — | $ | 14,181 | $ | 522 | ||||

| John B. Yowell |

$ | 2,598 | $ | — | $ | 5,415 | $ | 864 | ||||

| John R. Congdon |

$ | 1,548 | $ | 16,928 | $ | — | $ | 6,768 | ||||

| J. Wes Frye |

$ | 2,267 | $ | — | $ | — | $ | 1,350 | ||||

Stock Options

Our Board of Directors and shareholders approved and adopted the 1991 Employee Stock Option Plan of Old Dominion Freight Line, Inc. (the “Option Plan”) for the benefit of key employees. The Option Plan covers 375,000 shares of our common stock after adjusting for the three-for-two stock split on June 16, 2003. The Option Plan provides for the granting of stock options that qualify as incentive stock options pursuant to Section 422 of the Internal Revenue Code as well as nonqualified options. Earl E. Congdon and John R. Congdon are not eligible to participate in the Option Plan.

The Option Plan does not allow any options to be granted after August 31, 2001; therefore, no options were granted in 2003.

After giving effect to the June 16, 2003 stock split, options to purchase 336,000 shares have been granted. As of March 29, 2004, there are options outstanding covering 13,500 shares of common stock at an exercise price of $12.6667 per share and 7,500 shares at an exercise price of $6.6667. All of the options have been granted as incentive options.

The following table reflects cumulative information for the last fiscal year regarding exercises under the Option Plan:

| Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values | ||||||||||||||

| (a) Name |

(b) Shares Acquired |

(c) Value Realized |

(d) Number of Securities Exercisable/Unexercisable (#) |

(e) Value of Unexercised In-The-Money Exercisable/Unexercisable ($) (2) | ||||||||||

| Earl E. Congdon(3) |

— | — | — | — | ||||||||||

| David S. Congdon |

4,500 | $ | 88,365 | 4,500 0 |

Exercisable Unexercisable |

$ $ |

105,360 0 |

Exercisable Unexercisable | ||||||

| John B. Yowell |

4,500 | $ | 85,374 | 4,500 0 |

Exercisable Unexercisable |

$ $ |

105,360 0 |

Exercisable Unexercisable | ||||||

| John R. Congdon(3) |

— | — | — | — | ||||||||||

| J. Wes Frye |

5,250 | $ | 101,570 | 6,000 0 |

Exercisable Unexercisable |

$ $ |

141,980 0 |

Exercisable Unexercisable | ||||||

| (1) | Value realized is calculated by subtracting the exercise price from the closing price of our stock on the exercise date. |

| (2) | Value is calculated by subtracting the exercise price from $34.080, the closing price of our stock on December 31, 2003. |

| (3) | Not eligible to participate in the Option Plan. |

-13-

Equity Compensation Plan Information

The following table sets forth information as of March 29, 2004 with respect to the Option Plan, the only compensation plan that authorizes the issuance of our equity securities:

| Plan Category |

(a) Number of Securities to be |

(b) Weighted-Average |

(c) Number of Securities Remaining Available | ||||

| Equity Compensation Plans Approved by |

21,000 | $ | 10.5238 | — | |||

| Equity Compensation Plans Not Approved by |

— | — | — | ||||

| Total |

21,000 | $ | 10.5238 | — | |||

Old Dominion 401(k) Retirement Plan

All employees meeting certain service requirements are eligible to participate in the Company’s 401(k) employee retirement plan. Employee contributions are limited to a percentage of their compensation, as defined in the plan. Company contributions are based upon the greater of a percentage of employee contributions or ten percent of net income.

REPORT OF COMPENSATION COMMITTEE

The Compensation Committee is responsible for conducting an annual review of the Company’s compensation program for its executive officers, including an evaluation of the components of the program, the standards of performance measurement and the relationship between performance and compensation. The Committee reviews the compensation of each executive officer and makes specific recommendations to the Board of Directors based on factors that include the individual officer’s performance, the ability of the Company to attract and retain qualified, experienced personnel and whether the program provides appropriate motivation to achieve goals outlined by the Board of Directors.

Base Compensation – Since 1997, the Committee has set base compensation to approximate competitive market levels, which have been determined from contacts with other carriers in the LTL industry and other public information, such as filings with the SEC. Annual increases from base salaries for executive officers are generally limited to cost of living adjustments; however, the Compensation Committee periodically reviews these base salaries for competitiveness and makes adjustments as deemed appropriate.

Executive Profit Sharing Program – The Company’s executive profit sharing program rewards key officers and other management personnel for achieving their financial goals. Participants in the plan are eligible to receive a percentage, determined by the Compensation Committee, of pre-tax profits. Periodically, the Compensation Committee reviews the balance of profit sharing bonuses and base salary for each executive to ensure that each executive’s overall compensation is appropriate. Pre-tax profits increased 49.7% in 2003 and 55.1% in 2002; therefore, similar increases in the executive profit sharing program were implemented for executives under this program.

-14-

Chief Executive Officer Compensation – In determining the base salary for Earl E. Congdon, the Company’s Chief Executive Officer, the Compensation Committee considers factors including Mr. Congdon’s tenure with the Company, his leadership in the industry and comparisons of compensation with other chief executive officers with similar responsibilities at other similarly-sized public companies, which are obtained from public sources. The Compensation Committee also considers the Company’s revenue growth, operating ratio and net income compared with other carriers who compete in the same markets.

In August 2002, the Compensation Committee performed a review of the Chief Executive Officer’s base salary and determined that the average increase of 1.8% per year since 1991 was not sufficient to keep pace with increases in executive pay of other similarly-sized public companies. As a result of adjustments made at that time and a 1.5% cost of living adjustment in May 2003, the Chief Executive Officer’s base salary increased 20.5% in 2003 over the prior year.

Both the base salary and the incentive bonus are evaluated in determining overall compensation for the Chief Executive Officer. In 2003, the incentive bonus for the Chief Executive Officer increased 35.4% over 2002 due to a pre-tax profit improvement of 49.7% in 2003 over the prior year. The Chief Executive Officer is not eligible to receive options under the Company’s Option Plan.

Other Officers’ Compensation – In August 2002, the Compensation Committee also reviewed the Vice Chairman’s base salary and determined it was not competitive with those of executives with similar responsibilities at other similarly-sized public companies, particularly considering the fact that the Vice Chairman does not participate in the executive profit sharing program. As a result of an adjustment made at that time and a 2.2% cost of living increase in May 2003, the Vice Chairman’s base salary increased 32.7% over the prior year.

The base salary for all of our other officers is based upon the experience and qualifications of each officer, with the additional objective of remaining competitive in the industry in recruiting and retaining a well-qualified, effective management team. The executive profit sharing program for officers is determined by the Compensation Committee and is based upon the same criteria as the Chief Executive Officer – the performance of the Company as measured by its pre-tax profitability. No stock options were granted to any individual in 2003.

Section 162(m) of the Internal Revenue Code (the “Code”) generally limits amounts that can be deducted for compensation paid to executives to $1 million, unless certain requirements are met. In 2003, the components of compensation that exceeded this threshold for Earl E. Congdon, and are thus deemed nondeductible to the Company under Section 162(m) of the Code, totaled $208,061. No other executive received compensation in excess of $1 million in 2003. The Compensation Committee will continue to monitor the applicability of this section of the Code to our compensation program each year.

The Compensation Committee,

Franz F. Holscher, Chairman

Robert G. Culp, III

John A. Ebeling

-15-

Compensation Committee Interlocks and Insider Participation

John A. Ebeling, who serves as a member of our Compensation Committee, formerly served as Vice Chairman of the Company from May 1997 to May 1999 and as President and Chief Operating Officer of the Company from August 1985 to May 1997. As part of its determination that a majority of the members of the Board of Directors are independent in accordance with applicable Nasdaq listing standards, the Board reviewed and considered Mr. Ebeling’s former employment with the Company. The Board has determined that such former employment does not impair or otherwise affect Mr. Ebeling’s status as an independent director.

Compensation of Directors

For the period between January 1, 2003, and October 26, 2003, each of the Company’s outside directors received an annual retainer of $12,000 plus $1,500 for each meeting attended, including Board meetings and Board committee meetings not held in conjunction with a meeting of the full Board.

On October 27, 2003, the Board approved certain modifications regarding the fees that the Company pays to its outside directors. Effective October 27, 2003, the annual retainer for each of the Company’s outside directors was increased to $20,000 plus $1,500 for each Board meeting attended. The Board also approved certain modifications with respect to the fee structure for certain Board committee members. The chairman of the Audit Committee receives an additional annual retainer of $5,000 and the members of that committee receive an additional annual retainer of $3,000. The chairman of the Compensation Committee receives an additional annual retainer of $3,000 and the members of that committee receive an additional annual retainer of $2,000. All members of these committees receive $1,500 for each meeting attended that is not held in conjunction with a meeting of the entire Board of Directors.

All outside directors receive reimbursement of expenses incurred as a director. Directors who are also officers of the Company receive no retainers or expense reimbursements.

-16-

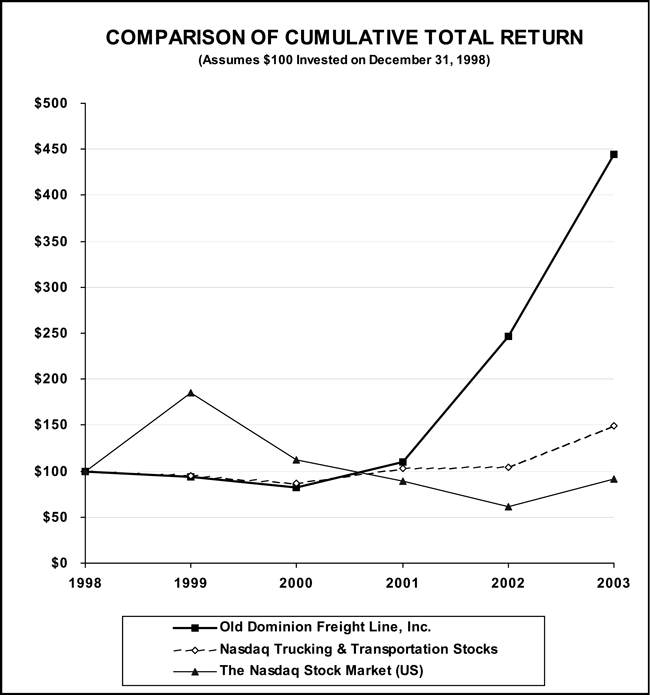

Performance Graph

The following graph compares the total shareholder cumulative returns, assuming the reinvestment of all dividends, of $100 invested on December 31, 1998, in (i) our common stock, (ii) the Nasdaq Trucking & Transportation Stocks and (iii) The Nasdaq Stock Market (US) for the five-year period ended December 31, 2003:

-17-

| Cumulative Total Return | ||||||||||||||||||

| 12/98 |

12/99 |

12/00 |

12/01 |

12/02 |

12/03 | |||||||||||||

| Old Dominion Freight Line, Inc. |

$ | 100.00 | $ | 93 | $ | 83 | $ | 110 | $ | 247 | $ | 445 | ||||||

| Nasdaq Trucking and Transportation Stocks |

$ | 100.00 | $ | 95 | $ | 87 | $ | 102 | $ | 104 | $ | 149 | ||||||

| The Nasdaq Stock Market |

$ | 100.00 | $ | 185 | $ | 112 | $ | 89 | $ | 61 | $ | 92 | ||||||

RELATED PARTY TRANSACTIONS

Transactions with Old Dominion Truck Leasing, Inc.

Old Dominion Truck Leasing, Inc. (“Leasing”), a North Carolina corporation whose voting stock is owned by the Earl E. Congdon Intangibles Trust, David S. Congdon, Trustee, the John R. Congdon Revocable Trust and members of Earl E. Congdon’s and John R. Congdon’s families, is engaged in the business of purchasing and leasing tractors, trailers and other vehicles. John R. Congdon is Chairman of the Board of Leasing, and Earl E. Congdon is Vice Chairman of the Board of Leasing. Since 1986, we have combined our requirements with Leasing for the purchase of tractors, trailers, equipment, parts, tires and fuel. We believe that, by combining our requirements, we are often able to obtain pricing discounts because of the increased level of purchasing. While this is beneficial, we believe that the termination of this relationship would not have a material adverse impact on our financial results.

For the years ended December 31, 2003, 2002 and 2001, we charged Leasing $39,000, $14,000 and $11,000, respectively, for vehicle repair, maintenance and other services, which we provide to Leasing at cost plus a negotiated markup. In addition, we charged Leasing $12,000 annually in 2003, 2002 and 2001, for rental of a vehicle maintenance facility located in Chesapeake, Virginia. On March 15, 2003, we entered into an agreement to sublease a vehicle maintenance facility in South Bend, Indiana, to Leasing for which we charged $10,000 in 2003.

We purchased $266,000, $297,000 and $287,000 of maintenance and other services from Leasing in 2003, 2002 and 2001, respectively. We believe that the prices we pay for such services are lower than would be charged by unaffiliated third parties for the same quality of work, and we intend to continue to purchase maintenance and other services from Leasing, provided that Leasing’s prices continue to be favorable to us. We did not lease any equipment from Leasing in 2003 and 2002, however, we paid Leasing $8,000 for short-term tractor rentals in 2001.

On January 4, 2002, we purchased 91 1997 model pickup and delivery trailers from Leasing for an aggregate purchase price of $774,000. We also purchased one trailer from Leasing on May 1, 2003, for a purchase price of $8,000.

-18-

Transactions with E & J Enterprises

On July 29, 2002, our Board of Directors approved the purchase of 163 trailers for $1,200 each, or a total of $195,600, from E & J Enterprises, a Virginia general partnership of which Earl E. Congdon, our Chief Executive Officer and Chairman of our Board of Directors, and John R. Congdon, Vice Chairman of our Board of Directors, are each 50% owners. These trailers had been leased to us by E & J Enterprises since 1988 pursuant to a term lease that converted to a month-to-month lease in 1999. At year-end 2002, we had completed the purchase of 50 of these trailers for a purchase price of $60,000. During the first quarter 2003, we continued to lease the remaining 113 trailers on a month-to-month basis until we completed the purchase of those trailers in March 2003 for a purchase price of $135,600. Also in March 2003, we purchased an additional 10 trailers from E & J Enterprises for $5,000 each for a total purchase price of $50,000.

On July 29, 2002, our Board of Directors also approved the leasing from E & J of 150 pickup and delivery trailers on a month-to-month basis for $204 per month for each trailer. On December 1, 2003, we purchased these 150 trailers for an aggregate purchase price of $907,000, thereby ending all lease activity with E & J Enterprises.

The total amount paid to E & J for all trailers under lease was $357,000, $387,000 and $401,000 for 2003, 2002 and 2001, respectively.

In December 1988, we sold to E & J certain tracts of unimproved land and a vacant service center facility in exchange for a receivable in the amount of $579,798. E & J has repaid the amount outstanding under the receivable as parcels of the property have been sold. In December 2003, E & J paid the remaining receivable balance of $195,677, which effectively ended this related party transaction.

Greensboro, North Carolina Service Center Purchase

On October 15, 2002, we purchased a 116-door service center facility and shop located in Greensboro, North Carolina for $6,000,000 from an irrevocable trust created for the benefit of the families of Earl E. Congdon, our Chief Executive Officer and Chairman of our Board of Directors, and John R. Congdon, Vice Chairman of our Board of Directors. Prior to October 15, 2002, this property was leased to us with payments totaling $285,000 and $380,000 in 2002 and 2001, respectively. We had originally planned to enter into an arrangement to complete an expansion of this service center and enter into a long-term lease. However, we determined that it was in our best interest to purchase this facility because the cost of the expansion to 229 doors on additional acreage made continued leasing undesirable and because we generally prefer ownership to leasing our service centers when conditions warrant.

In determining the value of the facility, we considered the value of the land, the cost of improvements we had made to the land, including construction of a new building, and other matters. We then applied a method of depreciation to arrive at a purchase price. In addition, we obtained an appraisal of the facility by a nationally recognized real estate brokerage company specializing in the trucking industry. The appraisal was based on the depreciated construction cost of a similar facility and the value of a similar parcel of land. The purchase of this property ended all related party transactions between this trust and the Company.

-19-

Disposition of Certain Split Dollar Life Insurance Policies

Prior to December 31, 2003, five split-dollar life insurance agreements to which we were a party terminated. Two of these agreements involved policies administered by Aurora Life Insurance Company. One policy insured the life of Earl E. Congdon and the second insured the life of John R. Congdon. Each policy was owned by the wife of the insured. The owners assigned their interests in the policies to us as payment in full for any obligations owed by them pursuant to the split dollar agreements. As a result of the assignments, we currently own both policies and currently hold them as key man life insurance on Earl. E. Congdon and John R. Congdon.

A third split-dollar agreement involved a policy administered by The Prudential Insurance Company of America insuring the joint lives of Earl E. Congdon and Kathryn Congdon. The policy was owned by Earl E. Congdon’s children. Under the Prudential split-dollar agreement, the owners had the right to terminate the split-dollar agreement upon payment to us of the total amount of premiums paid by us on the policy less any amounts previously reimbursed. In exercise of that right, the owners terminated the split-dollar agreement and paid to us $595,137. This entire amount represented premiums previously advanced on the insured’s behalf. We no longer own any interest in the Prudential policy.

The final two split-dollar agreements involved policies administered by American General Life of Houston, Texas. One policy insured the joint lives of Earl E. Congdon and Kathryn Congdon and the second insured the joint lives of Jack Congdon and Natalie Congdon. Each policy was owned by a family limited partnership. Under each American General split-dollar agreement, the owners had the right to terminate the split-dollar agreement upon payment to us of the total amount of premiums paid by us on the policy less any amounts previously reimbursed. In exercise of that right, the owner of the American General split-dollar agreement for Earl and Kathryn Congdon terminated that agreement and paid to us $1,367,678 and the owner of the American General split-dollar agreement for Jack and Natalie Congdon terminated that agreement and paid to us $1,373,626. All of these amounts represented premiums previously advanced on the insured’s behalf. We no longer own any interest in the American General policies.

Audit Committee Approval

Each of the foregoing transactions has been reviewed by the Audit Committee of our Board of Directors, which consists of three independent directors. The Audit Committee has approved the transactions that continue to be in effect and determined that they are fair to the Company. The Audit Committee believes that the terms and conditions of the foregoing transactions are substantially the same as, or more favorable to the Company than, transactions that would be available from unaffiliated parties. Any extensions, modifications or renewals of existing transactions with such persons must be approved, in advance, by the Audit Committee and must be on terms no less favorable to the Company than the terms that could be obtained in a similar transaction with an unaffiliated party.

-20-

PROPOSAL 2 – AMENDMENT TO ARTICLES OF INCORPORATION REGARDING

LIABILITY OF DIRECTORS AND OFFICERS

Subject to approval of our shareholders at the Annual Meeting, our Board of Directors has adopted an amendment to the Amended and Restated Articles of Incorporation of the Company to add a new Article V, as follows:

V.

In any proceeding brought by a shareholder of the Corporation in the right of the Corporation or brought by or on behalf of shareholders of the Corporation, no director or officer of the Corporation shall be liable to the Corporation or its shareholders for monetary damages with respect to any transaction, occurrence or course of conduct, whether prior or subsequent to the effective time of this provision, except for liability resulting from such person’s having engaged in willful misconduct or a knowing violation of the criminal law or any federal or state securities law.

If adopted, the amendment would become effective upon the filing of articles of amendment with the Commonwealth of Virginia State Corporation Commission, which would occur as soon as practicable following the Annual Meeting. The remainder of our articles will not change, except as provided under Proposal 3 below.

Our Board adopted this amendment pursuant to the provisions of Section 13.1-692.1 of the Virginia Stock Corporation Act, which provides that the articles of incorporation of a corporation may limit the damages that may be assessed against an officer or director of the corporation in any proceeding brought by or in the right of a corporation or brought by or on behalf of shareholders of the corporation, subject to certain limitations. This statute is similar to the provisions of many other state corporation laws that authorize a corporation to adopt a charter that limits or eliminates the personal liability of its directors or directors and officers.

State corporation laws such as Section 13.1-692.1 of the Virginia Stock Corporation Act recognize that the threat of personal liability resulting from suits brought against management of corporations can be a barrier to the recruitment and retention of qualified directors and officers. Such threat may also discourage a director or officer from fully and freely carrying out his or her duties, including responsible entrepreneurial risk-taking. Our Board of Directors, accordingly, believes that it would be in the best interests of the Company to amend our articles of incorporation to eliminate the personal liability of the Company’s directors and officers, except liability for willful misconduct or a knowing violation of the criminal law or of any federal or state securities law.

To the knowledge of the Board of Directors, none of the Company’s directors or officers is currently subject to any liability that would be eliminated as a result of the adoption of the proposed amendment.

The Board of Directors recommends a vote “FOR” approval of the proposed amendment to our articles of incorporation. The holders of more than two-thirds of the outstanding shares of Common Stock entitled to vote at the Annual Meeting must vote in favor of this proposal in order for it to be approved.

-21-

PROPOSAL 3 – APPROVAL OF AMENDMENT TO AMENDED

AND RESTATED ARTICLES OF INCORPORATION TO

INCREASE AUTHORIZED COMMON STOCK

Subject to approval of our shareholders at the Annual Meeting, our Board of Directors has adopted an amendment to the Amended and Restated Articles of Incorporation of the Company to increase the number of authorized shares of Common Stock from 25,000,000 shares to 100,000,000 shares. The amendment would revise Article II of the our articles to read as follows:

II.

The Corporation shall have the authority to issue One Hundred Million (100,000,000) shares of Common Stock having a par value of Ten Cents ($.10) per share.

If adopted, the amendment would become effective upon the filing of articles of amendment with the Commonwealth of Virginia State Corporation Commission, which would occur as soon as practicable following the Annual Meeting. The remainder of our articles will not change, except as provided under Proposal 2 above.

On March 29, 2004, we had 16,059,352 shares of Common Stock outstanding. On that date, an additional 21,000 shares of Common Stock also were reserved for issuance pursuant to our 1991 Employee Stock Option Plan. The additional authorized shares of Common Stock would be available for future issuance by the Company.

The aggregate number of shares issued and reserved for future issuance (16,080,352) leaves us with the ability to issue 8,919,648 additional shares under our current articles. In the opinion of the Board of Directors, approval of the proposed amendment to the articles is appropriate to enable the Company to respond to future business opportunities requiring the issuance of shares, including consummation of common stock-based financings, acquisition transactions involving the issuance of Common Stock, issuances of Common Stock under any new equity compensation plans that the Company may adopt in the future, stock splits or dividends and issuances of Common Stock for other general corporate purposes. Although the Company has no present plans to issue additional shares of Common Stock, except for shares reserved for future issuance as noted in the preceding paragraph, approval of the proposed amendment to our articles will allow the Company to act promptly in the event opportunities requiring the issuance of additional shares arise. Failure of the shareholders to approve the proposed amendment could adversely affect the Company’s ability to pursue such opportunities.

Issuance of additional shares of Common Stock would dilute the voting rights and could dilute equity and earnings per share of existing shareholders. The proposed increase in authorized but unissued shares of Common Stock could be used by the Board of Directors to make a change in control of the Company more difficult. However, the Board of Directors’ purpose in recommending this proposal is not as an anti-takeover measure, but for the reasons discussed above.

Authorized shares of Common Stock may be issued by the Board of Directors from time to time without further shareholder approval, except in situations where shareholder approval is required by state law or the listing standards or rules of The Nasdaq Stock Market, Inc. Shareholders of the Company have no preemptive right to acquire additional shares of Common Stock, which

-22-

means that current shareholders do not have a right to purchase any new issue of shares of Common Stock in order to maintain their proportionate ownership interests in the Company.

The Board of Directors recommends a vote “FOR” approval of the proposed amendment to our articles of incorporation. The holders of more than two-thirds of the outstanding shares of Common Stock entitled to vote at the Annual Meeting must vote in favor of this proposal in order for it to be approved.

INDEPENDENT AUDITOR FEES AND SERVICES

The Audit Committee of the Board of Directors has selected Ernst & Young LLP, who have served as our independent auditors since 1994, to audit our financial statements for the year ended December 31, 2004. A representative of Ernst & Young LLP is expected to be present at the Annual Meeting and will have the opportunity to make a statement if he or she desires to do so and to respond to any appropriate questions. The Company incurred the following fees for services performed in 2003 and 2002:

| Fiscal 2003 |

Fiscal 2002 | |||||

| Audit Fees |

$ | 168,000 | $ | 187,000 | ||

| Audit-Related Fees |

— | — | ||||

| Tax Fees |

65,000 | 94,000 | ||||

| All Other Fees |

— | — | ||||

| Total |

$ | 233,000 | $ | 281,000 | ||

Audit Fees. This category includes the aggregate fees billed for professional services rendered for the audits of the Company’s consolidated financial statements for fiscal years 2003 and 2002, including fees associated with the annual audit and reviews of our quarterly reports on Form 10-Q, and for services that are normally provided by the independent auditors in connection with statutory and regulatory filings or engagements for the relevant fiscal years.

Audit-Related Fees. This category includes the aggregate fees billed in each of the last two fiscal years for assurance and related services by the independent auditors that are reasonably related to the performance of the audits or reviews of the financial statements and are not reported above under “Audit Fees,” and generally consist of fees for other attest engagements under professional auditing standards, accounting and reporting consultations, internal control-related matters, and audits of employee benefit plans.

Tax Fees. This category includes the aggregate fees in each of the last two fiscal years for professional services rendered by the independent auditors for tax compliance, tax planning and tax advice. Tax compliance includes the preparation of state and federal income tax returns as well as assistance in calculating estimated quarterly income tax payments. Tax planning and tax advice includes assistance with various tax accounting methods, analysis of various state filing positions and assistance in obtaining state and federal tax credits.

All Other Fees. This category includes the aggregate fees in each of the last two fiscal years for products and services provided by the independent auditors that are not reported above under “Audit Fees,” “Audit-Related Fees” or “Tax Fees.” There were no such services provided in fiscal year 2003 or fiscal year 2002.

-23-

ANNUAL REPORT ON FORM 10-K

Shareholders may obtain a copy of our Annual Report on Form 10-K as filed with the SEC for the year ended December 31, 2003, without charge, from our web site, www.odfl.com, or by writing to J. Wes Frye, Senior Vice President – Finance, Treasurer, Chief Financial Officer and Assistant Secretary, Old Dominion Freight Line, Inc., 500 Old Dominion Way, Thomasville, North Carolina 27360. Exhibits are not included, but copies of them may be obtained upon payment of copying charges.

DEADLINE FOR SHAREHOLDER PROPOSALS

Any shareholder desiring to present a proposal for action at our 2005 Annual Meeting must ensure that the proposal is received by the Company at its principal executive offices no later than December 13, 2004.

In addition to any other applicable requirements, for business to be properly brought before the annual meeting by a shareholder, even if the proposal is not to be included in the Company’s proxy statement, our bylaws provide that the shareholder must give timely notice of such business in writing to the Secretary of the Company at least 60 days and not more than 90 days prior to the meeting, except that if public disclosure of the date of the meeting is given less than 70 days prior to the meeting, notice by the shareholder will be considered timely if received by the Secretary by the close of business on the 10th day after public disclosure of the date of the meeting. As to each item of business, the notice must contain (i) a brief description of the business to be brought before the meeting and the reasons therefor, (ii) the name and the address of record of the shareholder and the number of shares of the Company’s stock owned of record or beneficially by the shareholder and (iii) any material interest the shareholder has in the proposed business, other than in his or her capacity as a shareholder.

| By Order of the Board of Directors |

|

|

| Joel B. McCarty, Jr. |

| Secretary |

Thomasville, North Carolina

April , 2004

-24-

Appendix A

OLD DOMINION FREIGHT LINE, INC.

AUDIT COMMITTEE CHARTER

| I. | PURPOSE |

To establish membership, meeting and responsibility requirements for the Audit Committee of the Board of Directors of Old Dominion Freight Line, Inc. (the “Company”) in its efforts to assist the Board of Directors in fulfilling its oversight responsibilities to shareholders related to accounting and financial reporting practices, including the quality, integrity and regulatory compliance of financial reports. While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the Audit Committee’s responsibility to directly plan or conduct audits to attest that the Company’s financial statements are complete, accurate and in accordance with generally accepted accounting principles.

| II. | MEMBERSHIP |

| A. | The Audit Committee shall be comprised of a minimum of three directors. |

| B. | All Audit Committee members shall be independent as defined by NASDAQ listing standards and the Securities and Exchange Commission (the “SEC”). No Audit Committee member or immediate family member of such Audit Committee member may be an “affiliated person” of the Company, as that term is defined by the SEC. |

| C. | Audit Committee members, including a Chairman, shall be appointed at the annual meeting of the Board of Directors for one year terms based on the Governance and Nomination Committee’s recommendations. The members of the Audit Committee shall serve until their resignation, retirement or removal by the Board of Directors or until their successors shall be appointed. |

| D. | All Audit Committee members shall be financially literate and shall be capable of understanding fundamental financial statements, including the balance sheet, income statement and cash flow statement. At least one member shall have past experience in accounting or related financial management to qualify as an “audit committee financial expert”, as that term is defined by the SEC. |

| E. | Compensation for Audit Committee members shall be solely limited to director fees without any additional direct or indirect compensation from the Company. |

| III. | MEETINGS |

| A. | The Audit Committee shall meet as many times during the year as deemed necessary to fulfill their responsibilities with at least four meetings each year, and each member is required to attend at least 75% of each year’s meetings. |

| B. | A majority of the members of the Audit Committee shall constitute a quorum. |

| C. | The Audit Committee may also conduct meetings by telephone conference calls so long as each committee member can communicate with the other members. |

A-1

OLD DOMINION FREIGHT LINE, INC.

AUDIT COMMITTEE CHARTER

| D. | The Audit Committee may form and delegate authority to one or more members of the Audit Committee as deemed necessary to fulfill the Audit Committee’s responsibilities. |

| E. | Information related to the agenda shall be distributed to the committee members prior to meetings to allow directors to better prepare for meetings. |

| F. | Minutes shall be maintained for all Audit Committee meetings and the results reported to the Board of Directors. |

| IV. | RESPONSIBILITIES |

GENERAL

| A. | The Audit Committee shall adopt and maintain a formal written charter that shall be approved by the Board of Directors and published on the Company’s website. The Audit Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board of Directors for its approval. |

| B. | The Audit Committee shall cause the report required by the rules of the SEC to be included in the Company’s proxy statement. |

| C. | The Audit Committee shall have the charter disclosed in the annual report to the shareholders or the proxy statement at least every three years or in the next year’s report if significant amendments are made to the charter. |

| D. | The Governance and Nomination Committee shall annually review the Audit Committee’s performance and report the results to the Board of Directors. |

| E. | The Audit Committee shall have the authority to obtain opinions or reports from external or internal resources, to the extent required to fulfill its duties, subject to the Board of Directors approval for the required expenditures. |

| F. | The Audit Committee shall keep minutes of its meetings and periodically report the results of its meetings to the Board of Directors. |

| G. | The Company shall provide the Audit Committee with the appropriate funding, as determined by the Audit Committee, to compensate any registered public accounting firm or outside consultant engaged by the Audit Committee. |

| H. | The Audit Committee shall develop and oversee procedures for (i) receiving, retaining and addressing complaints regarding accounting, internal accounting controls or auditing matters, and (ii) confidential and anonymous submissions by Company employees regarding questionable accounting or auditing matters. |

EXTERNAL AUDITORS

| A. | The Audit Committee shall be responsible for communicating to the external auditors that the Board of Directors and the Audit Committee are the external auditors’ clients and the external auditors are ultimately accountable to the Board of Directors and the Audit Committee. |

| B. | The Audit Committee shall have the authority to evaluate and recommend the selection or replacement of the external auditors for auditing the financial statements of the Company. The external auditors shall report directly to the Audit Committee. |

A-2

OLD DOMINION FREIGHT LINE, INC.

AUDIT COMMITTEE CHARTER

| C. | The Audit Committee shall review and pre-approve the external auditors’ written proposed audit scope, fees for the current fiscal year, staffing requirements and non-audit work to be performed by the external auditors. |

| D. | Pre-approvals of all audit and permissible non-audit services and fees by the Audit Committee, shall be made in accordance with the Company’s policy for the Approval of Services Performed by Independent Auditors to help ensure compliance with SEC regulatory guidelines and the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). |