| By Order of the Board of Directors |

|

|

| Joel B. McCarty, Jr. Secretary |

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

File by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x |

Definitive Proxy Statement |

|||||

| ¨ |

Definitive Additional Materials |

|||||

| ¨ |

Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

OLD DOMINION FREIGHT LINE, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined). |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

OLD DOMINION FREIGHT LINE, INC.

500 Old Dominion Way

Thomasville, North Carolina 27360

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of Shareholders of Old Dominion Freight Line, Inc., will be held Monday, May 19, 2003, at 10:00 a.m., in the Company’s executive offices, 500 Old Dominion Way, Thomasville, North Carolina, for the following purposes:

| 1. | To elect a board of nine directors of the Company. |

| 2. | To transact such other business as may be brought before the meeting. |

Shareholders of record at the close of business on March 31, 2003, are entitled to notice of and to vote at the meeting.

| By Order of the Board of Directors |

|

|

| Joel B. McCarty, Jr. Secretary |

Thomasville, North Carolina

April 14, 2003

| If you do not intend to be present at the meeting, please sign, date and return the accompanying proxy promptly so that your shares of Common Stock may be represented and voted at the meeting. A return envelope is enclosed for your convenience. |

OLD DOMINION FREIGHT LINE, INC.

Executive Offices: 500 Old Dominion Way

Thomasville, North Carolina 27360

PROXY STATEMENT

This Proxy Statement is being sent to shareholders on or about April 16, 2003, in connection with the solicitation of proxies by the Board of Directors for use at the Annual Meeting of Shareholders of Old Dominion Freight Line, Inc. (the “Company”), to be held on Monday, May 19, 2003, and at any adjournment thereof.

GENERAL

The accompanying Proxy is solicited by and on behalf of our Board of Directors, and the entire cost of such solicitation will be borne by us. In addition to solicitation by mail, arrangements will be made with brokerage houses and other custodians, nominees and fiduciaries to send proxy material to their principals, and we will reimburse them for their reasonable expenses in so doing.

The Board of Directors has fixed March 31, 2003 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. On March 31, 2003, there were 10,692,264 outstanding shares of Common Stock of the Company, each entitled to one vote.

The presence in person or by proxy of a majority of the shares of Common Stock outstanding on the record date constitutes a quorum for purposes of conducting business at the meeting. Shareholders do not have cumulative voting rights in the election of directors. Directors are elected by a plurality of the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present. With regard to the election of directors, votes may be cast in favor or withheld. Votes that are withheld will be excluded entirely from the vote and will have no effect, although they will be counted for purposes of establishing the presence of a quorum. Under the rules of the New York Stock Exchange, Inc., brokers who hold shares in street name for customers have authority to vote on certain items when they have not received instructions from beneficial owners. Brokers that do not receive instructions are entitled to vote on the election of directors.

Where a choice is specified on any Proxy as to the vote on any matter to come before the meeting, the Proxy will be voted in accordance with such specification. If no specification is made but the Proxy is properly signed, the shares represented thereby will be voted in favor of each proposal. Such proxies, whether submitted by shareholders of record or by brokers holding shares in street name for their customers (“broker non-votes”), will be voted in favor of nominees for directors. Broker non-votes will not be counted either way in voting on other matters (where direction of beneficial owners is required) and, therefore, will have the effect of negative votes.

Any shareholder submitting the accompanying Proxy has the right to revoke it by notifying the Secretary of the Company in writing at any time prior to the voting of the Proxy. A Proxy is suspended if the person giving the Proxy attends the meeting and elects to vote in person.

Management is not aware that any matters, other than those specified above, will be presented for action at the meeting, but, if any other matters do properly come before the meeting, the persons named as agents in the Proxy will vote upon such matters in accordance with their best judgment.

ELECTION OF DIRECTORS

Our bylaws provide that the number of directors shall be not less than five nor more than nine. The Board of Directors has determined that the number of directors should increase from seven to nine in 2003 to increase the number of independent directors on our Board as required by the Sarbanes-Oxley Act of 2002 and to address other proposed rule changes of the Securities and Exchange Commission and the Nasdaq Stock Market. Unless authority is withheld, it is intended that Proxies received in response to this solicitation will be voted in favor of the nominees. The Board has nominated the following nine individuals named below to serve as directors until the next Annual Meeting and until their successors shall have been elected and shall qualify. The age and a brief biographical description of each director nominee are set forth below. This information and certain information regarding beneficial ownership of securities by such nominees contained in this proxy statement has been furnished to us by the nominees or obtained from filings with the Securities and Exchange Commission. All of the nominees have consented to serve as directors if elected. Nominees for election as directors are:

Earl E. Congdon (72) joined our company in 1950 and has served as Chairman of the Board of Directors and Chief Executive Officer since 1985 and as a director since 1952. He is a son of E. E. Congdon, one of our founders, the brother of John R. Congdon and the father of David S. Congdon.

John R. Congdon (70) joined us in 1953 and has served as Vice Chairman of the Board of Directors since 1985 and as a director since 1955. He is also the Chairman of the Board of Directors of Old Dominion Truck Leasing, Inc., a North Carolina corporation that is engaged in the full service leasing of tractors, trailers and other equipment, to which he devotes more than half of his time. He is a son of E. E. Congdon, one of our founders, and the brother of Earl E. Congdon.

John A. Ebeling (65) has been a director since August 1985. He formerly served as Vice Chairman from May 1997 to May 1999 and as President and Chief Operating Officer from August 1985 to May 1997. Mr. Ebeling was previously employed by ANR Freight Systems from 1978 to 1985, holding the positions of Chairman and Chief Executive Officer.

Harold G. Hoak (73) was elected a director in August 1991. Now retired, he serves on the Board of Directors of the Charlotte Merchants Foundation, Inc. He was President and General Manager of the Charlotte Merchants Association, Inc. from 1989 to 1994. Mr. Hoak was formerly employed by Wachovia Bank of North Carolina, N.A. from 1956 to 1989 and served as Regional Vice President for the Southern Region from 1976 to 1989.

-2-

Franz F. Holscher (81) was elected a director in August 1991. He served in a number of executive positions from 1970 to 1987 with Thurston Motor Lines and was its Chairman of the Board of Directors from July 1984 through December 1987, when he retired. Mr. Holscher has been active in a number of organizations and associations in the trucking industry.

David S. Congdon (46) has been employed by us since 1978 and, since May 1997, has served as our President and Chief Operating Officer. He has held various positions with us including Vice President – Quality and Field Services, Vice President – Quality, Vice President – Transportation and other positions in operations and engineering. Mr. Congdon became a director in May 1998. He is the son of Earl E. Congdon.

John R. Congdon, Jr. (46) was elected a director in 1998. He currently serves as the Vice Chairman of the Board of Directors of Old Dominion Truck Leasing, Inc., where he has been employed since May 1979. He is the son of John R. Congdon.

J. Paul Breitbach (65) is the President of Krispy Kreme Foundation, a non-profit organization established by Krispy Kreme Doughnuts, Inc. From November 1992 to January 2002, Mr. Breitbach was employed by Krispy Kreme Doughnuts, Inc. where he held Executive Vice President positions in Finance and Administration as well as Support Operations. Mr. Breitbach is a Certified Public Accountant.

Robert G. Culp, III (56) is the Chairman of the Board of Directors of Culp, Inc., a High Point, N.C. based producer of upholstery and mattress fabrics, which he co-founded in 1972. Mr. Culp also serves on the Board of Directors of Stanley Furniture Company, Inc.

The Board of Directors recommends a vote “FOR” the election of each of the nominees identified above.

EXECUTIVE OFFICERS

The following provides certain information concerning the executive officers of the Company who are not directors:

John B. Yowell (51) joined us in February 1983 and has served as Executive Vice President since May 1997. He has also served the Company as a Vice President in many functional areas including Corporate Services, Operations and Information Systems. He is a son-in-law of Earl E. Congdon.

J. Wes Frye (55) has served as Sr. Vice President – Finance since May 1997. He has also served as Chief Financial Officer and Treasurer since joining us in February 1985 and has held the position of Assistant Secretary since December 1987. Mr. Frye is a Certified Public Accountant.

Joel B. McCarty, Jr. (65) was appointed Sr. Vice President in May 1997 and has served as General Counsel and Secretary since joining us in June 1987. He was formerly the Assistant General Counsel of McLean Trucking Company and was in private law practice prior to 1985.

-3-

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth information with respect to the beneficial ownership of our common stock (“Common Stock”), $.10 par value, the only class of voting security, as of March 31, 2003, or such other date as indicated in the footnotes to the table, for (i) each person known by us to own beneficially five percent or more of our Common Stock; (ii) each director and director nominee; (iii) each executive officer; and (iv) all current directors, director nominees and executive officers as a group. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”). In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares subject to options or warrants held by that person that are currently exercisable or that are or may become exercisable within 60 days of March 31, 2003 are deemed outstanding. These shares, however, are not deemed outstanding for purposes of computing the percentage ownership of any other person. Except as indicated in the footnotes to this table and under applicable community property laws, each shareholder named in the table has sole voting and dispositive power with respect to the shares set forth opposite the shareholder’s name.

| Name of Beneficial Owner |

Shares Owned(1) |

Percent |

||||

| David S. Congdon 500 Old Dominion Way Thomasville, NC 27360 |

1,264,659 |

(2) |

11.8 |

% | ||

| Fidelity Management & Research Company 82 Devonshire Street Boston, MA 02109 |

1,026,300 |

(3) |

9.6 |

% | ||

| Earl E. Congdon 20 Harborage Isle Fort Lauderdale, FL 33316 |

912,180 |

(4) |

8.5 |

% | ||

| John R. Congdon 7511 Whitepine Road Richmond, VA 23237 |

867,646 |

(5) |

8.1 |

% | ||

| Dimensional Fund Advisors Inc. 1299 Ocean Avenue, 11th Floor Santa Monica, CA 90401 |

582,200 |

(6) |

5.4 |

% | ||

| John B. Yowell |

520,627 |

(7) |

4.9 |

% | ||

| J. Wes Frye |

13,358 |

(8) |

Less than 1 |

% | ||

| Joel B. McCarty, Jr. |

8,300 |

(9) |

Less than 1 |

% | ||

| John A. Ebeling |

5,000 |

|

Less than 1 |

% |

-4-

| Name of Beneficial Owner |

Shares Owned(1) |

Percent |

||||

| Harold G. Hoak |

1,000 |

|

Less than 1 |

% | ||

| Franz F. Holscher |

1,000 |

|

Less than 1 |

% | ||

| Robert G. Culp, III |

200 |

(10) |

Less than 1 |

% | ||

| J. Paul Breitbach |

— |

|

— |

| ||

| All Directors, Director Nominees and Executive Officers as a Group (12 persons) |

3,266,539 |

(11) |

30.5 |

% |

| (1) | Except as described below, each person or group identified possesses sole voting and investment power with respect to the shares shown opposite the name of such person or group. |

| (2) | Includes 5,764 shares owned of record by the named shareholder, 6,000 shares obtainable upon exercise of stock options exercisable within 60 days, 271,623 shares held as trustee of a revocable trust, 120,126 shares held as trustee or custodian for minor children of the shareholder, 667,513 shares held through shared voting and investment rights as trustee under the Earl E. Congdon Intangible Trust, 103,000 shares held through shared voting and investment rights as trustee under the Kathryn W. Congdon Intangible Trust, 80,633 shares held through shared voting and investment rights by David S. Congdon’s wife as trustee of an irrevocable trust and 10,000 shares owned by Mr. Congdon’s wife. |

| (3) | Based on information obtained from a Schedule 13G, dated February 14, 2003, filed with the SEC, Fidelity Management & Research Company, a wholly-owned subsidiary of FMR Corp. and an investment adviser registered under Section 203 of the Investment Advisers Act of 1940, is the beneficial owner of 1,026,300 shares of the Company’s common stock outstanding as a result of acting as investment adviser to various investment companies registered under Section 8 of the Investment Company Act of 1940. The ownership of one investment company, Fidelity Low Priced Stock Fund, amounted to 1,026,300 shares, or 9.6%, of the common stock outstanding. |

| (4) | Includes 667,513 shares held through shared voting and investment rights as grantor of the Earl E. Congdon Intangible Trust, 100,000 shares owned through the Earl E. Congdon Grantor Retained Annuity Trust 2003, 41,667 shares held through shared voting and investment rights as grantor of the Earl E. Congdon Family Trust and 103,000 shares owned beneficially by Earl E. Congdon’s wife’s through shared voting and investment rights under the Kathryn W. Congdon Intangible Trust with respect to which Earl E. Congdon disclaims beneficial ownership. |

| (5) | Includes 824,247 shares held as trustee of a revocable trust, 41,667 shares held through shared voting and investment rights as trustee of the Earl E. Congdon Family Trust and 1,732 shares owned by John R. Congdon’s wife as trustee of a revocable trust for which John R. Congdon disclaims beneficial ownership. |

-5-

| (6) | Based on information obtained from a Schedule 13G dated February 3, 2003, filed with the SEC, Dimensional Fund Advisors Inc. (“Dimensional”), an investment advisor registered under Section 203 of the Investment Advisors Act of 1940, is deemed to have beneficial ownership of 582,200 shares of the Company’s common stock as of December 31, 2002. Dimensional furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager to certain other commingled group trusts and separate accounts. These investment companies, trusts and accounts are the “Funds”. In its role as investment adviser or manager, Dimensional possesses voting and/or investment power over the securities of the Old Dominion shares owned by the Funds. All securities reported in the 13G are owned by the Funds. Dimensional disclaims beneficial ownership of such securities. |

| (7) | Includes 14,310 shares owned of record by the named shareholder, 49,105 shares held by the shareholder as trustee of an irrevocable trust, 6,000 shares obtainable upon exercise of stock options exercisable within 60 days, 1,764 shares owned of record by the named shareholder’s wife, Audrey L. Congdon, 297,391 shares held by Audrey L. Congdon as trustee of a revocable trust, 80,084 shares held by Audrey L. Congdon as trustee or custodian for minor children of the shareholder and 71,973 shares held by Audrey L. Congdon through shared voting rights as trustee under the Karen C. Vanstory Irrevocable Trust. |

| (8) | Includes 5,474 shares owned of record by the named shareholder, 284 shares owned in the named shareholder’s 401(k) retirement plan, 7,500 shares obtainable upon exercise of stock options exercisable within 60 days and 100 shares owned by the named shareholder’s wife. |

| (9) | Includes 800 shares owned of record by the named stockholder and 7,500 shares obtainable upon exercise of stock options exercisable within 60 days. |

| (10) | Consists of 200 shares owned jointly by named shareholder and his wife. |

| (11) | Includes 912,180 shares for which certain directors and executive officers share voting power with other directors and executive officers; however, these shares are counted only once in the total for the group. Also includes 27,000 shares issuable upon exercise of stock options within 60 days by certain executive officers and directors. |

Section 16 Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires certain of our officers, directors and persons who own more than 10% of a registered class of our equity securities to file reports of ownership and changes in ownership with the SEC. Such officers, directors and shareholders are required by the SEC regulations to furnish us with copies of all such reports that they file. Based solely on a review of copies of reports filed with the SEC since January 1, 2002 and of representations by certain officers and directors, all persons subject to the reporting requirements of Section 16(a) filed the reports required to be filed in 2002 on a timely basis.

-6-

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table provides a three-year overview of the cash compensation paid to our five most highly compensated executive officers (the “Named Executive Officers”):

| Annual Compensation |

Long-Term Compensation |

(i) All Other Compensation ($)(2) |

||||||||||||||

| Awards |

||||||||||||||||

| (a) Name and Principal Position |

(b) Year |

(c) Salary ($) |

(d) Bonus(1) ($) |

(f) Restricted Stock Award(s) ($) |

(g) Securities Underlying Options (#) |

|||||||||||

| Earl E. Congdon Chairman of the Board and Chief Executive Officer |

2002 2001 2000 |

$ $ $ |

349,210 315,260 300,800 |

$ $ $ |

567,436 367,856 439,326 |

0 0 0 |

0 0 0 |

$ $ $ |

10,324 9,948 15,373 |

(3)

| ||||||

| David S. Congdon President and Chief Operating Officer |

2002 2001 2000 |

$ $ $ |

212,760 210,585 198,100 |

$ $ $ |

343,448 222,650 267,981 |

0 0 0 |

0 0 0 |

$ $ $ |

6,537 6,092 6,020 |

(3)

| ||||||

| John B. Yowell Executive Vice President |

2002 2001 2000 |

$ $ $ |

168,180 166,380 154,200 |

$ $ $ |

149,325 96,804 142,230 |

0 0 0 |

0 0 0 |

$ $ $ |

6,963 6,351 5,731 |

(3)

| ||||||

| J. Wes Frye Treasurer, Chief Financial Officer and Assistant Secretary |

2002 2001 2000 |

$ $ $ |

160,740 160,125 148,620 |

$ $ $ |

104,528 67,763 82,587 |

0 0 0 |

0 0 0 |

$ $ $ |

1,962 2,010 2,319 |

(3)

| ||||||

| Joel B. McCarty, Jr. Senior Vice President, Secretary, General Counsel |

2002 2001 2000 |

$ $ $ |

138,860 138,235 127,500 |

$ $ $ |

104,528 67,673 82,587 |

0 0 0 |

0 0 0 |

$ $ $ |

6,573 6,373 6,118 |

(3)

| ||||||

-7-

| (1) | Pursuant to an executive profit-sharing bonus program, we pay incentive cash bonuses to the Named Executive Officers based upon our income before taxes during the fiscal year. |

| (2) | Includes pre-tax contributions we made to the Old Dominion 401(k) retirement plan, personal use of Company cars, excess premiums we paid on group life insurance and the compensation element of premiums we paid on split-dollar life insurance policies. We are a party to certain split-dollar life insurance agreements with certain members of the families of Earl E. Congdon and John R. Congdon pursuant to which we pay a portion of the premiums on life insurance policies insuring their lives in the aggregate face amounts of $16,998,597 and $17,112,385, respectively. The total benefits currently payable to us under these policies upon the death of Earl E. Congdon and John R. Congdon are $2,317,202 and $3,939,816, respectively. The Company’s interest in the death benefit and cash surrender value of each policy is determined by reference to the amount of premiums we paid, which in 2002, 2001 and 2000 were $423,521, $400,466 and $423,934, respectively. |

| (3) | Allocation of 2002 All Other Compensation: |

| Name |

Company Contribution to 401k Plan |

Split-Dollar Life Insurance |

Personal Use of Company Car |

Excess Life Insurance Premiums | ||||||||

| Earl E. Congdon |

$ |

933 |

$ |

8,155 |

$ |

— |

$ |

1,236 | ||||

| David S. Congdon |

|

1,656 |

|

— |

|

4,791 |

|

90 | ||||

| John B. Yowell |

|

2,093 |

|

— |

|

4,732 |

|

138 | ||||

| J. Wes Frye |

|

1,704 |

|

— |

|

— |

|

258 | ||||

| Joel B. McCarty, Jr. |

|

1,729 |

|

— |

|

4,082 |

|

762 | ||||

Stock Options

Our Board of Directors and shareholders have approved and adopted the 1991 Employee Stock Option Plan of Old Dominion Freight Line, Inc. (the “Option Plan”), for the benefit of key employees. The Option Plan covers 250,000 shares of our Common Stock. The Option Plan provides for the granting of stock options that qualify as incentive stock options pursuant to Section 422 of the Internal Revenue Code as well as nonqualified options. The exercise of a nonqualified stock option will result in compensation income equal to the difference between the option price and the fair market value of the stock acquired upon the exercise. Earl E. Congdon and John R. Congdon are not eligible to participate in the Option Plan.

The Option Plan does not allow any options to be granted after August 31, 2001; therefore, no options were granted in 2002.

Options to purchase 224,000 shares under the Option Plan have been granted. As of March 31, 2003, there are options outstanding covering 13,000 shares of Common Stock at the exercise price of $19.25 per share, 9,000 shares at the exercise price of $19.00 per share and 6,000 shares at the exercise price of $10.00 per share. All of the options have been granted as incentive options.

-8-

The following table reflects cumulative information regarding grants under the Option Plan:

| Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values | ||||||||||||||

| (d) |

(e) | |||||||||||||

| (a) Name |

(b) Shares Acquired on Exercise (#) |

(c) Value Realized ($) (1) |

Number of Securities Underlying Unexercised Options at FY-End Exercisable/Unexercisable (#) |

Value of Unexercised | ||||||||||

| Earl E. Congdon(3) |

— |

|

— |

— |

|

— |

||||||||

| David S. Congdon |

4,000 |

$ |

20,460 |

6,000 0 |

Exercisable Unexercisable |

$ $ |

64,656 0 |

Exercisable Unexercisable | ||||||

| John B. Yowell |

4,500 |

$ |

23,018 |

6,000 0 |

Exercisable Unexercisable |

$ $ |

64,656 0 |

Exercisable Unexercisable | ||||||

| J. Wes Frye |

4,500 |

$ |

23,018 |

7,500 0 |

Exercisable Unexercisable |

$ $ |

83,133 0 |

Exercisable Unexercisable | ||||||

| Joel B. McCarty, Jr. |

4,500 |

$ |

23,018 |

7,500 0 |

Exercisable Unexercisable |

$ $ |

83,133 0 |

Exercisable Unexercisable | ||||||

| (1) | Value realized is calculated by subtracting the exercise price from the closing price of our stock on the exercise date. |

| (2) | Value is calculated by subtracting the exercise price from $28.401, the closing price of our stock on December 31, 2002. |

| (3) | Not eligible to participate in the Option Plan. |

Equity Compensation Plan Information

The following table sets forth information as of March 31, 2003 with respect to our 1991 Employee Stock Option Plan, the only compensation plan that authorizes the issuance of our equity securities:

| (a) |

(b) |

(c) | ||||

| Plan Category |

Number of Securities To be Issued upon Exercise of Outstanding Options, Warrants and Rights |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) | |||

| Equity Compensation Plans Approved by Security Holders |

28,000 |

$17.19 |

— | |||

| Equity Compensation Plans Not Approved by Security Holders |

— |

— |

— | |||

| Total |

28,000 |

$17.19 |

— |

-9-

Compensation of Directors

Each of the Company’s outside directors receives an annual retainer of $12,000 plus $1,500 for each meeting attended, including Board meetings and meetings of committees of the Board of Directors not held in conjunction with a meeting of the Board. Such directors also receive reimbursement of expenses incurred as a director. Directors who are also officers of the Company receive no such fees or expense reimbursement.

Report of Compensation Committee

The Compensation Committee (the “Committee”) is responsible for conducting an annual review of the Company’s compensation plan for its executive officers, including an evaluation of the components of the plan, the standards of performance measurement and the relationship between performance and compensation. The Committee reviews the compensation of each executive officer and makes specific recommendations to the Board of Directors based on factors that include the individual officer’s performance, the ability of the Company to attract and retain qualified, experienced personnel and whether the plan provides appropriate motivation to achieve goals outlined by the Board of Directors.

In determining the base salary for Earl E. Congdon, the Company’s Chief Executive Officer, the Committee considered factors including Mr. Congdon’s tenure with the Company, his leadership in the industry and comparisons of compensation with other chief executive officers of companies of similar size and responsibility, which was obtained from public sources. The Committee also considered the Company’s recent financial performance and financial strength, achieved in a relatively difficult operating environment, and the Company’s prospects for future growth and profitability.

The incentive bonus for the Chief Executive Officer is based upon the Company’s profitability, a program that has been in place for many years, and the Committee believes that this is a fair measure of executive bonus compensation. The bonus is based upon a percentage, determined by the Committee, of pre-tax profits. In 2000, the Committee reduced the percentage of pre-tax profits used in determining the incentive bonus for many of the participants in the plan, including the Chief Executive Officer. The decision to revise and reduce the incentive bonus plan was based upon the Committee’s projections of future profitability and its objective of compensating its senior employees with a balance of competitive salaries and bonus incentives. The salary and bonus amounts for 2002, 2001 and 2000 are reflected in the Summary Compensation Table. Both the base salary and the incentive bonus are evaluated in determining overall compensation. The Chief Executive Officer is not eligible to receive options under the Company’s Option Plan.

The base salary for all other officers is based upon the experience and qualifications of each officer, with the additional objective of remaining competitive in the industry in recruiting and retaining a well-qualified, effective management team. The incentive bonus for officers is determined by the Compensation Committee and is based upon the same criteria as the Chief Executive Officer, the performance of the Company as measured by its profitability. No stock options were granted to any individual in 2002.

Section 162(m) of the Internal Revenue Code (the “Code”) generally limits amounts that can be deducted for compensation paid to executives to $1 million, unless certain requirements are met. No

-10-

executive received compensation in excess of $1 million in 2002; therefore, there were no compensation amounts that would be deemed nondeductible for us under Section 162(m) of the Code. The Committee will continue to monitor the applicability of this section of the Code to our compensation program each year.

The Compensation Committee,

Franz F. Holscher, Chairman

Earl E. Congdon

John R. Congdon

Compensation Committee Interlocks and Insider Participation

Earl E. Congdon, Chairman of the Board of the Company and its Chief Executive Officer, and John R. Congdon, Vice Chairman of the Board, are members of the Compensation Committee. Mr. Holscher, the Chairman of the Compensation Committee, is not an employee of the Company and receives no compensation other than directors’ fees from the Company.

Greensboro Service Center Purchase

On October 15, 2002, we purchased a 116-door service center facility located in Greensboro, North Carolina for $6,000,000 from an irrevocable trust created for the benefit of the families of Earl E. Congdon, our Chief Executive Officer and Chairman of our Board of Directors, and John R. Congdon, Vice Chairman of our Board of Directors. Prior to that date, the property was leased to us on a month-to-month basis for $31,705 per month.

We had originally planned to enter into an arrangement to complete an expansion of this service center and enter into a long-term lease. However, we determined that it was in our best interest to purchase this facility because the cost of the expansion to 229 doors on additional acreage made continued leasing undesirable and because we generally prefer ownership to leasing our service centers when conditions warrant.

In determining the value of the facility, we considered the value of the land, the cost of improvements we have made to the land, including construction of a new building, and other matters. We then applied a method of depreciation to arrive at a purchase price. In addition, we obtained an appraisal of the facility by a nationally recognized real estate brokerage company specializing in the trucking industry. The appraisal was based on the depreciated construction cost of a similar facility and the value of a similar parcel of land.

Transactions with Old Dominion Truck Leasing, Inc.

Old Dominion Truck Leasing, Inc. (“Leasing”), a North Carolina corporation whose voting stock is owned by the Earl E. Congdon Intangibles Trust, David S. Congdon, Trustee (38.2%), John R. Congdon Revocable Trust (38.2%) and members of Earl E. Congdon’s and John R. Congdon’s families (23.6%), is engaged in the business of purchasing and leasing tractors, trailers and other vehicles. John R. Congdon is Chairman of the Board of Leasing, and Earl E. Congdon is Vice Chairman of the Board. Since 1986, we have combined our requirements with Leasing for the

-11-

purchase of tractors, trailers, equipment, parts, tires and fuel. We believe that, by combining our requirements, we are often able to obtain pricing discounts because of the increased level of purchasing. While this is beneficial to us, our management believes that the termination of this relationship would not have a material adverse impact on our financial results.

For the years ended December 31, 2002, 2001 and 2000, we charged Leasing $14,000, $11,000 and $15,000, respectively, for vehicle repair, maintenance and other services, which we provide to Leasing at cost. In addition, we charged Leasing $12,000 annually in 2002, 2001 and 2000, for rental of a vehicle maintenance facility located in Chesapeake, Virginia.

We purchased $297,000, $287,000 and $244,000 of maintenance and other services from Leasing in 2002, 2001 and 2000, respectively. We believe that the prices we pay for such services are lower than would be charged by unaffiliated third parties for the same quality of work, and we intend to continue to purchase maintenance and other services from Leasing, provided that Leasing’s prices continue to be favorable to us. In addition, Leasing has a right of first refusal for our future tractor and trailer leases, exercisable on the same terms offered to us by third parties. We did not lease any equipment from Leasing in 2002, but we paid Leasing $8,000 and $4,000 for short-term tractor rentals in 2001 and 2000, respectively.

On January 4, 2002, we purchased 91 1997 model pickup and delivery trailers from Leasing for an aggregate purchase price of $774,000.

Transactions with E & J Enterprises

Earl E. Congdon and John R. Congdon are each 50% owners of E & J Enterprises (“E & J”), a Virginia general partnership that leases trailers to the Company. Pursuant to a lease agreement dated August 1, 1991 and as subsequently amended, the Company leased 163 trailers from E & J for a monthly rental rate in 2002 of $33,415. The lease provides that we are responsible for insurance coverage, maintenance and repairs to the trailers, which are approximately 20 years old. On July 29, 2002, our Board of Directors approved the purchase of these trailers for $1,200 each, or a total of $195,600. We continued to rent these trailers under the month-to-month basis provided in the amended lease until the purchase was completed, and the final group of trailers was purchased in March 2003. We purchased these trailers because their age and condition made ownership more economical. In determining the value of the trailers, we considered published prices of comparable trailers.

Also on July 29, 2002, our Board of Directors approved the leasing of 150 1995 model pickup and delivery trailers from E & J on a month-to-month basis for $204 per month for each trailer. We chose to lease these trailers because recent increases in tonnage and shipments require us to increase capacity, and leasing trailers provides greater flexibility than purchasing to respond to fluctuations in tonnage and shipments. In determining the lease values, we considered published lease prices by national leasing companies.

The total amount paid for trailer leases under both of our trailer lease agreements was $387,000, $401,000 and $401,000 for 2002, 2001 and 2000, respectively.

-12-

In December 1988, the Company sold to E & J certain tracts of unimproved land and a vacant service center facility in exchange for a non-interest-bearing receivable in the amount of $579,798. E & J has repaid the amount outstanding under the receivable as parcels of the property have been sold. As of December 31, 2002, the amount outstanding on the receivable was $195,677.

Split Dollar Life Insurance Policies

We are a party to certain split dollar life insurance policies, of which certain members of the families of Earl E. Congdon and John R. Congdon are designated beneficiaries. See Note (2) under the Summary Compensation Table in this Proxy Statement.

Audit Committee Approval

Each of the foregoing transactions has been reviewed by the Audit Committee of our Board of Directors, which consists of three non-employee directors. The Audit Committee has approved the transactions that continue to be in effect and determined that they are fair to the Company. The Audit Committee believes that the terms and conditions of the foregoing transactions are substantially the same as, or more favorable to the Company than, transactions that would be available from nonaffiliates. Any extensions, modifications or renewals of existing transactions with such persons must be approved, in advance, by the Audit Committee and must be on terms no less favorable to the Company than the terms that could be obtained in a similar transaction with an unaffiliated party.

-13-

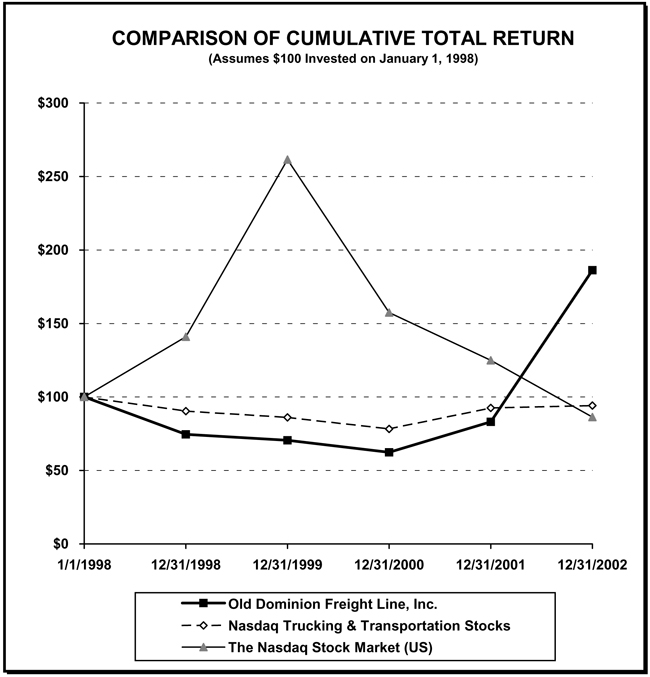

Performance Graph

The following graph compares the total shareholder cumulative returns, assuming the reinvestment of all dividends, of $100 invested on January 1, 1998, in our Common Stock, Nasdaq Trucking & Transportation Stocks and The Nasdaq Stock Market (US) for the five-year period ended December 31, 2002:

| 1/1/1998 |

12/31/1998 |

12/31/1999 |

12/31/2000 |

12/31/2001 |

12/31/2002 | |||||||

| Old Dominion Freight Line, Inc. |

15.25 |

11.375 |

10.75 |

9.50 |

12.68 |

28.401 | ||||||

| Nasdaq Trucking & Transportation Stocks |

309.529 |

279.677 |

266.549 |

242.276 |

286.491 |

291.570 | ||||||

| The Nasdaq Stock market (US) |

521.358 |

735.062 |

1363.268 |

820.707 |

651.100 |

450.136 |

-14-

CORPORATE GOVERNANCE

Our Board of Directors held five meetings during 2002, and all directors attended at least 75% of the meetings. The Board of Directors has four standing committees: the Executive Committee, the Audit Committee, the Compensation Committee and the Stock Option Plan Committee.

The Executive Committee consists of Earl E. Congdon (Chairman), John R. Congdon and David S. Congdon. The Executive Committee is empowered to act between meetings of the Board of Directors with powers of the full Board, to the extent permitted by our bylaws and applicable law. This committee did not meet in 2002.

The Audit Committee currently consists of Harold G. Hoak (Chairman), Franz F. Holscher and John A. Ebeling, three of our independent directors. The Audit Committee is governed by a written charter approved by the Board of Directors. Information regarding the functions performed by this committee is set forth in the “Report of Audit Committee”, which is included in this annual proxy statement. The Audit Committee met five times in 2002, at which all members were present.

The Compensation Committee consists of Franz F. Holscher (Chairman), Earl E. Congdon and John R. Congdon. The Compensation Committee meets periodically to review and approve the salaries and classifications of our executive officers and other significant employees and its personnel policies. The Compensation Committee met once in 2002, at which all members were present.

The Stock Option Plan Committee consists of Earl E. Congdon (Chairman), John R. Congdon, Harold G. Hoak and Franz F. Holscher. The Committee has authority to administer our 1991 Employee Stock Option Plan. The Stock Option Plan Committee did not meet in 2002.

INDEPENDENT AUDITORS

Ernst & Young LLP has served as our independent auditors since 1994. A representative of Ernst & Young LLP is expected to be present at the Annual Meeting of Shareholders with the opportunity to make a statement if he desires to do so and to respond to any appropriate questions.

FEES PAID TO INDEPENDENT AUDITORS

The Audit Committee and the Board of Directors have approved all of the nonaudit services performed by Ernst & Young LLP and believe they have no effect on audit independence. The Audit Committee has authorized management to engage our independent accountants in nonaudit services relating to preparation of tax returns and working with state and federal agents on audits, but other matters require prior approval from the Audit Committee. For the last fiscal year, audit fees were $120,914, audit-related fees were $66,050 and all other nonaudit fees were $46,125.

REPORT OF AUDIT COMMITTEE

The Audit Committee is comprised of three directors who are considered independent or whom the Board has determined to be independent under applicable Nasdaq rules. The Audit Committee

-15-

oversees our financial reporting process on behalf of the Board of Directors and operates under a written charter adopted on April 24, 2000. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report with management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards and under Statement on Auditing Standards No. 61, Communication with Audit Committees, as currently in effect. In addition, the Audit Committee has discussed with the independent auditors their independence from management and the Company, including the written disclosures and the letter from the independent auditors required by Independence Standards Board No. 1, Independence Discussions with Audit Committees, as currently in effect, and has considered the compatibility of nonaudit services with the auditors’ independence.

The Audit Committee discussed with our internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee meets with the internal and independent auditors to discuss the results of their examinations, their evaluations of our internal controls and the overall quality of our financial reporting.

The Audit Committee has also reviewed transactions between the Company and entities in which our officers or directors or their affiliates have material interests and has determined that such existing transactions are fair to the Company. Any new transactions with officers, directors or their affiliates, and any extensions, modifications or renewals of existing transactions with such persons must be approved in advance by the Audit Committee as being on terms no less favorable to the Company than the terms that could be obtained in a similar transaction with an unaffiliated party.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2002, for filing with the Securities and Exchange Commission.

The Audit Committee,

Harold G. Hoak, Chairman

Franz F. Holscher

John A. Ebeling

-16-

ANNUAL REPORT ON FORM 10-K

Shareholders may obtain a copy of our Annual Report on Form 10-K as filed with the Securities and Exchange Commission for the year ended December 31, 2002, without charge, from the our web site, www.odfl.com, or by writing to J. Wes Frye, Treasurer, Chief Financial Officer and Assistant Secretary, Old Dominion Freight Line, Inc., 500 Old Dominion Way, Thomasville, North Carolina 27360. Exhibits are not included, but copies of them may be obtained upon payment of copying charges.

DEADLINE FOR SHAREHOLDER PROPOSALS

Any shareholder desiring to present a proposal for action at our 2004 Annual Meeting must deliver the proposal to the Company at its executive offices no later than December 18, 2003.

In addition to any other applicable requirements, for business to be properly brought before the annual meeting by a shareholder, even if the proposal is not to be included in the Company’s proxy statement, our bylaws provide that the shareholder must give timely notice of such business in writing to the Secretary of the Company at least 60 days and not more than 90 days prior to the meeting, except that if public disclosure of the date of the meeting is given less than 70 days prior to the meeting, notice by the shareholder will be considered timely if received by the Secretary by the close of business on the 10th day after public disclosure of the date of the meeting was made. As to each item of business, the notice must contain (i) a brief description of the business to be brought before the meeting and the reasons therefor, (ii) the name and the address of record of the shareholder and the number of shares of the Company’s stock owned of record or beneficially by the shareholder and (iii) any material interest the shareholder has in the proposed business.

| By Order of the Board of Directors |

|

|

| Joel B. McCarty, Jr. Secretary |

Thomasville, North Carolina

April 14, 2003

-17-

PROXY

OLD DOMINION FREIGHT LINE, INC.

The undersigned shareholder of Old Dominion Freight Line, Inc. designates Earl E. Congdon, John R. Congdon and Joel B. McCarty, Jr., and any of them, agents to vote the shares of the undersigned at the Annual Meeting of Shareholders, Monday, May 19, 2003, at 10:00 a.m., and at any adjournment thereof, as follows:

Please sign the proxy printed on the other side and return

it at once unless you expect to attend the meeting in person.

(Continued on reverse side)

Please date, sign and mail your

proxy card back as soon as possible!

Annual Meeting of Shareholders

OLD DOMINION FREIGHT LINE, INC.

May 19, 2003

| ¯ |

Please Detach and Mail in the Envelope Provided |

¯ |

| A |

x |

Please mark your votes as in this example. |

| VOTE FOR all nominees (except as marked to the contrary) |

WITHHOLD AUTHORITY TO vote for all nominees listed at right |

|||||||||||||||

| (1)

|

ELECTION OF DIRECTORS |

¨ |

¨ |

Nominees: |

Earl E. Congdon John R. Congdon John A. Ebeling Harold G. Hoak Franz F. Holscher David S. Congdon John R. Congdon, Jr. J. Paul Breitbach Robert G. Culp, III |

(2)

|

To transact such other business as may be brought before the meeting. | |||||||||

|

(Instruction: To withhold authority to vote for an individual nominee strike a line through the nominee’s name.) |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS AND WILL BE VOTED AS SPECIFIED BY THE STOCKHOLDER. | |||||||||||||||

| IF NO SPECIFICATION IS MADE WITH RESPECT TO A MATTER WHERE A BALLOT IS PROVIDED, THIS PROXY WILL BE VOTED FOR SUCH MATTER. | ||||||||||||||||

| Your shares should be represented at the meeting by your proxy. The meeting will be held Monday, May 19, 2003, at 10:00 a.m. in the Executive Offices of Old Dominion Freight Line, Inc. 500 Old Dominion Way, Thomasville, North Carolina. | ||||||||||||||||

| PLEASE SIGN AND SEND IN YOUR PROXY | ||||||||||||||||

SIGNATURE (S) __________________________________________________________________ DATE __________________________ 2003

| NOTE: | Please sign above as name(s) appear(s) on this card. (When signing as attorney, executor, administrator, trustee, guardian, etcetera, give full title as such. For joint accounts, each joint owner should sign.) |